Roger Farmer is an old grad skool buddy. We were in the same MA and PhD class at UWO in the late 1970's, though we have lost touch a bit over the decades. That's a sort of disclaimer. Roger preferred punk to disco; I think he was right on that score. But Peter Diamond's "A Search-Equilibrium Approach to the Micro Foundations of Macroeconomics" came out in 1982, and I think of it as a Saturday Night Fever model of the multiplicity of natural rates of unemployment.

Roger's publisher, Oxford University Press, has sent me an advance copy of his forthcoming book "How the Economy works: Confidence, Crashes, and Self-Fulfilling Prophecies". Roger actually has two books coming out at the same time. The one I got is aimed at the general reader. I haven't read his other book. That's probably as it should be. The version aimed at the general reader ought to be self-sufficient, so you can understand his argument without needing to read a lot of technical stuff.

There is a lot to like about Roger's book. The thumbnail sketches of economic thinkers and their ideas are alone worth the price of admission. And here's just one idea that is worthy of some serious consideration.

How can the central bank prop up the banking system in a crisis without at the same time creating moral hazard? Roger's solution is beautiful in its simplicity. The central bank should target and support an index of banks' share prices. Each individual bank can go bust, and will if it screws up worse than the other banks, (its share price can go to zero). But all banks together cannot go bust (because the central bank will buy as many shares of the index as is needed to capitalise the banking system). This solves the moral hazard problem, and also recognises (as I argued in this earlier post), that the problem is not "Too big to fail": it's "Too big a percentage to fail".

It's at the macro level, putting all the bits together, that I have difficulty understanding Roger's main thesis.

The main themes are clear enough: search theory of unemployment; multiplicity of equilibrium natural rates; and using monetary policy to target an index of share prices. And I'm sympathetic to all those themes. But I don't really understand how Roger is connecting them together. I'm going to take a guess below; but I could be totally wrong.

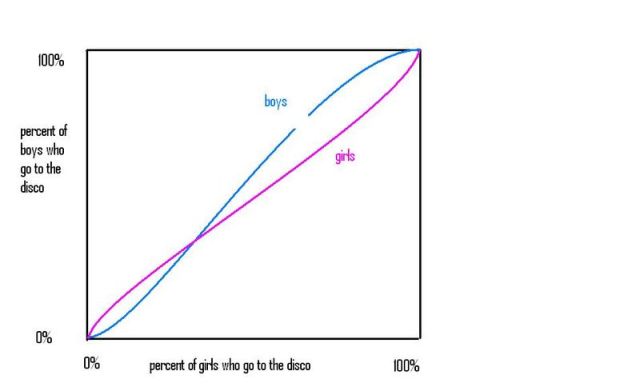

Here's the Saturday Night Fever search model. Boys are searching for a girl they like, and who likes them. Girls are searching for a boy they like, and who likes them. The bigger the numbers of boys and girls who meet at the same time and place, the better the chances of a good match. More boys will go to the disco if they think more girls will be there. More girls will go to the disco if they think more boys will be there. This is a model with positive feedback ("strategic complementarity").

If that strategic complementarity is strong enough (if positive feedback exceeds one over some range), it's possible to get multiple equilibria with such a model. Typically we get two stable equilibria that are locally stable, with a third equilibrium between them that is unstable. For example, if half the girls go to the disco, that might be just enough to persuade half the boys to go, and vice versa. So that's one equilibrium. But if a small temporary shock caused the number of girls going to increase by 1%, and if that caused the number of boys to increase by 2%, which in turn caused girls to increase by another 4%, etc., then that halfway equilibrium is unstable. There's a second equilibrium in which all boys and girls go to the disco, and a third equilibrium where no boys or girls go to the disco.

A big enough shock, even if temporary, can jump the dating market from one locally stable equilibrium to another, where it stays until another big shock comes along.

Saturday Night Fever can sometimes work for the labour market too. Lots of hi-tech workers go to Kanata, because there's lots of hi-tech firms. Lots of hi-tech firms go to Kanata because there's lots of hi-tech workers. You don't necessarily need anything exogenous, like climate, to explain why Kanata has a hi-tech industry and Wawa doesn't.

But I don't think it works for business cycles. If it did, we would get two natural rates of unemployment, and two Long Run Aggregate Supply curves. In theory it's fine, but numerically the feedbacks just don't seem big enough to make it work in practice. In recessions the workers don't look for jobs because there aren't any firms looking for workers; and the firms don't look for workers because there aren't any workers looking for jobs? No. It just doesn't sound plausible. Everything I hear tells me it's much easier for firms to find a suitable worker during a recession, when unemployment is high. Some workers may be discouraged, but many keep looking for jobs. Enough boys go to the disco regardless that it's even easier for girls to find a suitable boy on a quieter night.

