The New Year is when we try to look ahead and project

what we think the economy will be like.

There is no shortage of forecasts from banks, international economic

agencies and independent forecasters as to how the Canadian, US and world economies will fare over the

next year.

I am not pessimistic with respect to the coming year. With respect to Canada, the economy may

slow a little but there will still be growth. The Asian economies are slowing somewhat but there is still

substantial growth and this should keep resource demand stable which will benefit Canada. The US economy is recovering, slowly

but surely, and despite the economic drama and opera associated with fiscal

cliffs and debt ceilings they will manage to get through these episodes. It is disconcerting watching the US political system at work and the associated brinksmanship given their importance to the world economy but they still manage to resolve the

issues albeit temporarily. The

United States is dealing with its long-term economic and fiscal problems as a

series of short-term fixes rather than as a long-term strategic approach.

As for Europe, this is the weakest part of the picture. Europe is not growing and there are

members of the EU in pretty bad shape.

The European Central Bank is forecasting that 2012 will ultimately see

the Eurozone’s GDP shrink by half a percent in 2012 and is forecast to shrink a

further 0.3 percent in 2013. Despite all this, I

think the Euro will still exist twelve months from now and the Eurozone will still have 17 members and while we may see

another debt crisis involving either Spain, Italy or perhaps France, I think

they will also get through it. The only evidence I can offer is past

performance in the face of crisis – they have managed to get through each crisis

since 2009. Financial markets in Spain and Italy have stabilized since the

summer and borrowing costs declined.

However, unemployment especially among the young is high. I suppose fragile is a good descriptor for Europe's economy.

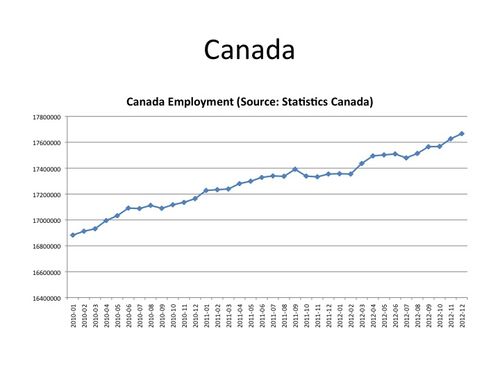

If you look at employment over the last couple of years in

Canada, the United States and Europe (see figures), Canada and the United

States have seen total employment grow between 2010 and 2012 by 4.6 and 3.5

percent respectively. Growing employment is a good sign even if it is anemic growth. However, everything is relative to when you want to start measuring from. A post by Floyd Norris in the New York Times says that compared relative to 2008, US employment is only up by 0.02 percent. That makes things in the US not so good. The Euro

zone (17 countries) on the other hand has seen its total employment level

remain flat since 2010. That is also not good.

Nevertheless, I am cautiously optimistic about the year ahead based on

what I have seen to date and what I can see. Even Europe should see some improvement. After all, Mark Carney is crossing the pond. I suppose, the real concern is always the unexpected but who can

see that? Happy New Year.

I’m still very pessimistic on the Eurozone. It has taken longer to explode than I thought it would. Mostly, I think, because the ECB finally did things it wasn’t supposed to do. I’m still surprised at how many people and parties in even the worst hit countries seem so willing to complain about everything — except the Euro itself. Their main hope now is that recovery in the rest of the world might pull the Eurozone out of a deepening recession, and avoid an eventual explosion. Maybe.

In 2010 and 2011 WCI had forecasting contests – here’s Nick’s post announcing the winner of the 2011 contest: http://worthwhile.typepad.com/worthwhile_canadian_initi/2012/01/canadian-economic-forecasts-2011-revisited.html. It looks like we didn’t have one for 2012?

Yes – Let’s have a 2013 prediction contest like in 2010 and 2011

It’s kind of fun and a good reality check on how darn hard it is to predict!