The story of the Canadian economy since 2002 is one of an improvement in the terms of trade created by a surge in commodity prices. As commodity prices rose, the CAD appreciated and the real buying power of Canadian incomes increased. But in the past few weeks, much of this has been reversed. The possibility of a fall in commodity prices was the thing I feared most, and it seems to have come to pass: the price of oil and other commodities have been falling over the past few weeks and months. It's useful to put these movements in context.

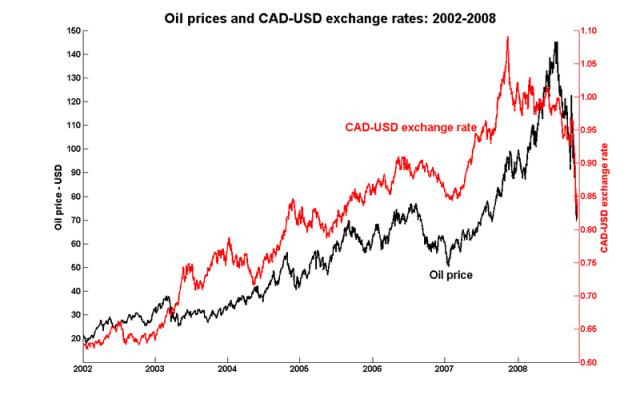

Here is a graph of oil prices and the CAD-USD exchange rate:

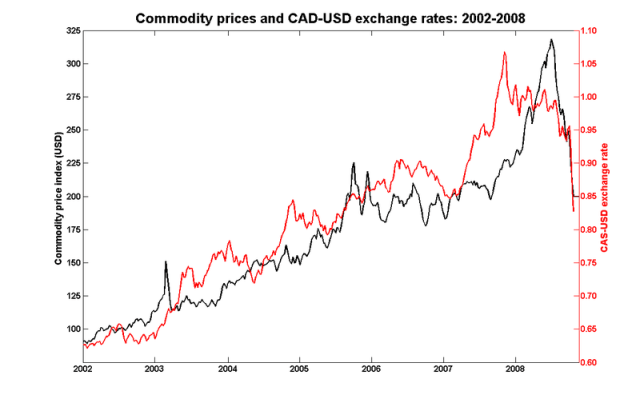

Oil isn't the only commodity that Canada exports; here is a graph of the Bank of Canada's index of commodity prices along with the exchange rate:

As of last Wednesday (where these series end), we're back to roughly where we were a couple of years ago; I suspect we've moved back a few months since then.

This is not good news. The 2002-2008 expansion provided significant real income gains, and more than half of those gains were due to the improvement in Canada's terms of trade.

So where do we go from here? One possibility might be going back to the 1990's recipe of low exchange rates and increased manufacturing activity. But that would be more of a fuite en avant* than anything else: real wages declined during the 1990's. It's hard to see how competing with China and other low-wage exporting countries for US market shares is going to be a recipe for prosperity anytime soon.

In the short run, there's not a lot we can do to counter these trends. But there's reason for optimism in the medium term. The main driver for the rise in commodity prices has been the development of the Chinese, Indian and other developing economies. Their growth rates will no doubt be slowed by the financial crisis over the next few quarters, but their incomes have by no means plateaued. The demand for commodities will resume when the developing economies pick up again.

For all of our history, Canadian economic development has depended on the fortunes of the leading economic powers of the time: first Britain, then the United States. It now appears to be China's turn.

*I'm not aware of an equivalent English expression; babelfish translates this as 'escape ahead', but the phrase is supposed to convey the notion of a desperate choice in unfavourable circumstances.

The commodity prices are also going to do a number on the provincial budgets of a number of provinces, particularly Newfoundland, Saskatchewan, and Alberta.

Is there a site anywhere that has oil priced in Canadian dollars, along with natural gas, whether it is traded here or just a converted price.

Since those numbers are what is required to predict government and corporate revenues, it might be more useful for certain situations.

In this context I think your “fuite en avant” translates into the very standard “race to the bottom”.

I might suggest “between a rock and hard place”.

Let’s give into the pessimism. Canadians are not particularly innovative or productive. Privatizing (quickly) resource rents are the only way to go.

Increase subsidies to the resource sector. Bring back the royalty trusts, i.e., income trusts for oil and gas companies. Lower royalties, lower stumpage fees, subsidize even more excess capacity in the wood fibre business.

Increase year-in-year out seasonal employment insurance labour subsidies to resource-extraction businesses. Increase the generosity of fishing category employment insurance benefits for fishermen.

I say the Old Testament should be the guiding light for resource development.

Avoid Sovereign Wealth funds at all costs. For they are nothing but an evil communist plot.

I was conveying the same thing to a client a couple of weeks ago, regarding how well the CAD/US rate tracks oil prices. He suggested this shouldn’t be the case since oil is transacted in US dollars and most oil and gas companies are US based – therefore higher oil prices shouldn’t create demand for Canadian dollars vs US dollars.

I admit I didn’t have a good answer for him. Any thought?

My answer would be that to the extent that producing oil in Canada requires paying workers, Canadian-based suppliers and Canadian taxes in Canadian dollars, expanding activity in Canada will increase the demand for Canadian dollars.

What, no dotted line on this graph?

fuite en avant* between the devil and the deep blue sea

If Canada’s fortunes are to be tied to those of its major trading partner, and if you see that partner as increasingly becoming China– doesn’t this heighten the regional East-West tensions in Canada? What China wants from Canada largely come from BC, Alberta, and Saskatchewan. Ontario and Quebec are much less significant in a “rise of China” scenario than they were in a regime dominated by trade with the US

Flug nach vorn?

“Flight forward” is the translation I have read. I first saw this used to describe the behaviour of large armies which depended on extracting their supplies from the countryside through which they moved. Napoleonic I think.