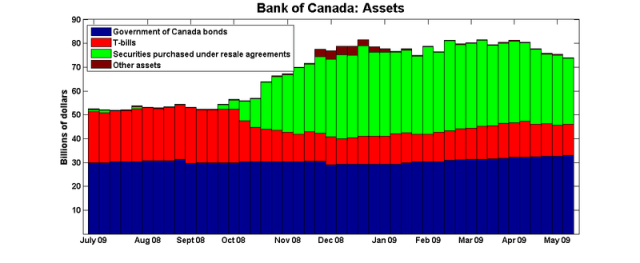

Five weeks ago, I posted on the evolution of the Bank of Canada's balance sheet during the financial and economic crisis. Since then, several things have happened:

- The size of the balance sheet has fallen by almost 9%: $81.1b to $74.0.

- The quantity of assets purchased under resale agreements (SPRA) has fallen by 14.7%: $34.2b to $27.7b.

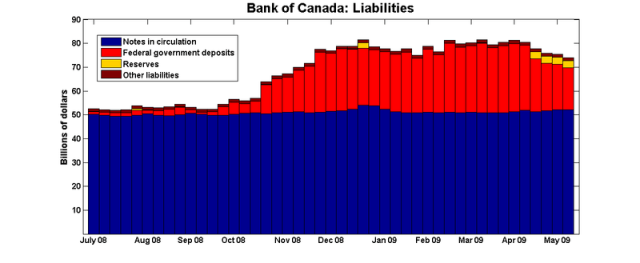

- The federal government's deposits at the Bank of Canada have fallen by 38.9%: $28.7b to $17.6b.

This sounds very much like what we'd expect the exit strategy from the Bank's credit easing policy to look like: as the SPRA are wound down from the asset side, the federal government's deposits would be taken off the Bank's liabilities.

But here's the thing: the $11.1b drawdown in the federal govt's deposits is greater than the $4.8b reduction in the SPRA. And some $3b of that difference has been taken up by reserves (and since Canada doesn't have required reserves, these can be interpreted as excess reserves) on the part of banks.

Here are the graphs of the evolution of the Bank of Canada's balance sheet. First up is the asset side:

And now liabilities:

That $3b in reserves appears to be the first step of a policy of quantitative easing, even as the credit easing policy appears to be winding down. Or at least, that's my reading of the tea leaves in the Bank's Weekly Financial Statistics.

Update: Brendon of Shock Minus Control informs us that the $3b is part of the Bank's framework for keeping interest rates at 25bps.

Interesting that the deposit number is precisely round: 3,000 million

It’s also the fourth week in a row for this number, with only April 29th being slightly lower for some reason.

It looks like a 3 billion deposit target has been the marching order for the past month – with government deposits adjusted as necessary to achieve this result.

I also noticed in the monthly chartered bank series, which has only been updated to March, chartered bank holdings of notes and coins are the lowest they’ve been in 2 years. That’s interesting, but almost certainly not directly related to the deposit number.

Yes, a nice, round number like that sounds very much like “Okay, let’s start with $3b and see how things go.”

The $3 billion is related to the Bank’s operating framework at the “effective lower bound” of 25bps. The excess balances are to drive trading of overnight balances down to the lower end of the operating band. I think this means that target balances higher than $3 billion would signal a QE strategy is in place.

See details here: http://www.bankofcanada.ca/en/fixed-dates/2009/rate_210409_1.pdf

Ah – thanks very much Brendon. Good thing I posed the title as a question, then.

So we’re back to ‘quantitative easing if necessary, but not necessarily quantitative easing’.