The strong-ish November GDP number has revived the debate about when the Bank of Canada will start increasing its target for the overnight rate. On one hand, we have this:

Recovery points to summer rate hike: With the North American economy growing significantly faster than

expected at the end of 2009, and with mounting evidence that Canada is

pulling clear of recession, economists are increasingly of the view

that central bank Governor Mark Carney will pull the trigger on an

interest-rate hike this summer, rather than wait until later in the

year.

David Rosenberg has staked out the contrarian territory:

Interest hike this summer?: The history of the Bank of Canada is such that – outside of when it had

to defend the Canadian dollar – it typically does not embark on its

tightening phase until the output gap is close to closing… If such a strategy is replicated this time around – and the cause for

being on pause longer in the context of a historic deleveraging cycle

is certainly quite strong – then the very earliest the bank will move

is the second quarter of 2011.

I think we can safely set aside the latter scenario. For one thing, the recent history of the Bank's behaviour really shouldn't be used as a guide, because it never had to start from 0.25% before. If the Bank thinks that interest rates should be (say) 4.25% when the output gap closes, it's not going to raise the overnight target by 400 basis points in a single day. Or in a single quarter. Or even in a period of six months. Dramatic movements in interest rates are generally something the Bank avoids if it can. There's no reason to wait until the last minute to go from full throttle to full stop.

It should be emphasised that the Bank's current monetary stance is extremely expansionary. Thanks to its history of focusing on its target, expectations for inflation are essentially nailed down at 2%, so the current real T-bill rate is something like -1.75%. By any standard, that's an enormous amount of monetary stimulus. The Fed is still pushing on a string in the US, but Canada is already seeing the effects of low interest rates in the construction sector. And it should also be remembered that the most recent recession was milder than the two that preceded it.

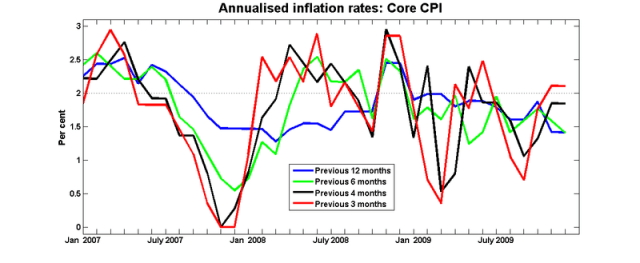

Here are a couple of graphs summarising the current situation. First up is the annualised inflation rates for core CPI across various horizons:

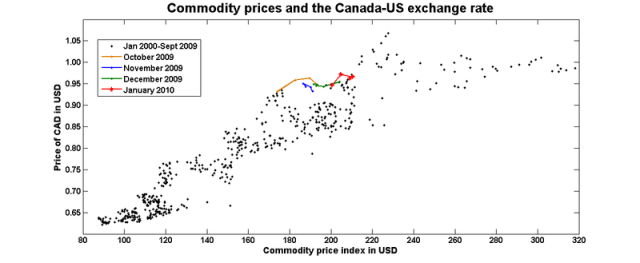

And next is the relationship between the exchange rate and commodity prices:

Last October, when the case for intervening to slow the appreciation of the CAD was at its strongest ([1], [2]), inflation was running well below target, and the exchange rate was well above levels consistent with previous levels of commodity prices. Since then, inflation has returned to the Bank's comfort zone, and the 20% increase in commodity prices has been accompanied by a comparatively small appreciation in the CAD. The Bank could be forgiven for believing that its current stance is appropriate for current conditions.

Then again, conditions are likely to change over the next five or six months. If the 2009Q4 GDP numbers come in as people seem to expect (and are followed by not-entirely-disappointing data), and if employment growth stays non-negative, then the output gap will shrink to the point where an overnight target of 0.25% is no longer appropriate, and this is likely to occur well before June.

If the Bank hadn't already made the promise (conditional on the overriding principle of sticking to its inflation target) of keeping the overnight target at 0.25% until June, analysts could be entirely justified in calling for a reduction in monetary stimulus, perhaps even starting as soon as the March 2 decision.

But I think that it's important for the Bank to keep its promise, even if doing so risks seeing inflation drift above target for a few months. Much of the Bank's success in the past year or two was based on the reputation it has built up over the past couple of decades: when the Bank of Canada says that it's going to do something, it does it. This is an advantage worth keeping. We don't know if or when the Bank will be called upon to draw upon its stock of credibility in a future crisis.

Where does this data come from? Did you make the graphs, or can they be found somewhere? As a student I am always curious where economists gather their data. If you did make the graphs, what program did you use? Thanks for the interesting post! Really liked Nick’s post on EMH a few days back.

If the bank does raise rates, what do you think would be the initial jump? At most?

I got the data are from CANSIM, although you can get them from the Bank of Canada’s website:

Core CPI: v41690926

Commodity price index: v36387

Daily exchange rate (I took the weekly average): V121716

The graphs were made with Matlab.

They should hold steady. I would much rather see a bit of extra inflation than sacrificed output. Also, I wouldn’t over react to what commodity prices are doing at the moment – they could decline this year.

indefease: my guess is that the Bank of Canada will raise the overnight rate by 25 basis points at first. It doesn’t like to move more than 25bps at a time, unless it really needs to, and I don’t think it will need to. I think an appreciating exchange rate will do most of the work in keeping inflation under control. Just a guess.

I agree with Nick.

I cannot imagine the Bank of Canada raising overnight rates until after the US federal reserve has started to raise rates.

In my opinion, the US fed should start nudging up rates this mid-summer at the latest. Use the moment to declare victory over the financial crisis.

dear professor:

I agree with your assessment. If output gap is expected to close in 3Q 2011 per BoC, the bank rate should reach the neutral level by then assuming inflation within tolerance. Market is pricing only ~65 bps hikes in 2010; that leaves a hefty ~350 bps move in first 3 quarters. This tells me hiking will be more front-loaded in nature than market pricing suggests currently.

Long time reader, my first post. Thank you for this very educational blog.