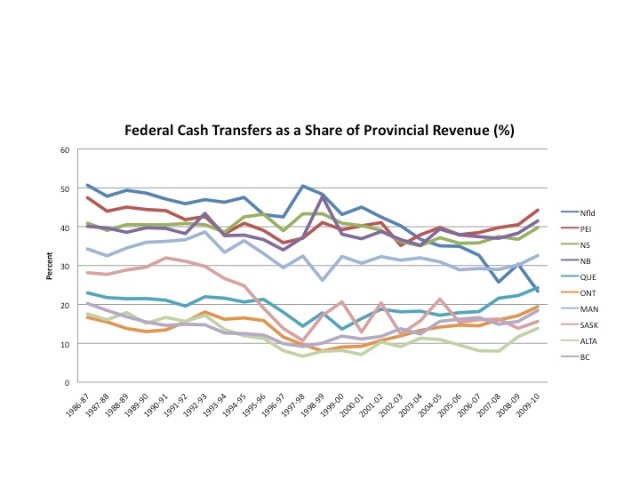

Well, I decided to finish off my postings on provincial revenues and go to the Federal Fiscal Reference Tables which provide a federal transfer revenue variable for each province from 1987/87 to 2009/10 as well as provincial revenues. I have a plot of nominal per capita transfer revenues and not surprisingly it shows an upward trend. More importantly, I then construct a share of provincial revenue accounted for by federal transfers.

First, there is clustering into two tiers of transfer recipients. Historically, the four Atlantic provinces and Manitoba are in the top tier while everyone else is in the lower grouping. This top tier of transfer recipients currently averages about 36 percent of its revenues from federal transfers – double the share of the bottom tier recipient provinces, which is at 18 percent. Moreover, by 2009/10, average per capita transfers for the top tier group are between 3,000 and 4,500 dollars while for the lower tier they are between about 1,400 and 2,000 dollars per capita. While per capita transfers have risen, the share of provincial revenues from federal transfers has declined since the mid 1980s. For the top tier, the average revenue share dropped from 43 percent to 36 percent while for the bottom five it was a smaller drop – 21 percent to 18 percent.

However, the averages mask some interesting fluctuations. There has been some recent change with Newfoundland and Labrador dropping downwards and it now has a federal transfer share of revenue equivalent to Quebec. As for the members of the lower tier – Ontario, Saskatchewan, Alberta, British Columbia, and Quebec – their revenue share from transfers declined from the mid 1980s to the late 1990s but then began to rise. Ontario has seen some of the steepest growth going from about 8 percent of total provincial revenues from federal transfers in 1998/99 to 19 percent in 2009/10. Obviously, Ontario has been successful in having its “fiscal imbalance” issue addressed though another interpretation is simply that Ontario has really been having a tough economic time and this has affected its own-source revenue side.

