Pre-requisite: second year macro (go read the intermediate textbook on ISLM).

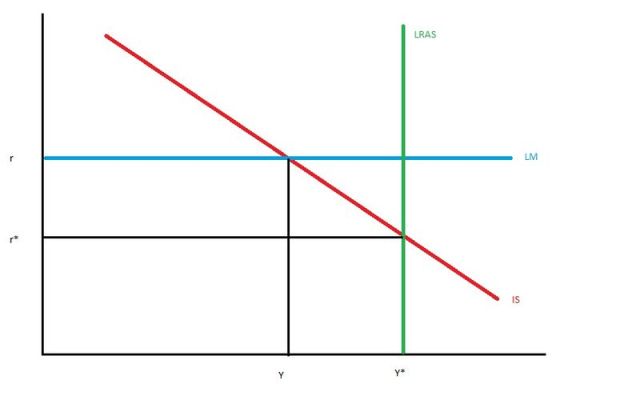

Start with the standard ISLM model. Then assume the central bank targets a rate of interest, so the LM curve goes horizontal. This is what we get:

The IS and LM curves intersect at the level of real income Y. In my diagram, I have assumed the central bank has set the interest rate too high, so Y is below potential/natural rate/"full-employment" output Y*. (I have drawn the LRAS curve as vertical in {r,Y} space, but it doesn't have to be; New Classical RBC theorists would draw it upward-sloping, because of intertemporal substitution of leisure, but we can ignore that here.) If the central bank cut the interest rate to the natural rate, r*, output would rise to Y*.

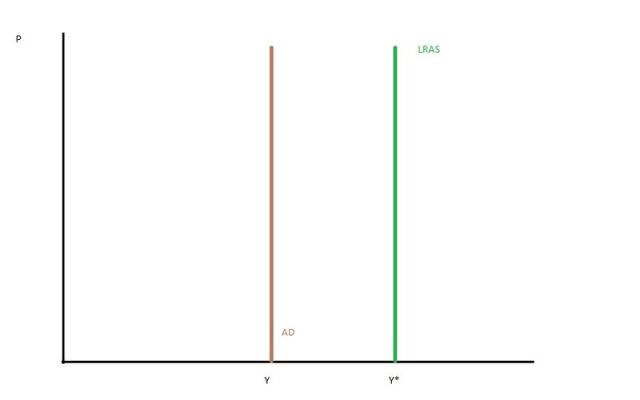

The intersection of IS and LM curves determines Aggregate Demand. If we draw the AD and LRAS curves in {P,Y} space, they look like this:

If the central bank targeted the money supply, rather than the interest rate, the AD curve would slope down, because a fall in the price level would increase M/P, which shifts the LM right, which reduces r and moves the economy down along the IS curve to a higher Y. But if the central bank targets the interest rate, which is what we are assuming here, this doesn't happen, so the AD curve is vertical.

With vertical AD and vertical LRAS curves, there is no long run equilibrium for the price level. Price stickiness is the only thing preventing P being zero, or infinite (if the AD curve is to the right of the LRAS curve). Even if the central bank gets it exactly right, and sets r=r*, any level of P is an equilibrium. P is indeterminate.

That was the Old Wicksellian indeterminacy.

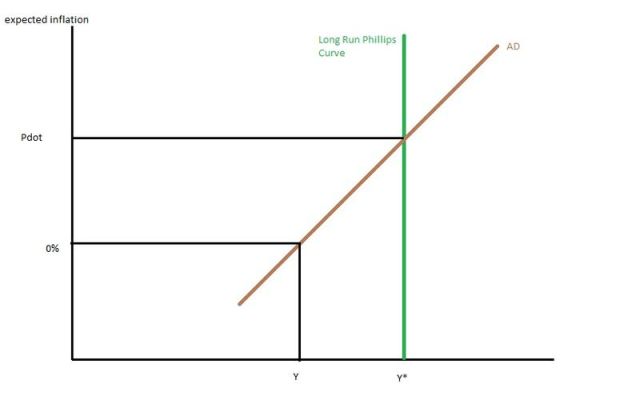

If we draw the AD and LRAS curves in {inflation;Y} space, we get a different picture:

I'm assuming that the central bank sets a nominal interest rate. For a given nominal interest rate, an increase in actual and expected inflation reduces the real interest rate, which moves the economy down along the IS curve and increases AD. That's why this AD curve slopes up. (It is conventional to re-name the LRAS curve the Long Run Phillips Curve when we draw it with inflation rather than the price level on the axis.)

Notice that there does exist an equilibrium inflation rate, Pdot in this example. If the central bank sets the nominal interest rate too high, we still get to potential output, provided inflation increases in proportion, to keep the real interest rate equal to the natural rate. But that is a rather stupid equilibrium, because under any reasonable story of price adjustment it will be an unstable equilibrium. If inflation is below the equilibrium, there will be excess supply of goods, which would tend to make actual and expected inflation fall, getting even further away from equilibrium.

The only way to keep inflation on target is if the central bank moves the nominal interest rate quickly enough and more than one-for-one in response to expected inflation rising above or falling below target, to make that AD curve slope down instead of sloping up. That's the Howitt-Taylor Principle.

