The pressure to cut taxes comes from those who pay relatively more in taxes, and benefit relatively less from government spending.

Men, on average, earn more than women. Hence they pay more taxes than women do:

Men account for about half of those filing tax returns in Canada, but 59 percent of taxable income is earned by men. Because the income tax system is progressive, higher income earners pay a relatively higher percentage of their income in tax. That's why two-thirds of federal and provincial income tax revenues are collected from men.

The pressure for income tax cuts comes primarily from men, because men pay more, on average, in income taxes than women do.

Not all taxes have the same kind of gender split as the income tax. Men actually pay less in employment insurance premiums, relative to their income, than women do. That's because employment insurance premiums are regressive – they max out at a certain income level, so they are a lower percentage of income for high income individuals, and men make up the bulk of Canada's high earners. Also, EI premiums are only paid by employees, and more of men's incomes comes in the form of business and professional income.

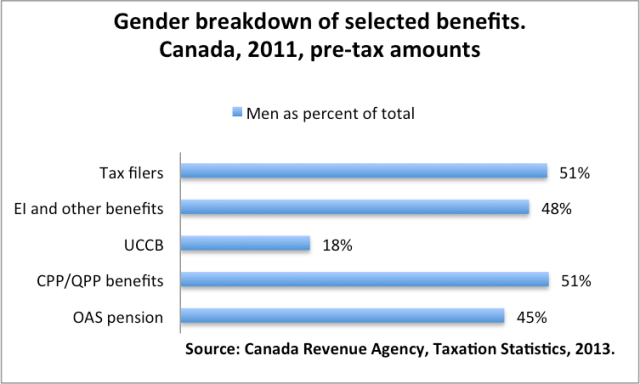

Men might be willing to pay higher taxes than women if they felt disproportionately advantaged by government spending. Some types of government spending, like infrastructure or military spending, create jobs in male-dominated industries. Yet the bulk of government spending goes to health care, education, and support for people in need. Drawing again from Canada's taxation statistics, which summarizes the information reported on people's tax returns – and thus represents pre-tax amounts of benefits –

Women live longer than men, hence collect their Old Age Security pension (OAS) for longer than men do. The Universal Child Care Benefit is usually paid to women. Maternity and parental leave, combined with women's greater risk of poverty, mean EI and other (anti-poverty, income support) benefits go slightly more to women than to men.

A salaried employee with a stay-at-home spouse earning $150,000 or $200,000 a year pays a good percentage of his income in tax, but he is unlikely to benefit disproportionately from government spending. I use "his" and "he" advisedly – the majority of people fitting this description are men. That's the gender politics of taxation, the gender politics of support for income splitting, and the source of serious tension between the federal and provincial governments.

The federal government is seriously contemplating allowing families with children to split their incomes. This would cost billions in tax revenue, and no serious economist argues that it would have benefits in terms of economic efficiency, or do anything to reduce poverty or overall income inequality (although some argue income splitting is fair). The federal government can afford to give away this kind of tax revenue because it has unlimited taxation powers, and limited spending responsibilities. Provincial governments pay for health care and support for the poor and vulnerable - the spending areas that are set to grow in a serious way with population aging. Yet the provinces have a limited revenue raising capacity, because their tax base is relatively more mobile – see, e.g. Kevin Milligan and Michael Smart's work.

That we as a nation can contemplate the kind of tax cuts that income splitting would involve when the national finances – taking provincial and federal governments together – are in such precarious shape, boggles the mind.

But that's the gender politics of taxation.

“Members of the CF have pretty generous pension (though they literally have to kill for them), but if you think there are a lot soldiers running around with six-figure pensions, you’re kidding yourself. Badly.”

I didn’t say just soldiers: RCMP, CF and (meant to type) police. The point is, this group can collect a pension in their 40s (used to be in their 30s for CF, e.g. retired CF-18 pilots) and split them, start another career, get married, have kids etc. Most are not 6-figure pensions, but does that matter? I have a neighbour down the street in his 40s, doing exactly this. He was in the CF, and never fired a shot.

@Determinant, no, the age 65 restriction only applies to RRSPs, not pensions. There is no age restriction on pensions.

“First, for most Canadians, income splitting translates into a few hundred bucks, at most (in fact, unless the provinces followed the federal lead – which none of them can afford to do – the maximum tax reduction would be~$6500, so I don’t know where you think the $8,000 figure comes from). So the only pony they’re getting from income splitting is the diseased one on its way to the glue factory.”

You’re the tax lawyer. I’m sure I don’t have to point you at the various provincial income tax acts which all use the federal definition of income.

I didn’t see any of the provinces rush to change this definition for pension splitting.

Why does everyone try to suggest that the provinces don’t have to go along? Unless they change their ITAs, they are automatically IN.

“Apart from the equitable considerations I discussed earlier (which you don’t seem inclined to rebut), there’s also the reality that it sharply discourages participation in the labour market for lower-income spouses (since it means that the low-income spouse pays tax on their income at the marginal rate of the higher income spouse.”