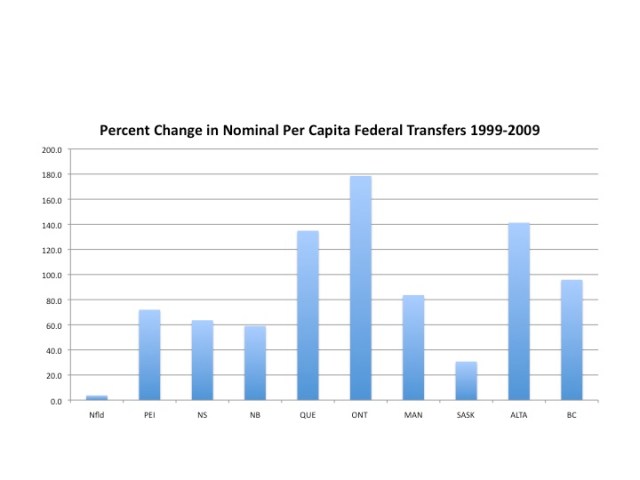

Trying to pull everything together, it appears that provincial revenues overall have risen over the last two decades but the proportion accounted for by federal transfer revenues has declined though there has been some recovery in the share since the late 1990s – particularly for Ontario, Quebec, Saskatchewan, Alberta and British Columbia. This is quite interesting as it suggests when transfers are revisited – as they inevitably will be even before the expiry of the Health Accord in 2014 – any reductions in either the levels or the growth rate will not just hurt the traditionally transfer dependent provinces but also some of the new beneficiaries. Ontario, for example, has seen its nominal per capita transfer revenues rise from about 400 dollars per capita in the late 1990s to just over 1400 dollars at present. In percentage terms, this has been the largest increase in per capita transfers – followed by Alberta, Quebec and British Columbia. My guess is that the case for increasing federal transfers this time around will see the loudest advocates not from the traditional recipient provinces but from the new beneficiaries.

Does this include the value of transferred tax points?

Jim:

These are described in the tables as Federal Cash Transfers.

What would this look like if federal employment by region was included, since much of that is allocated for political reasons. I’m thinking of government offices, military bases (but not RCMP since provinces paying for that). Would that give a different picture?

What does net revenue look like? This would seem to be the relevant metric for beneficiaries although I suspect that the two broad groupings would look the same with maybe some shuffling within them.

Interesting…as Ontario will receive more seats by next election as well, which very well could be before 2014!

Jim,

Stricly speaking tax points aren’t transferred. Other than indirect taxes, the federal government and the provinces have the same constitutional power to raise taxes, so the “transferred tax points” are really federal tax cuts and provincial tax increases which should, righly, be described a provincial own source revenue. The notion of “transferring” tax point is a political concept, so as to pursuade voters that the provinces weren’t increasing their tax (we recently saw the same game played, quite succesfully, by Nova Scotia when they increased their HST rate to 15% to occupy the tax room created when the feds cut the GST. Unlike the disaster in BC, that tax incraese went over quite well, largely I suspect because the optics were that they were just returning to the old rate).

These tables mask the fact that federal revenues comme from somewhere. For the lower tier, essentially, the feds are sending back money collected in the province to which it is sent. But the feds like the meme that some all-powerful god in Ottawa somehow helps the provinces. And the huge total amount ( even though it is in the bottom per capita) sent to Québec is useful to others.

Shangwen: unlike the U.S., military expenditures in Canada are more or less related to real military activities and historical inertia ( path dependency in economic bafflegab). Esquimalt and Halifax are obvious sites for naval bases and have been so for a century (probably the next ones too). Comox protects Vancouver and the Pacific fleet. Bagotville was built to protect the WWII aluminum smelters and endures to this day. Cold Lake has a lot of nice flat uninhabited terrain not far from a big city. The fact that individual MPs cannot directly influence basing decisions ( and that the budget is not that high to begin with) may be a factor.

The only really noticeable manipulation I remember was when the fed invented an 11th province ( the National Capital region) to hide how much Ontario was receiving in federal gunmint jobs and contracts.

What would this look like if federal employment by region was included, since much of that is allocated for political reasons. I’m thinking of government offices, military bases (but not RCMP since provinces paying for that). Would that give a different picture?

Actually the provinces only pay for 70% of their policing cost for the RCMP, the Federal Government pays for the other 30%. This was the carrot in getting provinces to accept the RCMP as their provincial police force. Ontario and Quebec have never accept this and therefore pay a 30% penalty for having our own provincial police.

Bob:

The notion of tax point transfers also results from the history of the income tax system, particularly the tax-rental agreements from 1941 – 1962. The first agreement resulted from the need to finance the Second World War and it was the only one Quebec signed. The provinces were placed on an allowance and the Federal Government received all personal income taxes, corporate income taxes and 50% of the inheritance taxes under a uniform national rate. It established the precedent that Ottawa was primary in the income tax field and was determined to enforce a uniform national income tax rate. The abatement still given to Quebec filers on Federal income tax returns reflects this.