Last Friday's LFS release was the best we've seen in a long while. Not only did employment increase for the second month in a row, there was a significant jump in hours worked as well.

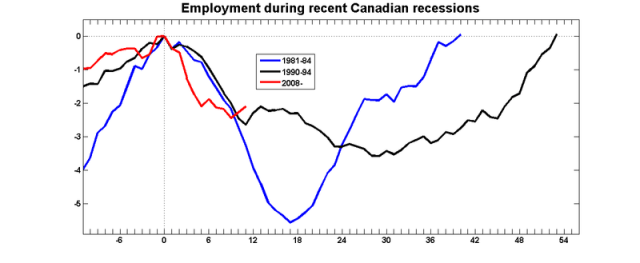

Here is the graph of employment over the past few recessions:

Once again, it's useful to compare this graph with its counterpart for US data, courtesy of Calculated Risk:

It's been said before, and I'll say it again: Canada is not the United States. Analyses developed in the US context should not be cut-and-pasted into a discussion of the Canadian economy.

At various points during the recession, it's been suggested that the employment picture is obscured by a shift from full-time to part-time employment. This is a valid concern, so I've also been I've been keeping an eye on the LFS numbers for hours worked. Although this series is pretty noisy, it's more closely related to measures of income and economic activity than the raw employment numbers.

Here, the news from September was a pleasant surprise:

The increase of 1.6% was the best we've seen in more than five years. Of course, the series is pretty choppy, so here is the graph of three-month moving averages:

Good news, to be sure. But it'll take a few months of these kinds of numbers before we can safely declare the recession to be over.

What do you think are the chances that we’ll see a second dip? I assume government spending will have to ease off next year, and consumers are not yet ready to spend. I could see a second, less drastic dip and a slow climb out in late 2010 and into 2011.

How much of this is related to cash for clunkers in the USA?

How much of this is related to commodity prices rebounding?

Andrew: That sounds a lot like a US narrative. I’m not sure it holds here.

I assume the US narrative is relevant. If US spending eases, I would expect both exports to the US and the value of those exports (commodity prices) to fall.

The Fed minutes reveal they are worries about a double dip once the fiscal stimulus wears off.

Canadian politicians with terminal US envy syndrome (remember a few years ago all those National Post articles about switching to the US dollar?) are going to go catatonic if the US unemployment rate goes south of 10% in a double dip while Canada continues to grow and unemployment drops to 6%.