The Department of Finance publishes monthly data for expenditures, revenues and the deficit. These numbers don't necessarily correspond to the annual numbers (for example, various items are sometimes booked to a fiscal year after it's over), but it gives us a good idea of where the government's finances are going. The monthly numbers are pretty choppy and have some significant seasonal factors, so I'm going to work with 12-month moving sums.

We all know that the federal government will be running a deficit this year, but it's still pretty impressive just how fast the situation has deteriorated. Here is a plot of the 12-month moving sum of monthly deficits through to August, 2009:

Since the beginning of the fiscal year, the federal government has been running a deficit of around $5b/month. As of August, the accumulated deficit was $24b, so if we add another 7 months of deficits running at a similar rate, you'd get something just under $60b for the fiscal year 2009-10 – not far from the PBO's forecast (pdf) of $54b.

Is this a lot? Most observers have been careful to put these numbers into context: a $54b deficit isn't what it used to be. But it's still a significant number. Here is what the PBO's forecast for the deficit expressed as a percentage of GDP compares to the historical series:

A deficit of 3.6% of GDP is nothing to sneeze at, but most of it is driven by factors that will disappear in the next year or two: stimulus spending will stop, and revenues will pick up again as the economy improves. The PBO expects the deficit to fall by half to $27b in the next two years. But the deficit won't go away entirely; the PBO estimates that the federal government has a structural deficit of $12-13b – about 0.8% of GDP.

Is this plausible? The federal government had been running surpluses for more than a decade, and had a structural surplus for much of this period – how could a structural deficit of that size happen?

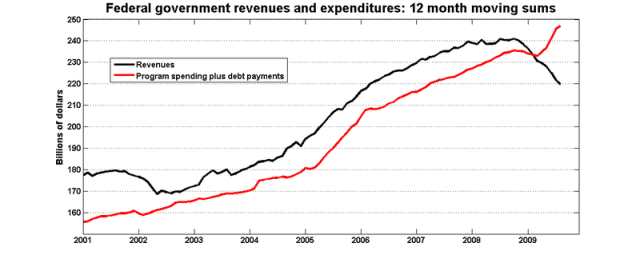

Firstly, let's look at a graph of revenues and spending (program expenditures plus debt payments):

I'm going to set aside the theory that spending increases could have generated a structural deficit. Spending was trending down towards the end of the 2008-09 fiscal year, and the jump in spending since April is on explicitly temporary stimulus projects.

So the story is going to be one of revenues, and it seems pretty clear that the origins of the federal deficit were in place more than a year before the recession hit. As I noted back in September 2008, federal government revenues started to plateau sometime in late 2007. Why?

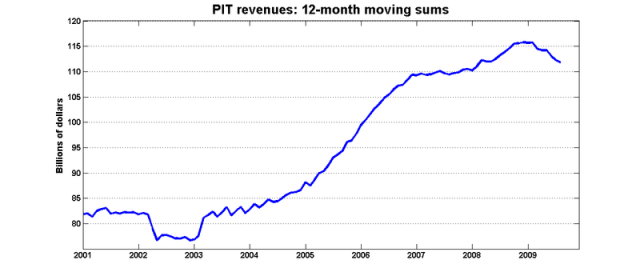

One place to start might be the single largest source of revenues: personal income taxes.

PIT revenues slowed a bit after the round of tax cuts in the 2007 budget, but they started to pick up again in 2008 before the recession hit. They are now off by about $4b/yr, but total revenues are down by about $20b. It's hard to see how cuts to personal income taxes could be much more than a partial explanation for a structural deficit, although they probably did eliminate the structural surplus.

How about GST and corporate income taxes?

And here we have an explanation for the structural deficit: the cuts to the GST. Each percentage point of the GST generates about $5b-$6b in revenues (the figures above are net of the GST rebate), so the gap between what current revenues are and what they would be if the GST had stayed at 7% is about $10b-$12b – which is also the PBO's estimate for the structural deficit.

The graph also explains why the structural deficit didn't manifest itself right away. The run-up in commodity prices in 2007-8 generated huge windfall profits, and provided a $10b boost to CIT revenues while GST revenues were falling. CIT revenues will eventually rebound (although they'll probably fall off even further before bottoming out), but they're not going back to their 2007-8 levels anytime soon. (It should also be noted that there were CIT cuts going on as well, but changes in CIT revenues are dominated in the movements in profits. And since increasing CIT rates in order to eliminate the structural deficit would be a spectacularly stupid move, I'm not going to pursue this point any further.)

