Any number of analysts – including me – have noted that 25% of Canadian output is exported to the US. So it's natural to conclude that a reduction in economic activity in the US will reduce the demand for Canadian goods, and that this would in turn induce a reduction of economic activity in Canada. So we shouldn't be surprised that the recent slowdown in the US should manifest itself in Canada, right? After all, a reduction in US aggregate demand means reduced imports from Canada, and that means a reduction in aggregate demand in Canada. Right?

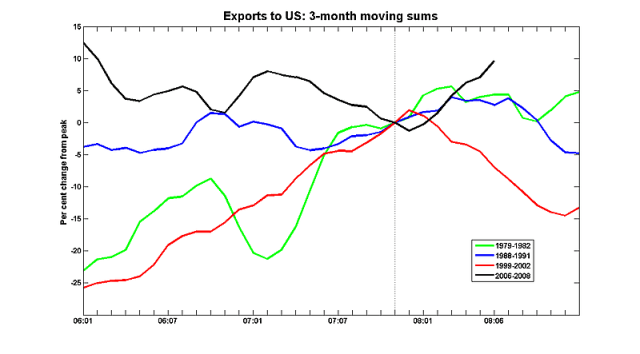

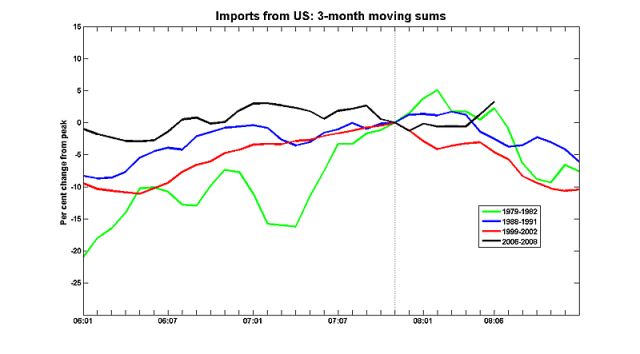

The trouble is: that's not what's happening. Continuing with the series of 'you are here' graphs in these posts [1], [2], here's a comparison of how movements in exports to and imports from the US have varied around the troughs of April 1981, March 1990, December 2000, and (provisionally, for the purposes of these graphs) November 2007. The monthly data are pretty noisy, so I've smoothed them a bit by using 3-month moving sums:

The monthly series for Canadian GDP has yet to reach the peak it set in November 2007, but it's awfully hard to blame the US for this weakness: exports to the US have risen by some 10% since then.

If it's not the goods market, maybe the conduit is the financial markets. That's a fairly plausible story, but the Bank of Canada has taken out much of its bite; mortgage and business borrowing rates – that is, the interest rates that actually matter for real economic activity – are now quite a bit lower than what they were when the subprime crisis hit.

I really don't see the connection between the US and the Canadian slowdowns. Is it possible that Canadian domestic demand – the factor that's been driving the expansion so far – is falling for reasons of its own? If so, which ones?

This is very good stuff Stephen. Is it not the case that as you have pointed out in earlier posts Canada is now running on commodities which are still going South in increasing volume. But in manufacturing where cross border ownership influences investment and closure decisions the sector principally based in Southern Ontario is in recession because of what is happening in the U.S.

Now if you could just explain what role the two currencies play in sorting out commodities and manufacturing outcomes I would be happy.

That story is pretty well-understood, and I’ve gone over it several times. Since we are a net exporter of commodities, the rise in the price of commodities relative to other goods (including manufactured goods) increases our terms of trade: for the same level of exports, we can receive higher levels of imports in return. The quantity of exports has been growing quite slowly during this expansion, but since they’re being sold at higher prices, our incomes have increased. That increase in our buying power – and the subsequent spending – has been the main source of growth during this expansion.

OTOH, the price that manufacturers receive for what they are selling has gone down, which means that they have to become more efficient, cut employment, and usually both. I went into the mechanics of how manufacturing employment has fallen in this post.

A bunch of ideas, any or all of which could be way off target, follow:

How does a graph of the CAD/USD overlaid with Canadian GDP look, with an intersection of the two lines when the CAD topped?

Could Canadians be feeling poorer due to the past year’s drop in the loonie relative to the USD? How does the savings rate look recently?

How about the Canadian stock market, with and without energy?

I am totally ignorant of what the Canadian housing market looks like. Did you have a bubble, or what looks like might (or might not) be a bubble? Ireland, the UK, Spain, Estonia, Latvia, and Lithuania, as well as possibly others I haven’t paid enough attention to, all have major housing bubble issues that are, or soon will be, popping. This has had a clear negative effect in the US, it is not unreasonable to think a similar negative effect will happen similarly elsewhere that had/has a boom/bust in domestic housing.

Even in the absence of a housing bubble in Canada, how is housing finance doing in Canada these days? Was/is it securitized to any significant degree? If so, has the rug been pulled out from under it, even in the absence of a price bust in housing? This would tend to hurt new housing starts, as would rising commodity prices in general. How are wousing starts doing by the way?

Alternatively, or additionally, could it be that enough spending that would’ve taken place in Canada has taken place south of the border [or vacation points elsewhere, (before Canadians think it is “too late” due to a CAD that is perhaps (or not?) perceived to have peaked?)] that this has messed up domestic (i.e. Canadian) consumption, consumption that would otherwise have been produced in Canada?

By the way, all of the above are just questions and thoughts due mainly to ignorance of Canada, not assertations or provocations.

I found this article really interesting and related to a piece I was doing previewing the second-quarter GDP figures. Hope it’s fine with you that I linked it for readers of currencythoughts.