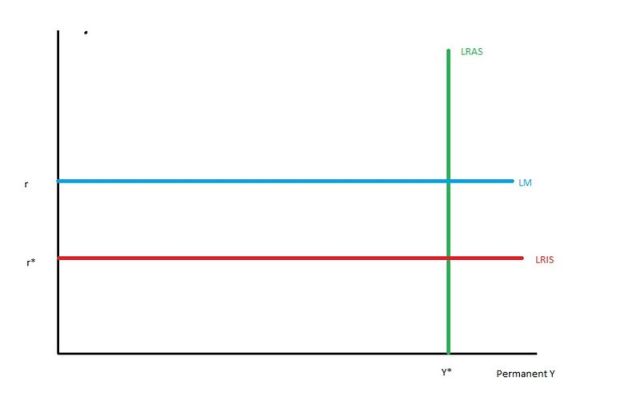

Now let's switch to the New Keynesian model with an Euler IS curve. First, lets put permanent income on the horizontal axis:

The Long Run IS curve is horizontal. The basic idea is that, if you assume homothetic(?) preferences and technology, everything scales up. Start with one desired saving=desired investment equilibrium, double output, income, consumption, and investment for current and all future periods, and you still have desired saving=desired investment at the same real interest rate. That's what the Euler equations say.

Now, my guess is that New Keynesian macroeconomists only assume homotheticity to keep the math simple. If we dropped that assumption, we could get the LRIS curve to slope either up or down. But I don't remember reading any New Keynesian macroeconomists talking about homotheticity and the problems it creates, so I'm going to run with it. (I do remember Patinkin talking about this, but that was a very long time ago, and New Keynesians don't pay any attention to macro books that have "money" in the title. [In-joke, sorry])

You can see the problem. If the central bank sets the interest rate too high or too low, there is no ISLM equilibrium. And if it sets it just right, any level of permanent income is an ISLM equilibrium. The interest rate is over-determined, and the level of real output is under-determined. If people expect output always to be 50% below potential, then output always will be 50% below potential. Or 60% or 99% or whatever. Even if the interest rate is exactly right.

New Keynesian macroeconomists duck this problem, by suddenly reverting to Monetarist reasoning and just assuming that people expect the economy eventually to converge to potential output. But this is not a Monetarist model, in which the central bank has a monetary target.

If the LM is strictly above or strictly below the IS curve, the AD curve does not exist. If it is exactly superimposed on top of the IS curve, the AD curve is very very thick. Everything is on the AD curve.

That's the Neo-Wicksellian indeterminacy.

Let us duck that indeterminacy too. Just assume that permanent income equals permanent potential output. Let's only consider fluctuations around potential output, even though we have no story whatsoever to explain why people expect the economy to be at potential on average. Their Monetarist animal spirits keep it there on average.

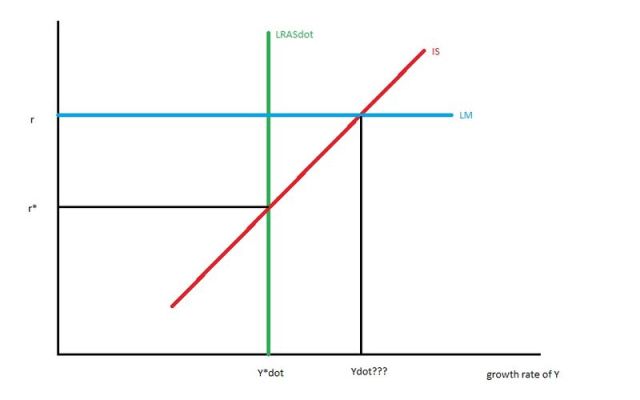

Here's the last diagram:

I have put the growth rate of output on the horizontal axis. If the central bank sets r above r*, as shown, Y will be below Y* (we get a recession), but will be growing faster than Y*. Because people will consume less than their permanent income, but their consumption will be growing faster than their permanent income.

Addendum on fiscal policy:

If we increase government spending, we shift the IS curve to the right. But that doesn't do anything, if the IS curve is horizontal, like in the fourth picture.

If we increase the growth rate of government spending, that shifts the IS curve right, in the fifth picture. But that IS curve slopes up. So it would reduce the natural rate of interest. And cause a recession, unless the central bank cut the interest rate.

“New Keynesian macroeconomists duck this problem, by suddenly reverting to Monetarist reasoning and just assuming that people expect the economy eventually to converge to potential output. But this is not a Monetarist model, in which the central bank has a monetary target.”

Are you saying that the only way people would expect the economy to converge to potential output is if the central bank had a monetary target?

Nick Edmonds: not quite. It has to be a target with $ in the units, Money, price of gold, level of NGDP, something like that. To make the LM slope up and the AD slope down.

If we have starting values for all the nominal variables and the model dictates the path, then shouldn’t things like the money supply (or any other $ variable) be determinate, even if they are not explicit targets? The rational optimizers who inhabit these types of models should be able to know what the money supply is going to be at any point, without it needing to be a target.

Nick Edmonds: but (in this case) the model does not dictate the path. That’s the indeterminacy problem.

Nick Edmonds: not quite. It has to be a target with $ in the units, Money, price of gold, level of NGDP, something like that. To make the LM slope up and the AD slope down.

Nick Rowe: Could the central bank target an interest expense instead of interest rate? The interest rate has units $ paid / ( $ borrowed * unit of time ) where as interest expense would be $ paid / unit of time. With an interest rate the $ cancel in numerator and denominator where as with an interest expense the $ units are retained in the numerator.

Frank: in some circumstances no. In other circumstances yes, but it would be a really stupid target.

But do you meet the prerequisite for this course? If not, you are only allowed to audit.

🙂