I don't know how the PBO calculated its estimate for the structural deficit, but sifting through these data suggests that its numbers are quite plausible. I'm not sure that the Minister of Finance has actually come out and said that there is no structural deficit. But if the official position if that there is no structural deficit, I think the burden of proof is on the government to explain how the deficit will disappear without some combination of spending cuts and tax increases.

The fact that the government is basing it’s estimates on the peak of the last economic cycle shows that, barring tax increases and/or spending cuts, we’re in a structural deficit. Most past recessions show a gradual recovery, so either:

1. the government will continue stimulus efforts and blame the deficit on that

2. the government will cut spending by more than the stimulus and present it as merely ‘ending the stimulus’

3. the government will raise indirect/hidden taxes such as EI premiums or payroll taxes (they’ve already done this in the case of EI)

4. the government will end the stimulus, and present economic recovery as just around the corner and the deficit is ‘almost gone’

5. the government will continue with the deficit, assuming canadians don’t care about a 5-10 billion deficit after a 55 billion dollar one

I think that either way, the government has got a taste of spending money to buy votes; you just have to look at their popularity. It seems to be working. This isn’t anything against the conservatives themselves, though I disagree with their politics extensively. Many governments of all stripes target spending to special interest groups to get votes. This is neither new nor innovative. They’ve gotten a taste for power and want to continue it, it’s as simple as that.

If anything, your first graph show that the 1990s liberals are a tax and ‘pay off debt’ party. The conservatives are a borrow and spend party, not much different that the 1980s PCs. I hardly expect the conservatives to actually cut spending, as that would mean cutting spending to their base as well. We’re therefore left with deficits until the peak of boom times again. That’s probably 10 years away. The question is can the conservatives keep the deficit small enough were economic growth is greater, thereby leaving it as smaller in real terms. I see no way to predict this.

And most Canadians trust the conservatives more with the economy, ignoring history… (again to be fair, the 1990s liberals are gone; a victim of Paul Martin’s abandoning the job he was best at and gunning for the top spot).

From what I’ve been hearing, it sounds as if Flaherty is going to stop increasing government spending to match inflation for a few years in an attempt to grow the way out of the deficit. Personally, I would love to see spending cuts and an overhaul of the regulator system. Throw on the Austrian hat for a while and cut the deficit away 🙂

When it comes to the GST, wasn’t it a reasonable economic stimulus? By reducing the GST, sectors such as the auto-sector and most other sectors saw small savings and encouraged large purchases. So should it really be said that the GST created the structural deficit? It’s not as if cutting taxes or creating new schemes to transfer money to low-income Canadians would of helped save the major industries. More bureaucrats would of benefited and the poor would of bought more cheeseburgers at McDonald’s. And as people love to say that savings are encouraged through value-added taxes, wouldn’t this go against the Keynesian fear of savings, specially during a recession?

But for the GST, I do agree they should of cut spending instead of just lowering the GST, as it was a short influx of revenues due to the low interest policies from the central bank before the malinvestment started to catch up.

“When it comes to the GST, wasn’t it a reasonable economic stimulus? By reducing the GST, sectors such as the auto-sector and most other sectors saw small savings and encouraged large purchases. So should it really be said that the GST created the structural deficit?”

If it is cyclical, then they should be planning on reversing the GST cut. Otherwise, yes it is structural.

“Personally, I would love to see spending cuts and an overhaul of the regulator system.”

Lets start by repealing the Canada Investment Act, firing everyone at the CRTC and abolishing the ridiculous supply management system in the dairy industry.

That devil the CRTC and CIA! The Canadian Wheat Board, the CBC, Via Rail, and Equalization Payments would be another thing that would be nice to see thrown out of the window from the CN Tower. Let’s get rid’ of them all.

Stabilize our currency by abolishing the Bank of Canada. Go back to the theory our parents taught us, “If you want something son, you save your money and buy it, if you spend it foolishly then you’ll be poor!” Actually trade gold, other metals or something valuable to us instead of inflated paper.

Just think of the possibilities. It almost makes me want to grow up and become a Finance Minister 🙂

I’m no economist, but it strikes me that your first two graphs are incorrectly labelled. Should be “Federal surplus” not “Federal deficit” (ie a negative federal deficit is a surplus)

[Quite right – they’ve been fixed. Thanks! SG]

Continuing on the theme of deficits, here are the latest pearls of economic wisdom from the G&M:

http://www.theglobeandmail.com/news/opinions/columnists/derek-decloet/as-dollar-tumbles-america-is-up-for-grabs/article1363074/

Not a bad article for the G&M. Despite, I didn’t really care for his constant “selling of our companies”, I think it’s more the falling and reduction of the American standard of life, too much monetary expansion. In the long run it would be pretty much a good idea for the Chinese to let the Yen gain value and encourage a healthy increase in imports.