I see this argument a lot. Makes no sense to me. The lower income spouse has the right to not split income with the higher income spouse, and start paying tax at the lowest marginal rate. Of course, that leaves the income of the higher-income spouse back up close to 50%.

Otherwise, yes, the lower-income spouse is taxed at the marginal rate of the higher-income spouse, which has dropped about 20% (fed+prov) thanks to income splitting.

“More to the point, as a country I can think of infinitely more pressing concerns that could be addressed with $3 billion in foregone tax revenue then righting the alleged inequality inflicted on certain upper middle-class families by an individualized tax system.”

In 2015, all that will matter is whether income-splitting will bring out the base to defeat the Liberals. I can’t predict exactly what the tax change will look like, but I’m fairly certain that the current tax differentials between 1 and 2-earner families will be narrowed considerably…if not altogether. We’ll know fairly soon.

@Taxrage:

Frances,

Like Friedman, I am favour of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible.

Let’s get to the issue – we do not need government to redistribute much of the national income. Other than for very clear public goods, like defence, policing etc., there is little reason to redistribute. The constant refrain, that we need to address income inequality, has nothing to do with economics, and yes Frances, you know better. Unless inequality is growing due to rent seeking, in which case more government is not the answer (but less would be), then there is nothing we need to do. As Mankiw demonstrates in his “Defending the One Percent”, redistribution for its own sake is political ideology or political philosophy, not economics. And if you do have some economic theory for redistribution, then first order, it should be focused on redistribution from Canada to the developing world, not within Canada.

The relatively mobile tax base between the provinces is exactly what we want. The more central the the powers the less ability I have to vote with my feet. As Friedman taught us, taxation should be as local as possible so that mobility can voice displeasure. But, once some economist thinks she knows society’s joint utility function and how to maximize it, I guess there is little reason to put up with the inconvenience of trying to convince everyone of eternal verities – coercion is so much more expedient!

Interesting post. (I wanted to reference your comment… Does typepad allow for numbered comments?)

In the USA a couple an file jointly or separately. It is not quite tax splitting to file jointly but it is a similar idea. I have a good friend who comes from a similar pox to taxrage and what I get from him is more social/political. He is not a 100k earner but he and his wife made a significant financial sacrifice to have her raise the kids for a few years. Now that the youngest is in school she is back at work. My point is this: this is not an economic question to him so much as a policy question about childcare. He wants parents at home encouraged by the gov’t.

One questions I do not know the answer to is what happens if the amount transferred has a small cap. Could the conservatives propose a cap at, say, 25 k and argue that the benefit isn’t skewed rich so much. (Yes marginal rates and all, but…)

One comment about retired people: by definition they don’t work so they need to split because the person with lwoer income can’t work more for money.

In 2015, all that will matter is whether income-splitting will bring out the base to defeat the Liberals. I can’t predict exactly what the tax change will look like, but I’m fairly certain that the current tax differentials between 1 and 2-earner families will be narrowed considerably…if not altogether. We’ll know fairly soon.

That assumes that defeating the Liberals is enough. It isn’t. The NDP is still leading in the polls in Quebec and especially among francophones. It gets the “Bloc bounce” that delivers seats efficiently. And the seats the NDP won outside Quebec will likely stay NDP. Which means even if the NDP and Liberals come in second and third, they could still form a coalition and oust the Conservatives.

ChrisJ,

It’s not retired people who can split pensions. Any pensioner can split. John Roth left Nortel with $100M in stock options and a $750K pension. I think he was still in his 50s. He wasn’t quite ready for a nursing home, but that entire $750K pension was splittable, for a savings of about $30K in taxes in Ontario.

A 35 year-old retired CF-18 pilot can split his CF pension, get married, start a family etc. As you can see, the can’t work arguments isn’t really valid.

Do you recall any outrage over people being able to split even a $1M pension? This whole policy change in came in with zero fanfare from announcement through to implementation.

Now, try to suggest that the rich, good-for-nothing stay-at-home wife of a $60K bus driver be allowed to save a few tax dollars through income splitting and it’s front page news of every newspaper in Canada and social media goes haywire. Why? Yet, two married doctors with $500K family income can write off the cost of a nanny.

Ah, but you see, the nanny is a form of paid daycare. Paid daycare is good in Canada. Income splitting is viewed as a threat to paid daycare…based on the fact that splitting $1M pensions and allowing $500K income families to get a 50% discount on their daycare costs never get attacked in the media.

The knives will come out when I suggest this, but just watch. Pension splitting and full deductions for daycare won’t even be mentioned by the media in the run-up to the next election, but once the words are issued again by Joe Oliver, it will be front-page news on every newspaper and the Twitter universe will go into overdrive.

“no serious economist argues that [income splitting] would have benefits in terms of economic efficiency”

I’m surprised to read this — isn’t one of the arguments in favour of income splitting that it would allow people to better exploit their comparative advantages?

