Apparently both Nick and I have been spending the weekend thinking about the recent run-up in the CAD and the Bank of Canada's attempt to talk it down. My take on it is based on the relationship between the exchange rate and commodity prices, and it starts below the fold.

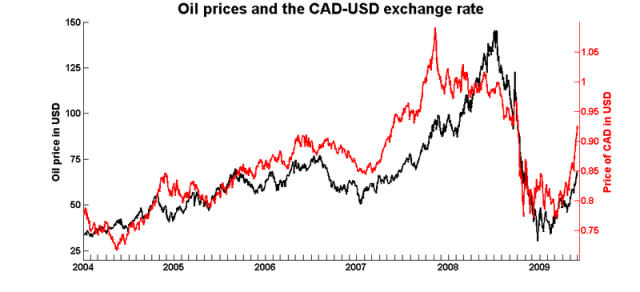

As ever, we can point our fingers at the recent run-up in oil prices:

Oil prices and the exchange rate are back where they were back in the summer of 2007. And we're even seeing news stories typical of that era (eg: "Loonie's surge threatens our recovery"). Back then, I thought that those worries were misplaced (see "Not Dutch Disease, it's China syndrome"), because other sectors of the economy were generating jobs more quickly that the manufacturing sector was shedding them.

So should we be concerned now? I don't think so, but I'm less certain of my case than I was two years ago. Here are the points I'm trying to juggle:

- The increase in the prices of oil and other commodities is likely to be reflected in an increase in our terms of trade. This will increase our incomes and increase consumer demand – the driving force of the most recent expansion.

- In the short term, it's not at all clear that other sectors can generate jobs more quickly than the manufacturing is destroying them.

If the Canadian economy really has turned the corner, then we can adopt the policy stance of 2007 and let the CAD appreciate. If not, then a quantitative easing policy might just as well be implemented in forex markets instead of domestic bond markets.

Right now, I'm leaning to the 'do nothing' option, because I'm optimistic about the next few months. But if things go less well, then the Bank may do well to back up its talk with action.

“Too few free variables”

How much can exchange-rates be explained by interest-rate mismatches?

If this is ‘nonzero’, how can exchange-rates balance trade-flows?

Hi Jon,

I have a little toy statistical model which I use to ‘predict’ the value of the Canadian dollar:

http://economics.about.com/od/exchangeratesbycountry/a/mert_predictor.htm

MERT value = 48.26 + Price Of Oil * 0.621 + Interest Rate Gap * 1.83

Where the Interest Gap = CDN Overnight Rate – US Federal Funds Rate.

There’s no real theory behind this at all – it is a black box. But it seems to work pretty well.

I have a little toy statistical model which I use to ‘predict’ the value of the Canadian dollar