Coverage of today's CPI release seems to be stressing the fall in the y/y all-items CPI inflation rate (example):

The recent fall in prices appears to have been entirely generated by the fall in gasoline prices, which has had the effect of canceling out the spike we saw a few months ago.

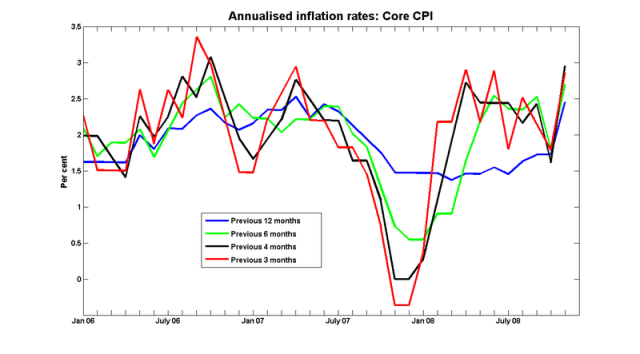

Here's what's happening with core inflation, the index on which the Bank of Canada focuses much of its attention:

The sharp drop at the end of last year was associated with the pass-through of an appreciating Canadian dollar: when the CAD-USD exchange rate hit 1:1, prices were revised sharply down as it became clear to even the most arithmetic-challenged consumer that Canadian prices were too high compared with what US retailers were offering. That one-off event has kept y/y core CPI inflation down for much of this year, but that's now starting to work itself out.

The Bank is unlikely to be displeased with these numbers. It'll still be possible to engineer negative real interest rates for awhile.

Neat graphs! I must learn how (no, I’m scared!)

I was surprised that inflation was not lower. I was especially surprised by core going up.

I assume CPI is seasonally adjusted? (It matters for anything other than 12 months). What about core? (Where can one find seasonally adjusted core?)

But what about durable goods deflation?

I was surprised to see the strong correlation between core and the exchange rate, and little correlation between CPI and the exchange rate. I can’t think of any obvious explanation of this.

Yes, everything is deseasonalised: Table 326-0022 of Cansim.

CPI is a measure of consumer prices, NOT true inflation. It is a valuable clue as to what inflation is doing, but not always. Prices have had dramatic decreases due to offshoring and more productivity, which masks the inflation we have had. Current CPI does not take into account the dramatic fall in asset values, which I believe is indicative of a coming dramatic decline in outstanding CREDIT. Remember, a borrowed dollar can be spent in the economy exactly like a saved dollar, but does not show up in the monetary base, as measured by most people. Thus we get all the benefits of a loose monetary policy with none of the pain. The borrowed dollar sloshes around the economy for a few turns, before parking itself in inflated asset values, which we can then borrow against to keep the party going. Now that credit is contracting, the emperor is about to be revealed in all his naked glory, and man, it’s cold out there!

The CPI is NOT inflation, and is intentionally used to obscure the fact that we have been in a credit bubble for years, and which seems to be in a retraction phase now. If this trend isn’t reversed soon, current debt servicing costs, both consumer and corporate, shall become unmanageable, which shall lead to a cascading cycle of debt default. This is why central banks worldwide are desperately trying to restart the credit growth cycle, despite people screaming of the inflationary danger of this approach.

alexcanuck: rather than arguing over whether or not changes in CPI are true inflation, I find it better to ask whether the CPI is a useful measure of inflation, because this leads to the question: “for what purposes?”. In other words, CPI might be a very useful measure of inflation for some purposes, but not for others. I did a post on this about one month ago.