I'm still playing around with demographic data, and one thing I've done is trace out a timeline of how we ended up having the population aging problem in the first place. I even prepared an animated gif file: a WCI first.

Once again, this isn't new to anyone who is familiar with the file, but these graphs of the distribution of the Canadian population by age group may make the point more clear for those who aren't.

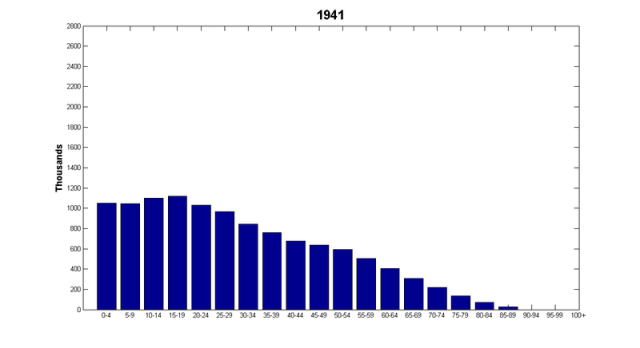

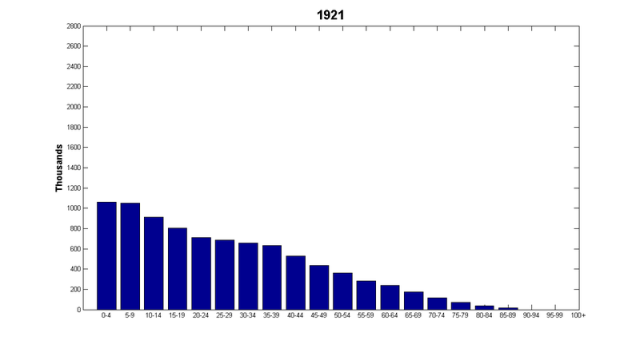

We start when the data do – in 1921:

This is the last census year in which the age profile is monotonically decreasing in age.

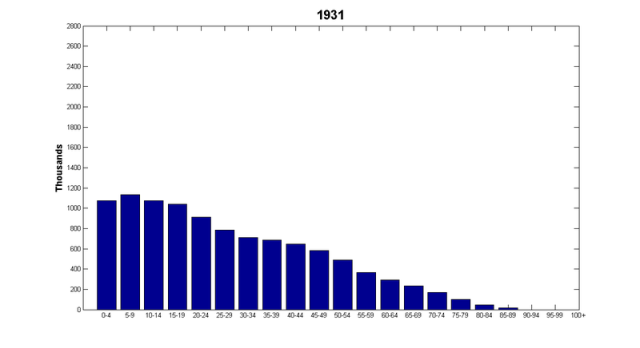

The arrival of the Great Depression also depressed the number of births. This is more visible in 1941:

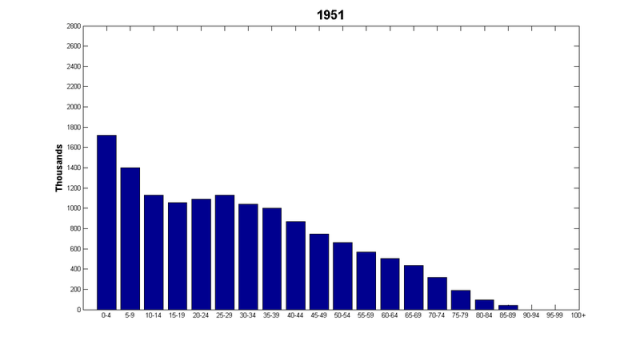

By 1951, we see the beginning of the baby boom:

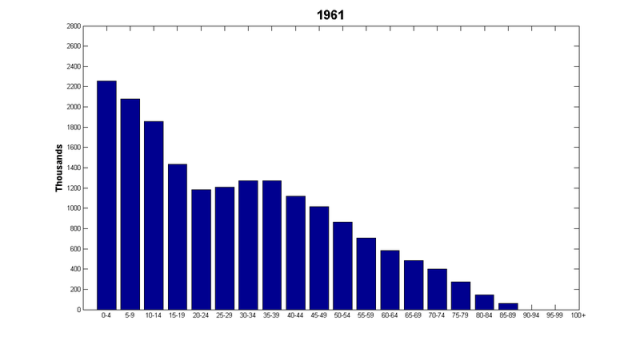

The 1961 cohort of births – of which I'm a member – is the largest in Canadian history:

