Paul Kugman's post title is "Keynes comes to Canada". Paul is wrong. Keynes was in Canada, but he just left.

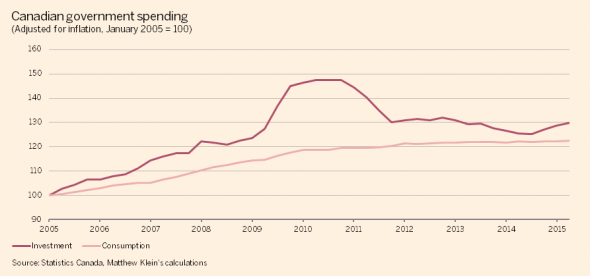

Look at this graph from Matthew Klein (a very good article, by the way):

The other bit of information you need to know is that the Bank of Canada hit the Zero Lower Bound in April 2009, and lifted off the ZLB in June 2010. (The Bank of Canada considers [update: did consider] an overnight rate target of 0.25% to be the "effective" ZLB.) Compare those two dates with the above graph.

New Keynesians, like Simon Wren-Lewis for example, prefer to use monetary policy in normal times, but advocate fiscal policy be used at the ZLB. (Just like Keynes doubted the effectiveness of monetary policy in a liquidity trap, and the ZLB is just another way of thinking about Keynes' liquidity trap.) And bringing forward government investment expenditure seems to be a very sensible way to implement a New Keynesian fiscal policy (though some lags are inevitable). Faced with the ZLB, the government invests sooner, rather than later.

And that is what Canada's recent Conservative government did.

No, it doesn't fit the narrative, does it. Too bad.

[Update 2.Lifted from comments: JKH: "Krugman's title more accurately should have been "Summers comes to Canada"."]

[Update 3: As Frances Woolley points out below, that graph shows combined (federal+provincial+municipal) government investment spending. But I think that's the right measure in this case, because a lot of federal money went on incentives for investment by lower levels. Plus, for example, my university got two big new semi-free buildings out of those incentives, and I have no idea whether that gets counted.]

Nick: You’re right that the policy doesn’t have to be right. Policy is made on belief. There are no crystal balls. The PM would only need to believe the BoC policy was right. Then, cutting spending would be consistent with Keynesian policy.

If the PM disagreed with the BoC, it would be valid Keynesian policy to continue spending until you thought it was no longer necessary. Monetary-fiscal offset doesn’t change that. Fiscal policy still mitigates destructive monetary policy.

I still think Harper left the “foxhole” in 2011.

Brad: “If the PM disagreed with the BoC, it would be valid Keynesian policy to continue spending until you thought it was no longer necessary. Monetary-fiscal offset doesn’t change that. Fiscal policy still mitigates destructive monetary policy.”

I disagree. As Scott Sumner puts it, “The Fed moves last”. If the PM loosens, he knows the BoC will simply tighten in response. That is how the game is played in Canada. You are implicitly assuming the PM moves last.

One old post on game between monetary and fiscal

An earlier simpler post

But the BoC hasn’t moved “last” very much for years. Since 2011-12, here are the fiscal imbalances added by the provinces and by the federal government:

Provincial: $61.3 billion

Federal: $48.5 billion

These amounts are roughly half of all the stimulus spending since the recession, but the bank rate hardly moved for most of the period:

BoC 2011-2014: 1.25%, 2015: 1%, .75%

Clearly the way the game is played in Canada is heavily divided between the levels of government. And some have argued that it’s silly for the federal government to cut expenses while benefiting from provincial stimulus spending which serves to improve federal revenues.

Since 2006-07, of the net $200 billion in additional deficits, fully 40% was incurred by the provinces. To speak of a single Conservative government running “optimal” fiscal policy seems to me to miss a good deal of the story.

Nick: As far as I know, there’s no special flavor of Keynesian economics that applies only to Canada. I’m trying to examine your case based on a general view of Keynesian economics. My simplistic view of Keynesian economics includes counter cyclical spending and the use of monetary policy before fiscal policy. I also think that the Great Recession was a special case.

In your graph, it appears the last move was a tightening of fiscal policy (spending) in 2011 that followed a tightening of monetary policy in 2010. That is definitely not offset. It isn’t at play. Keynesians tighten fiscal policy (spending) when they think the economy is doing well. Non-Keynesians, it appears to me, do not typically advocate fiscal policy and are fine with tightening spending at any time.

Your case depends on why spending was tightened. I don’t think you’ve made it well enough.

I also don’t think Krugman was right to say Keynes was returning to Canada. As you’ve said, Keynes was not spend, spend, spend.

Brad: We can’t tell whether or not there was offset just by looking at the Bank of Canada’s overnight rate, because we don’t know what the Bank of Canada would have done otherwise. We don’t observe the counterfactual conditional, of what the BoC would have done if fiscal policy had remained loose. (Plus, the exchange rate matters as much, if not a lot more than interest rates, in a small open economy like Canada with very open capital markets.)

But when the BoC says that it looks at everything, and adjusts the overnight rate to keep its forecast of future inflation at the 2% target, I am taking the BoC at its word. (Though in the past I have also tested that commitment empirically, and seen others test it, and it’s not easy to find evidence against it.)

” Keynesians tighten fiscal policy (spending) when they think the economy is doing well.”

That would be correct for Old Keynesian thought. It is not correct for New Keynesian thought. (Or rather, they have a very different definition of “doing well”, that is more like “the economy is above the ZLB so the BoC is back in charge of keeping inflation at the 2% target, and doesn’t need our help any more”.)

I should probably write a post on this.