The 2012 Federal Fiscal Reference tables are out and the

information on provincial net debt is interesting especially when the growth of

net debt is considered.

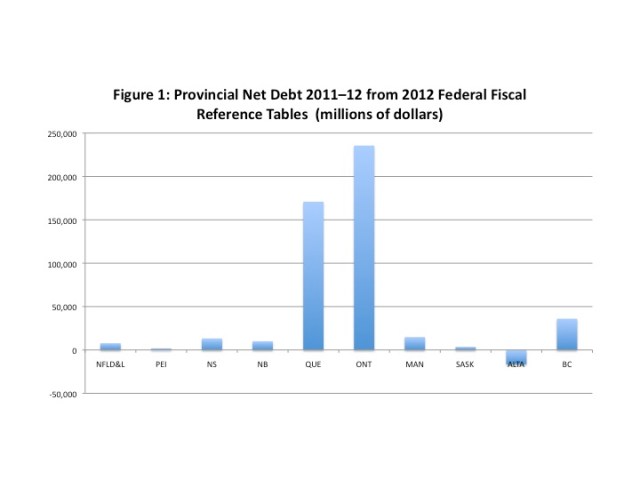

The basics of

provincial government net debt are well known and illustrated in Figure 1. For the 2011-12 fiscal year, Ontario and

Quebec lead the pack at 235.6 billion dollars and 170.9 billion dollars

respectively. Alberta, is unique amongst

Canada’s provinces in that once the value of its assets are taken into account,

it has a negative net debt.

What is more interesting is how fast net debt has been

What is more interesting is how fast net debt has been

growing across the provinces. One might

think that the provinces with the highest net debt growth would be Ontario and

Quebec but strangely enough it is Manitoba and British Columbia. As Figure 2 shows, for the 2011-12 fiscal

year, the growth rate of net debt was highest in Manitoba at 17.2 percent

followed by British Columbia at 11.8 percent.

Meanwhile, Alberta, Saskatchewan and Newfoundland and Labrador are all

showing a negative growth rate for their net debt.

In the case of Manitoba, the growth rate of net debt has

been growing steadily as it was 2.9 percent in 2009-10, 7.3 percent in 2010-11

and 17.2 percent in 2011-12. I was under

the impression that Manitoba’s economy had been weathering the recession

relatively well. If anything, one would

have expected growth in the net debt top be highest immediately after the

downturn in 2009. Perhaps Manitoba is doing as well as it is because of continuing stimulus via deficit financing but the bill will eventually have to be paid. Perhaps WCI readers in

the west might be able to shed some insight on what’s up in Manitoba.

As for British Columbia, it has been pretty consistent over

the last three fiscal years in its additions to the net provincial debt coming

in at 12.3, 9.8 and 11.3 percent.

Ontario on the other hand, with the third highest growth rate in 2011-12

has been slowly reducing the growth rate of its net debt with the last three

fiscal years seeing rates of 14.1, 10.8 and now 9.8 percent. New Brunswick seems to be doing well but its recent

relatively low growth rate comes after two years of double digit net debt

growth.

With regards to Manitoba, it might have been the floods which fiscally impacted them quite heavily.

Professor, per-capita numbers might be more useful, depending on what you are aiming to show. Ontario and Quebec, after all, represent about 63% of the Canadian population.

This is not the provincial debt post I was expecting! I thought that you (or maybe Mike) would comment on this: http://www.macdonaldlaurier.ca/files/pdf/Provincial-Solvency-October-2012.pdf.

Well Phil, that MacDonald Laurier report by Marc Joffe on provincial solvency is quite interesting. I’ve been going to conferences over the last week and was in the process of digesting it but this is as good a time as any to provide a quick summary. As the summary states: “Due to population aging, the provincial models forecast lower labor force participation, less economic growth and higher health spending in later years. Depending on how quickly interest rates revert to their post-World War II means provinces are at risk of encountering solvency crises over the next 10-30 years if fiscal policies do not change.” The crucial threshold based on a review of the historical evidence is spending more than 25% of your revenues on debt service and no province is near this point at present or expected to be in the near term. The long run of 10-30 years out is a different matter. According to this report, Ontario apparently has one of the highest risks of default in the longer term due to its large annual deficits as does Alberta. The interest rates facing the provinces are quite low and uniform and do not appear to reflect the risks because there seems to be an expectation that the federal government will assist the provinces if they run into difficulties in meeting their obligations. That however is not a sure thing. There seems to be some debate as to whether or not the federal government is obligated in any way to bail out provinces.

I looked at the Manitoba situation and apparently a good bit of the later run up in debt was a huge expenditure related to flooding in 2011. Nearly a billion in costs related to that.

Interestingly none of the things blamed for debt run up in PEI (above and beyond stimulus and cyclical budget issues). Here they’re blaming a slowdown in transfer growth, losses in provincial pension funds and continued capital spending on a development plan.

Agree that per capita or per GNP growth would be helpful. If Alberta were to add a billion of debt the growth rate would be stratospheric but untroubling.