The May GDP numbers are out, and we’re still below the level observed in November of last year. But can we call it a recession? If we do, we’d have to call it a 21st-century recession: it looks a lot like what we saw in 2001-2, but not much like we’d seen before.

Here are updated versions of the graphs from this post: variables are logged, set to zero at the peaks, and multiplied by 100; the result can be interpreted as a log per cent deviation from the values observed at the peak. First up is GDP:

Six months after the peak, GDP growth looks a lot like what we saw in 2002, and not a lot like what we saw after the end of the two previous expansions.

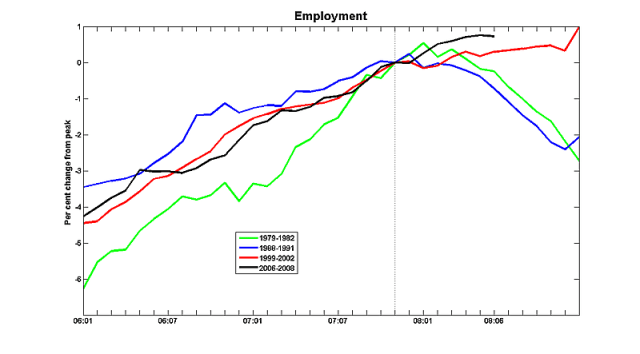

Although GDP growth is slightly weaker than in 2002, employment is doing better:

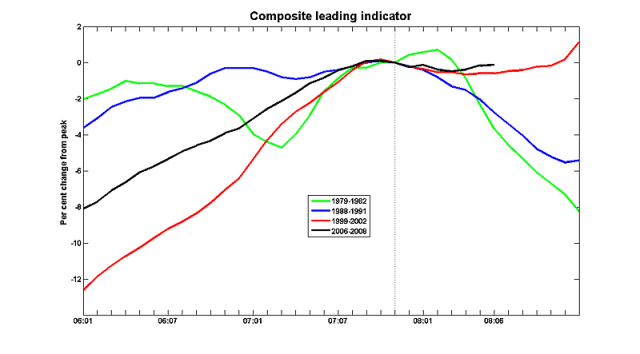

And so is the composite leading indicator:

Since recessions don’t occur that often, it’s still hard to get a handle on them. But this is twice in a row that we’ve seen slowdowns that don’t look like the ones we saw last century.

Interesting….

Realy nice information of The 21st century business cycle.