Once again, two very separate pieces of economic news in yesterday's employment releases for October: US employment declined by 2.5% at annual rates from September (which was not a good month for US employment), and Canadian employment rose by 0.7% at annual rates from September (which saw record employment gains).

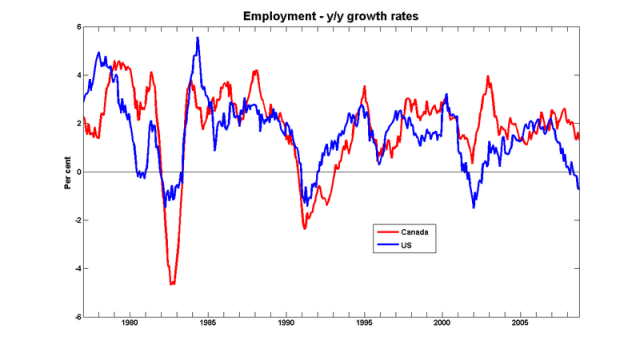

We're moving into uncharted territory here; there's usually been a pretty good degree of coherence in the timing of turning points in the employment cycles in Canada and the US:

Just for fun, I ran a quick-and-dirty [warning: the rest of this sentence is composed of impenetrable specialist jargon – ed] frequency domain estimation of the phase angles. On average, the US employment cycle leads that of Canada by about 5 or 6 months.

It seems pretty clear that the US economy hit its peak in November of 2007, so if Canada had kept to previous form, we should have fallen into recession sometime around May.

Sure looks as if it’s a downward trend to me. And you can beat that Stephen Harper was thinking the same way when he called for elections now, instead of in six months.

Anecdotally, there are a lot more apartment pour louer signs popping up here in Montreal/east Westmount–and we’re not talking the non-family size either. (That, of course, could be because the market was overpriced when everyone looked last Spring—but I’m seeing signs for 4.5s and 5.5s now that were not up then, so I’m inclined to guess it’s a second-order effect.)

I was surprised to see that graph — to see how closely the two economies have been tracking. Two theories of the recent divergence: high oil prices (until recently) were good for Canadian employment; house prices fell earlier in the US and have (so far) had a bigger impact there.