One of the least edifying spectacles of the domestic coverage of the Copenhagen conference was the pointing of fingers at Alberta, most notably by the leaders of the provincial (in every sense of the word) governments of Ontario and Québec. The tar sands are in Alberta, so the reasoning goes, and it's up to Albertans to pay for the problems they generate. The hypocrisy of this stance has already been pointed out by several commentators: as Lysiane Gagnon asks, where did the Québec government think the $8.4b equalisation cheque that it cashed last year came from?

Not enough Canadians appreciate just how much we owe our recent prosperity to the oil sands. Roughly half of the increase in real per capita income growth since 2000 can be attributed to the increase in our terms of trade, and the increase in oil prices played a key role there.

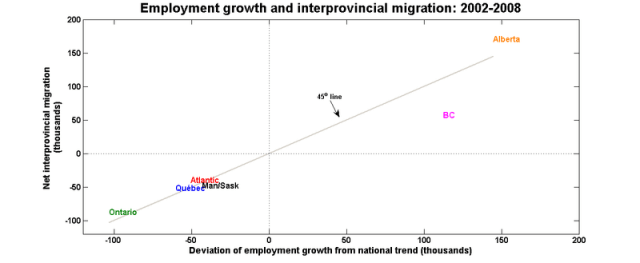

Moreover, the reduction in the unemployment rates in the provinces to the east of Alberta owes much to the fact that many of their unemployed workers moved to Alberta to find work. To illustrate this phenomenon, I calculated

- the difference between a regions's actual job growth and what it would have been if it had followed the national average, and

- net interprovincial migration

Here's what you get when you graph those numbers:

The first thing to note is that all the regions east of Alberta generated jobs at slower rate than the national average. The second is that to a rough approximation, the 45o line – which traces out combinations where the deviation of

employment growth from the national trend is equal to net

interprovincial migration – fits all regions other than BC. In other words, those who could not find jobs in their home provinces moved to Alberta and (and, to a lesser extent, BC) to find work.

So there's no point in pretending that we can stick one province with the costs of dealing with greenhouse gas emissions. As far as climate change policy goes, we are all Albertans.

Everyone likes white egg omelettes. Bird flu? Naaaa. 🙂

There have been a few comments suggesting that the rise in the price of oil and output from the Alberta Tar Sands have caused the Canadian dollar to appreciate, such as:

counterfactual what the effect on the economy east of Alberta would have been in the absence of exchange rate changes created by the existence of the oils sands.

and

a significant portion of the malaise east of Manitoba can be attributed to the higher dollar. Would factories be closing and workers moving westward with a 75 cent dollar? I’m not so sure.

and

over-exploitation of the oil resources in western Canada, which drove up our dollar, hampered our competitiveness

I think comments might be hampered by taking too much of a Canada-centric view on the Canadian dollar. And while I agree that improvements in Canada’s terms of trade have been driven by the rise in the price of oil and increases in Oil Sands production, it’s not so clear that this has driven the Canadian dollar higher. Rather, rise in CAD/USD has resulted from the US dollar falling.This becomes apparent if one includes a third currency as a reference, like the Euro.

Let’s look at the change in CAD/USD, CAD/EUR and EUR/USD from 2002 to 2008 (2008 saw the greatest appreciation in both currencies and crude oil). Below is the average exchange for each pair for each year, plus the percent change.

CAD/USD – 2002: 0.637, 2008: 0.943, change: +48%

EUR/USD – 2002: 0.945, 2008: 1.471, change: +56%

CAD/EUR – 2002: 0.676, 2008: 0.642, change: -5%

(10 years of exchange rate data is charted here http://special—-k.blogspot.com/2009/12/has-canadian-dollar-strengthened.html)

Between 2002 and 2008, the Canadian dollar strengthened 48% against USD, while the Euro strengthened 56%. And the Canadian dollar weakened slightly against the Euro. From the Euro perspective, the Canadian dollar hasn’t strengthened, it’s the US dollar that has weakened.

If the price of oil, and increased exports from the Tar Sands, were driving the Canadian dollar higher against the US dollar, then why wouldn’t these same factors drive the Canadian dollar higher against the Euro? Indeed, it seems counter intuitive that the Canadian dollar hasn’t strengthened significantly against the Euro given all the income generated by the oil exports.

It’s not clear that Alberta’s exports has caused the appreciation in CAD/USD, and the loss of competitiveness in manufacturing. Rather, it’s the USD depreciating that appears to be the major driver.

If they’d mention secure a place and job before moving there, Cgy’s homeless ## wouldn’t’ve ballooned (no mention of Prairie winters or shelter underinvestment). Their gov lauds a “Let Them Eat Cake” one income earner household (that extra $100+/wk Albertans earn over non-tar provinces is a part-time job for a mommy, why so mean to working class wage earners?). Fired best epidemiologist/planner on payroll in May 2009, just tried to take soap away from Mental Treatment Centres. Chretein put the gem of a NNI in Edmonton where are hostile to things like solar cell nanoimprovements instead of Regina natural complement to Saskatoon’s synchrotron.

A carbon tax is lobby-free, fast and small gov. Is now killed; now stuck with loudest chick lobby cap-n-trade someday. AB tried to pull a Kansas with their school curriculum. Equalization payments are capped at $3B per province, aren’t they (if they are $8.4B I stand corrected)? Less than $60B in non-inflation adjusted (ie. real figure is higher) federal transfers to AB mid 20th century to develop sands. How come don’t do the math the other way; how much AB’s gain from rest of world (even USA only creates 18% of their own wealth)?

Why I’m hostile is mandatory (imprisoning all pot farmers acceptable but insulting rich GOP-ish Province isn’t?!). The motive is greed and that greed exterminates us this/next century. They/we don’t complain about tranfers to province, only away from. Not defending some perfectly efficient capital arrangement. I think only USA and Canada don’t have nationalized oil, the norm. Both AB Parties say are for keeping wealth in AB and for clean tech research. Their own (lack of) policies and tax rates expropriate wealth away. Clean R+D budget now is $25M while clean-tar-sands propaganda budget is $50M. Federally, AB votes for a Party that isn’t very Stimulative of job growth; J.Flaherty will cut employment intensive Crowns to spare capital intensive sands and accountant-intensive banks. Danielle says some climate science is false.