There's not been a lot of drama in the Bank of Canada's recent announcements for its overnight rate target, nor does it look as though there will be for several months. As long as there's a non-negligible risk that the eurozone will produce a financial crisis, the Bank of Canada won't be in any hurry to increase interest rates. The Bank has made it clear that it will (temporarily) tolerate an inflation rate above 2%, rather than make an interest rate hike that it would later regret. I don't have any problem with this stance. So the only really interesting thing to write about is the evolution of the Bank's outlook.

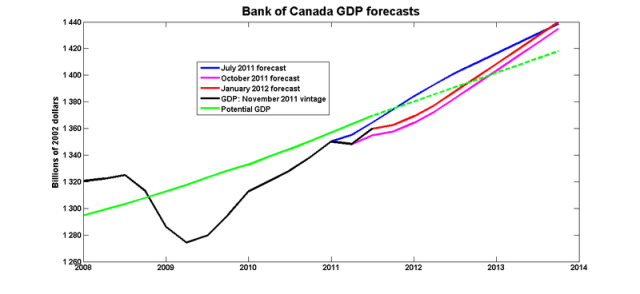

Here is my updated graph of the Bank's recent forecasts:

The dotted green line is an extrapolation of potential output.

There's not a lot to say. The eurozone crisis forced a sharp downward revision in October, and the better-than-expected recent news produced a slight upward revision in January.

To use Frances' analogy, our Toyota Matrix is still running.

Curiously enough, my car is also a Toyota Matrix.

The numbers on the Y-axis of the chart don’t make a whole lot of sense. The number above 1450 should be 1500, and so on.

I just noticed that. Something happened to the y axis labels while I was putting the graph together.

Out of curiosity, I put the Bank’s forecast for inflation and the output gap into the policy rule used in ToTEM to proxy for the future path of the overnight rate. This rule gives very little weight to the output gap but puts a high weight on the deviation of expected core inflation (two quarters ahead) from target. Interestingly, because the Bank expects core inflation to decline in the first half of 2012, the ToTEM rule would call for a CUT in the overnight rate to 0.50 by the middle of the year, and then return to 1.00 by the end of 2012, followed by a very gradual increase thereafter.

I’m curious where the Bank thinks growth is going to come from in 2013, particularly given the large downward forecast revision to US growth in 2013 (to 2.2 from 3.3).