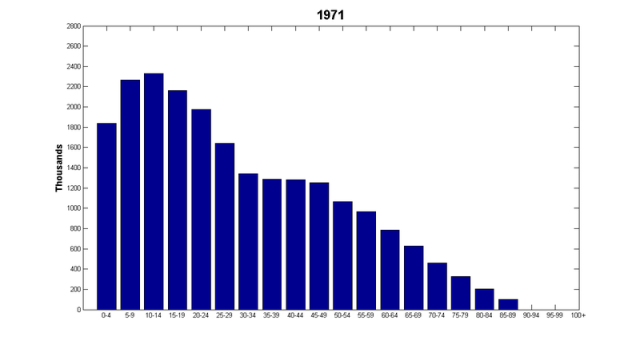

By 1971, we can see the beginnings of today's problem:

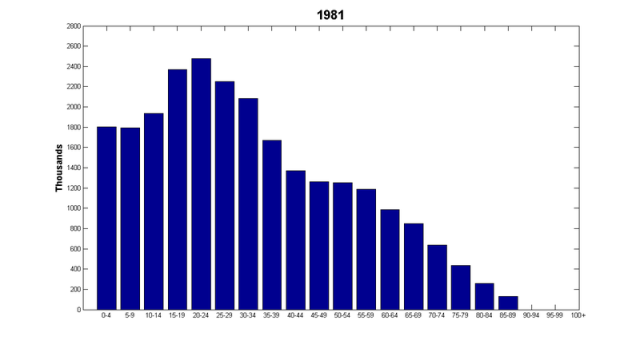

In 1981, those massive cohorts born in the late 1950s and early 1960s were entering the labour force, so the 1982 recession was particularly ill-timed:

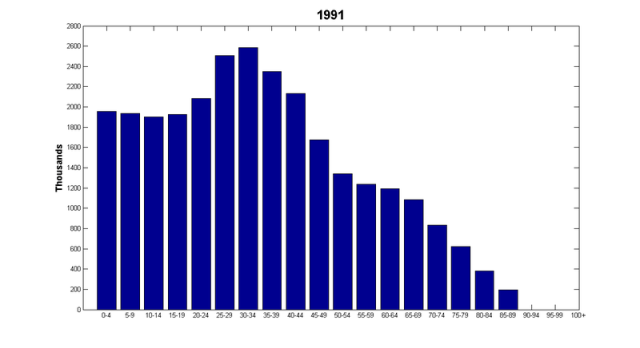

In 1991, you can see what David Foot calls the baby boom 'echo': the small increase in births as the baby boomers reached the age in which they would become parents:

That slight uptick didn't last long, though:

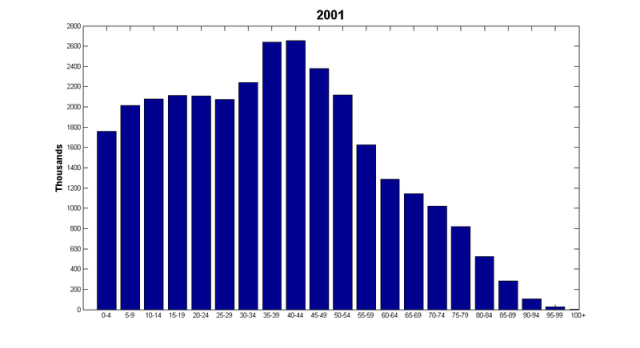

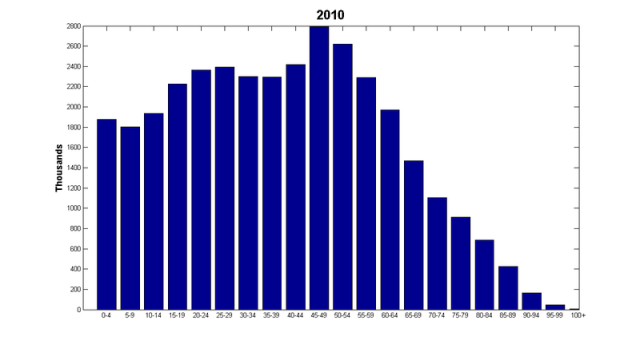

Which brings us to where we are today:

And just for fun, here are all of these graphs put together as an animated gif:

Stephen, I’ve heard someone use the metaphor of a snake eating its prey to describe the movement of the baby boom generation through the population distribution. So the 1961 graph is the snake opening its jaws wide and swallowing, 2010 the snake is about half way through digesting its dinner, and the process goes on until…. well, you get the picture.

These graphs are a great reality check for anyone who figures immigration can in some sense “solve” demographic crises by returning our demographic profile to what it was in, say, 1991 – just think how much the bars on the left hand side of the graph would have to increase in order to get the 2010 graph to look like the 1991 graph.

Well, when you animate it, it looks like a giant wave moving across the ocean. I guess it really is a silver tsunami of seniors.:)

Sufferin’ Succotash, Livio!

On the other hand, perhaps we can use things like delayed retirement to handle these problems. I am part of the 1970’s birth cohort and it took me a long time to become employed. If I have the option then I am unlikely to ever leave the work force as retirement savings are a tough issue.

I’m hoping that medical advances do a better job of keeping people in their late sixties and early seventies better able to work. We also need some social change that makes it easier for people to slow down while not relegating them to menial, low-skill positions like Wal-Mart greeter. Many of the older people I work with work pretty punishing hours, and it looks to me like their only viable way out of that lifestyle is to retire. Seems a waste to me, if they would be happy with a 50% pay cut and 50% cut in hours worked. People tend to be more productive when they work fewer hours, so maybe this will help with the lagging productivity for workers approaching retirement. Four day work weeks and four months off a year might not be such a bad way to semi-retire.

Aggregate demand worries me at least as much as gov’t finances. How are we going to avoid turning Japanese

Its not just a matter of health as a determinant of whether people stay in the labour force. There are some organizational/labour market artifacts that may induce people to leave the work force earlier.

For example, my cousin works as a municipal garbage collector, he started the job at age 18 and retired on full pension at age 48 completing 30 years of service. He can decide to either get a second job or stay retired. Finding a second job that provides another fully defined benefits pension is hard these days, so he may opt to work part-time in an area he enjoys.

Second example, another cousin, her husband works for a construction company in Ottawa, the way the union rules work is, over-time is counted towards years of service at “time and a half”. So many workers in that union will load up on overtime and get their 30 year pension in say 25 years. So many of them at around age 45 or 50 have a choice, retire and stay home or move to another province join the same union (different local) and work towards a second pension.

Point being, even if you are healthy leaving the work force at an early age is a rational choice for many with the appropriate pensions which be used like bridge financing until they qualify for CPP/OAS.

looks like a snake eating a pig!

oh, i might suggest cheking out immigration watch canada – http://www.immigrationwatchcanada.org/news-links/ – they also send out articles on immigration

Mick:

At our college, one of the “blues” (maintenance) is 58. He retired from a mining company with 90% pay at 48 after 30 years. Moving in seniority here , he was offered a full-time post. He choose to retire once again with his second pension ( 20%) and is now looking for a part-time back in the ore processing plant…Beats finishing a post-doc at 30 and payiing your student loan…

A lot of moral hazard with DB plans, it seems.

What is immoral or unfair about cashing in his DBPs? It is merely deferred pay,or an uncashed check put in the bank.

It is no different than working while cashing your RRSP or drawing your bank account. We might argue whether he was too-highly-paid in his first and second jobs or was his first job subsidized by the mining company not paying enough royalties. Not about the moral hazard of cashing its own chips.

“In 1981, those massive cohorts born in the late 1950s and early 1960s were entering the labour force, so the 1982 recession was particularly ill-timed.”

Right, tell me about it.

I’m at least moderately happy to note that both of my kids are in that 15 year ‘pocket’ that is appearing on the left. It’s no guarantee – but it’s better than the alternative.