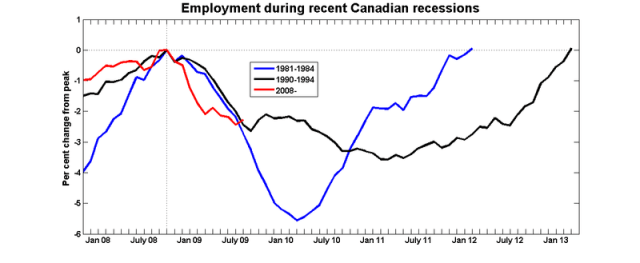

The August LFS release is out, so it's time to update my series of graphs comparing job losses in this recession with those of recessions past. And it's also time for Canadian economic forecasters to take a bow – their predictions for how the recession would proceed out turned out to be pretty much on the nose:

It's instructive to compare this pattern with that in Calculated Risk's graph using US data:

The US situation remains critical – albeit not entirely hopeless – and the policy debate there takes place in an environment where employment losses are on a scale not seen since the Second World War. But Canada is not the United States.

Does anyone other than Dan Gardner and I remember the tidal wave of apocalyptic commentaries to the effect that we were all going to be living in caves by Christmas? (Never one to miss out on an opportunity, Garth Turner started selling survivalist paraphernalia.) I certainly remember writing a series of posts explaining why it was reasonable to expect that a Canadian recession would be relatively short and shallow:

Why are forecasters predicting a mild recession for Canada? (Dec 10, 2008): Here's the story people tell when they explain why Canada will be affected by a US recession:

-

Canada exports a lot of what it produces.

- The US is by far the biggest market for Canadian exports.

Both assertions are true: about 36% of Canadian output is exported, and about 77% of exports go to the US.

So about 28% of what is produced here is shipped to the US. That's

quite a lot, but it's hard to see how this would work as a mechanism

for transmitting a severe recession. If (for the sake of argument)

demand for Canadian exports is proportional to US income, then a

Canadian recession would be about 30% as deep as the US recession that

generated it.

Maybe the Canadian recession will be short and shallow (January 6, 2009): [T]here seems to be some sort of consensus forecast to the effect that

the US economy will bottom out about sometime around mid-2009, although

there is a certain divergence of opinion about just how deep that

trough will be.

To the extent that the principal driving force

for a Canadian recession continues to be a US slowdown, then this is

encouraging news. If the Canadian economy was able to continue creating

jobs for 10 months after the US fell into recession, then there's a

decent chance that it will be able to do so once again when the US

economy picks up.

Why forecasters are predicting a short Canadian recession (February 8, 2009): Happily, we are starting to see some evidence that the credit crunch is easing:

the TED spread (the difference between the inter-bank rate and the

yield on T-bills) is now back to not-too-far-from-normal levels. There

could be another hidden time bomb out there that might blow things to

pieces, but then again, has there ever been a moment in our history in

which that was not the case? And even if that unhappy eventuality

should come to pass, central banks around the world are now acutely

aware of the importance of avoiding another Lehman Brothers-type

meltdown and will do whatever it takes to prevent credit markets from

seizing up. No-one will be worrying about moral hazard for a very long

while.

So this is what the story looks like:

-

US housing starts will hit bottom sometime around the middle of 2009.

- Credit conditions will continue to ease.

Put these two together – along with the prospect of a recovery in US

auto sales – and you can start to piece together a scenario in which

the US economy turns the corner, world trade recovers, and commodity

prices get back on the path that Hotelling foretold for them. In other words, the major ingredients of a Canadian recovery.

I hasten to add that I was not staking out a contrarian position in these posts; I was simply describing the reasoning behind the consensus forecast. At the time, these narratives got no traction in the general atmosphere of irrational panic. But they look pretty good now.

You make a good point Stephen. But unemployment comparisons paint a rosy picture for Canada and suggests a mild recession. If you look at GDP instead, was not the drop in Canada’s GDP this year was quite a bit worse with a quarterly drop on the order of -6% yoy. The view that Canada’s recession is mild might be metric-sensitive.

Actually, I was thinking more about the timing of the turning point.

The major flaw in your post is that you’re assuming we actually are out of the recession.

While we pat ourselves on the back, don’t forget that the forecasts out of Bay Street as late as December 2008 were way too optimistic: http://shockminuscontrol.blogspot.com/2008/12/short-and-mild.html

Three-day weather forecasts are surprisingly accurate. Near-term, within-regime forecasts are relatively easy.

I want to hear about the Canadian macro-forecasters who got it right for H209 back in August or September of 2008.

I want to hear about the Canadian macro-forecasters who have cracked the ‘Black Swan event’ nut.

I dunno. When I look back on my posts from that time, we were all waiting for the recession to hit. So when it did, it wasn’t really much of a surprise, even if the form and speed was.

I’d think that the black line in the top chart would suggest some caution in declaring victory.

I will admit that I underestimated the impact that cutting interest rates to 0 and leaving them there would have (was that a part of your prediction? Back in ’08 I didn’t foresee interest rates hitting the zero bound here in Canada, not so quickly anyway). It’s a strange environment we’re in, with economists declaring the recession both mild and over and the Bank of Canada openly contemplating ‘quantitative easing’!

I think we can declare victory over the IMPENDING DOOM meme peddled by lazy pundits.

Doom is relative. But south of the border it still looks pretty awful, (not to mention politically nuts) and living next to a rumbling volcano can be pretty unsettling.

Many economists saw the recession coming; few saw the financial sector crisis that made this recession an unusual event. (Roubini is the only high-profile economist that comes to mind who got it right but hadn’t been crying doom ‘n gloom for the past decade or more.)

There was nothing in the yield curve tea leaves, to use our best forecasting model as an example, to suggest the magnitude of the crisis.