“You’re the tax lawyer. I’m sure I don’t have to point you at the various provincial income tax acts which all use the federal definition of income”

They choose to do so. They can choose to define income differently from the feds if they’re so inclined (In fact, legislatively, it would be easy to do, they’d just take the current definition of taxable income and add a “as if such income were calculated without reference to section [whatever provision of the ITA includes income splitting rules) of the Federal Act”.

Taxrage,

You might be on more solid grounds if the income splitting where subject to the monetary limitations imposed on child care expense, i.e., you could allocate no more than $7000 to your spouse for a child under 7, and $4,000 for a child in other cases (with more generous limitations for children eligible for disability tax credits). Note, though, that that is significantly less generous than what is currently proposed (a blanket transfer of up to $50,000 in income), unless you’ve got a dozen or so kids.

More to the point, I hope you appreciate the irony that you objection to the current treatment of child care expenses (namely that, in dollar terms, they tend to benefit the wealthy) is the same objection to permitting income splitting. Apparently in one scenario you find it offensive, in another it’s not. I would have thought the better approach (and one the Tories previously adopted with the universal child care benefit) would be the provide a uniform refundable child tax credit – along the lines of what I previously proposed (replacing, in part, the current child care expense deduction). Done right, it’ll provide more funds to low- and middle-class families (regardless of whether their children are in daycare or not).

Colin: “I’m surprised to read this — isn’t one of the arguments in favour of income splitting that it would allow people to better exploit their comparative advantages?”

Household production already enjoys extremely favourable tax treatment – it’s not taxed at all. So the very presence of income taxes tends to encourage people to stay home and look after their kids.

The efficiency arguments, on balance, tend to go against joint taxation in general, and income splitting in particular, because they mean that the at-home spouse faces pays the higher-earner spouse’s marginal tax rate from the first (or close to the first, in the case of the Hartle-Krzepowski-Mintz proposal) dollar earned. Since at-home spouses tend to be married women with kids, and have fairly elastic labour supplies, their labour supplies are easily distorted – this is the efficiency costs of income splitting.

More to the point, I hope you appreciate the irony that you objection to the current treatment of child care expenses (namely that, in dollar terms, they tend to benefit the wealthy) is the same objection to permitting income splitting. Apparently in one scenario you find it offensive, in another it’s not.

I think my point was that no one objects to rich families getting to write off daycare expenses, but there is a huge outcry over any attempt to provide tax assistance to families who look after their own kids. Ditto for being able to split $1M in pensions.

Income splitting is far from perfect, but I’ll take it over the status quo. I’m okay with any reform that brings the tax liability for two families with the same aggregate income closer to parity. I’m even okay with the 1-earner family paying more – but not $8,000 more.

Either tax and deliver benefits to individuals based on their own income, or tax and deliver benefits to families based on the combined income. Let’s stop pretending that the individual is the basis of our system, when the individual completely disappears from the calculation of benefit and tuition loan eligibility.

Frances,

I’ve seen your elasticity argument before and it doesn’t hold water. Suppose that Protestants due to culture work ethics instilled by their religion made their labour supply highly inelastic to income tax. Your argument would tell us to use religion or religious denomination as a tag. You would argue that we should tax Protestants more because we won’t distort their behaviour much and everyone would get to ride on Protestants ethics.

If you want to go down this utility maximizing route (and I don’t), to first order, the best tag is not gender, but race, ethnic heritage, and height. That looks pretty disgusting to me – to set a taxes based on the ethnic origin or religious affiliation – and if it’s disgusting to you, your efficiency arguments concerning income splitting make little sense.

It’s not retired people who can split pensions. Any pensioner can split. John Roth left Nortel with $100M in stock options and a $750K pension. I think he was still in his 50s. He wasn’t quite ready for a nursing home, but that entire $750K pension was splittable, for a savings of about $30K in taxes in Ontario.

Looks like you didn’t read the CRA’s Income Splitting Guide, taxrage. Eligible income includes an annuity from an Registered Pension Plan, and RPP’s are limited to defined benefits of $64,000/year or defined contributions of $19,000/year.

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/314/q4-eng.html

Mr. Roth’s extra “pension” is in fact a salary deferral arrangement, and those are not eligible for the Pension Income Tax Credit and are therefore ineligible for income splitting.

Determinant,

Not sure what you’re talking about, salary deferral etc. Nortel had a DB pension plan, which paid 1.3% * nYears. I believe John Roth was earning something like $2M/yr, and after 30 years would be eligible for roughly 40% of his best 5 years’ salary. At age 60, he’d be eligible for over $750K/yr as a pension, pure and simple.

The worksheet referenced by the URL you provided does not introduce any limit on a split pension, other than life annuities etc. I am only familiar with the DB plan that Nortel had, which would not be subject to any limits.

I probably read the income splitting guide when I did my parent’s return. Both had public sector DB pensions. I also read the relevant sections of the Income Tax Act, and I don’t recall any age/pension limits being described therein.