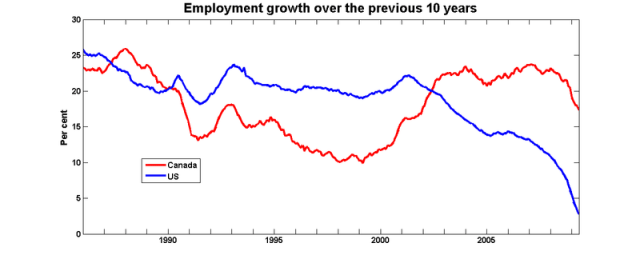

A recurring theme in discussions about what we might expect from an eventual US recovery is that it will be long and painful. This is not entirely due to the severity of the current recession. As Michael Mandel notes, the recent drop in US employment capped a decade in which employment growth was already slower than usual. But once again, Canadian data tell a very different story, so we should be careful about making direct comparisons between the outlook for the US and for Canada.

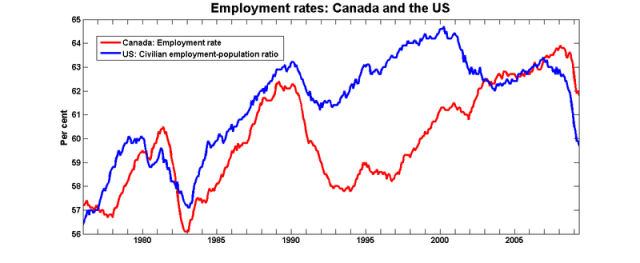

The employment rates are particularly instructive:

The US employment rates never had time to recover from the 2001 slump, so the 2008-9 recession was a blow upon a bruise: employment rates are back to what they were in 1985. But Canada had recovered from our lost decade – the 1990s – so we've only gone back to 2002.

And here are the 10-year employment growth rates for the two countries:

The Canadian recovery is going to be less arduous than that of the US, because we're in a hole that is much less deep.

Thanks for the post, very interesting to see the Canada-US comparison. Now I wonder why the US employment was so poor for the last decade?

I was listening to the CBC interview Paul Martin a few weeks ago, and he stressed this point. The recession is primarily an American phenomenon, a fact that mainstream Canadian media happily ignores, by and large.

I know, and it makes me crazy. Sometimes I get the impression that editors are looking at the truly scary stories coming out of the US and are instructing their journalists to match them.

I look at the top chart and the narrative that comes to mind is Free Trade caused massive job losses in Canada in the early 1990’s, but also caused a decline in the dollar which allowed us to bottom out and start adding jobs again.

I wonder if this has been studied at all, or what the consensus (if any) is.

The post also shows the difference between a natural optimist like yourself, who figures that higher employment rates in Canada mean the outlook is better here and a pessimist like myself who figures the U.S. has nowhere to go but up whereas we can still fall a long ways. Don’t most macroeconomic models incorporate an element of mean-reversion which would suggest that the growth outlook for the U.S. is better? Perhaps it is just that you are talking about the level and I am thinking about the trend.

There was a pretty massive reduction in gov’t spending and transfers in Canada during the ’90’s. That might be part of the Canadian cliff diving we see in the 90’s. I doubt free trade was the culprit.

Wow, the US employment graph is horrifying. Is that what an out of control finance sector looks like? A monster sucking up and/or misallocating huge amounts of capital leading to a drop in GDP and unemployment?

“There was a pretty massive reduction in gov’t spending and transfers in Canada during the ’90’s.”

I didn’t think the reduction in government spending really began until the mid ’90’s, see Stephen’s recent post for example on the Federal level. Also, I’ve heard a lot of criticism of the NDP government in Ontario under Bob Rae, but little saying that employment crashed due to their sharp cutbacks in government spending.

Certainly, living in Ontario in those years, it seemed like every night on the news was a story of some manufacturer departing for the U.S., but of course that is just anecdotal. I’m too lazy to dig up a historical commodity index (Stephen probaably has posted one of these as well!) but I guess if commodity prices crashed in the 90’s recession that might also explain the poor Canadian performance vs. the U.S. over that period.

The other thing I forgot to mention was how clearly the graph predicts the crushing defeat of both the federal Conservatives in 1993 and the Ontario NDP in 1995. At least Mulroney and co. got to enjoy some of the upside in the 80’s!

The early 1990’s was also the period when the Bank of Canada adopted inflation targeting, and it deliberately engineered a slowdown in order to reach its target. Add to that the transition costs of FTA/NAFTA, and you probably can account for much of the slump.

Yeah, you are probably right Stephen about the inflation targeting playing a big role. Looking back at the stats, interest rates were much higher in Canada vs. the U.S. in the early 90’s, until Crow was replaced by Thiessen as head of the Bank of Canada and then recovery started. With hindsight, even though it was painful at the time, perhaps Crow’s penchant for high interest rates is serving us well now, since it likely helps account to some extent for lower accumulated debt levels in Canada vs. the U.S.

Anybody have personal savings rate statistics for Canada? They are at 15 year highs in the US and (as expected) many people believe this could be a long term phenomenon. It’s good people are starting to understand the long term cycle. Apparently Roubini is looking for 10 to 11%.