Speaking of that run-up in commodity prices, of which the 2008 spectacle was a part, how much of that rapid increase in personal income tax revenues 2004-07 might’ve been helped by those additional tens of billions of dollars coming in, and the investment that followed?

I think the possibility that “spending increases could have generated a structural deficit” deserves a bit more respect. If spending did contribute to a structural deficit, surely it’d be the increase from around 2004-2008 that did it. In a period of such remarkable economic growth, I would think it more natural that government revenue should grow faster than its expenditures. Somehow, spending managed to keep up.

From 2004-2008 on your chart there it looks like expenditures went from about 170 to 225 billion over a 4-year period. That’s a somewhat large increase, particularly when you consider things like the falling unemployment rate, which might suggest that people would perhaps be needing less rather than more support from government social spending. Compare that spending increase to rate of nominal GDP growth, and I think you’ll find that the difference can account for just as much of any structural deficit as can the GST cut.

“When it comes to the GST, wasn’t it a reasonable economic stimulus? By reducing the GST, sectors such as the auto-sector and most other sectors saw small savings and encouraged large purchases. ” -Justin Donnelle

No. It was extremely cynical politics from a politically ambitious Trust-me-I’m-an-economist, graduate-trained Stephen Harper.

The cuts came during the height of commodity-driven, out-of-control economic boom. According to standard neo-classical/keynesian synthesis counter-cyclical fiscal policy, the Harper Conservatives should have been raising taxes not cutting them. Moreover, the conventional wisdom among economists and tax policy pundits these days is that governments should shift taxes to consumption away from income-earning opportunities.

Assume the GST cuts did have a stimulative effect. Then they would accentuate the boom and risk increasing the value of the Canadian dollar which would then in turn punish non-resource sectors.

If you believe that many Canadians can only make good incomes by exploiting natural resource windfalls, then no harm. But if you believe that Canadians are smarter and productive than that and that Canadians may value economic diversification and stability, then the cuts and the timing of those cuts was nothing short of awful.

Given Harper’s shameless sectarian fear mongering that he deployed late in 2008 to save his government, I am inclined to think that Harper believes his core constituency is largely uneducated, ill-informed, and with minimal potential to earn high incomes outside of rent-producing resource sectors.

Harper is a Hayekian, so cutting taxes was a good thing for him. Supply-siders loved it. It helps in the long-term to reduce government spending with future cuts, except if your at war or if the NDP ever took over and let the Post-Keynesians have fun with monetary policy.

What governments should do is abolish taxes and let the markets work instead of unionized and unproductive bureaucrats.

Keep in mind that your talking from a typical Keynesian view on fiscal measures. Harper praised Hayek many times and he didn’t mind the stimulus because it saved his political behind, followed by opening the potential for future government cuts. Hayek would disprove, but, oh well. If Harper plays his cards right he can be the nice guy, gain votes from uneducated voters or one-sided university students(who are easily manipulated) and form a majority. We already know that most “progressive” voters don’t vote in Universities, they’re busy causing trouble and securing themselves jobs with labour unions. With Harper’s majority we already know many things would be on the privatization/deregulation shelf. Unfortunately I have never heard of Harper’s policies regarding the Bank of Canada, I think he gave that one up a long time ago.

Don’t forget that even if the GST is a flat-tax on consumption, it would not help with the banks continuous inflationary position. The currency debate is going to be a long one and as Bernanke is printing money like a bat out of hell, the Bank of Canada is going to have to keep interest rates low and proceed with a lot of quantitative easing, which will increase revenues but it will create an unsustainable boom. Keeping in mind I’m following the Austrian Business Cycle. The issue revolving around the increased revenues will not help the government run a balanced budget because most likely the quantitative easing will come from new money that the Bank could create for the federal deficit, which Carney would probably praise. Increase the money supply by federal deficit, so either increase taxes and create long-term government spending and run a deficit, or cut taxes and run a deficit.

Could you explain to me what is exactly structural about any structural deficit? Why can’t any “structural” deficit be eliminated by simply raising taxes or cutting spending? A structural deficit does not seem to me to be very “structural” when both of the two component elements (revenue or spending) are essentially arbitrary. I’m serious. Could someone please explain what is structural about a structural deficit? Yours, Simon Kisss

Wikipedia’s answer is as good as any.