OK, so looking at the labour market alone won't give us enough positive feedback to create multiple natural rates. Let's throw the output market into the mix.

The keynesian multiplier has its own positive feedback loop, with the marginal propensity to consume. The higher is employment and income, the higher is aggregate demand for output, and the higher is the demand for labour, and employment.

Asset prices create another positive feedback loop. The higher is output and employment, the higher are assets' earnings, the higher are asset prices, the higher is aggregate demand, and the higher is output and employment.

Yep. It wouldn't take much to persuade me that under some circumstances an economy might have two (or more) aggregate demand curves. But two AD curves won't be enough to give you two long run equilibrium levels of real output.

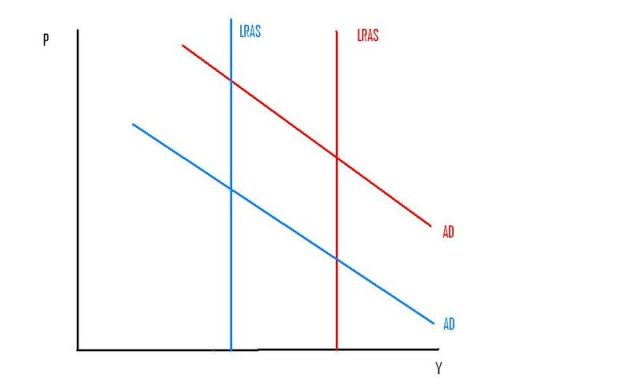

Suppose we had a model with two AD curves and two LRAS curves; something like this:

That would be a really neat model. A purely temporary shock could shift the economy from the red equilibrium to the blue equilibrium, and it would stay there indefinitely, even if all the exogenous variables returned to normal after the shock.

That would be a really neat model. A purely temporary shock could shift the economy from the red equilibrium to the blue equilibrium, and it would stay there indefinitely, even if all the exogenous variables returned to normal after the shock.

But I just can't believe it. It's those two LRAS curves that bother me. I can only see that happening if the labour supply curve were very elastic, so that a decline in job openings during a depression so discouraged workers that they gave up trying to find a job. So if firms tried to increase employment, they would face a labour shortage.

But it's quite possible, even very likely, that I have misunderstood what Roger is saying.

Is this story any more plausible – there’s two types of economies. One with employers like Ford, who pay their workers good wages so the workers can all go out and buy Fords, creating demand for the product and sustaining the equilibrium. Another type of economy has employers like Walmart, which pay their employees such low wages that the only place they can afford to shop is – Walmart. This isn’t my idea – lots of people talk about “Fordism” and “post-Fordist” economies. Does this work for Saturday night fever?

Great graphics, by the way.

“But all banks together cannot go bust (because the central bank will buy as many shares of the index as is needed to capitalise the banking system). This solves the moral hazard problem, and also recognises (as I argued in this earlier post), that the problem is not “Too big to fail”: it’s “Too big a percentage to fail”.”

I am having trouble visualizing a realistic scenario for the current crisis in the U. S. Let’s say that Citi, BoA, Well Fargo, Merrill Lynch, AIG, GS, and others fail, leaving J P Morgan Chase as the only Big Bank Left Standing. SunWest is the next largest bank, followed by some bank in the mid-South that nobody has ever heard of. The gov’t has cornered the market in the index. Assuming that the remaining banks can cash in on the index, how can they pick up the slack in a timely manner? I don’t see anything that I would call a solution. What would a solution look like?

You might get something like that if the skill set mismatch was so large that those in good jobs could only find bad jobs while the good jobs require skills they don’t have. They would have to be large sectors of the economy that don’t recover and have to be replaced with other sectors requiring different skills. That would change over time through education, retraining, and retirement but could take years.

My advanced copy is in transit.

I really enjoy Roger’s work — even when I don’t agree. The reason is very simple: he does a great job at explaining things to the reader. This is true whether he is writing for a general audience or trained economists.

I will let you know my thoughts when the text arrives.

Frances: Thanks, I did the pictures all by myself! Damn it was hard getting those boys’ and girls’ reaction functions to be S-shaped!

I’ve never understood the “Fordism” idea. It would seem to me that from the capitalists’ perspective, it would be better still to produce Aston Martins, pay the workers next to nothing, so profits would be so high the capitalists could afford to buy the cars.

Min: yes, I think that’s a good point. But if the central bank were supporting their share prices, couldn’t the banks left standing afford to buy up the remnants of the failed banks, to take over their business? I’m not sure.

Lord: Maybe. You are adding relative demand shocks into the mix, so it sounds more like a recalculation/real business cycle story. I didn’t interpret Roger that way.

Josh: yes, Roger writes very well. I wish he had drawn some pictures. I should have been keeping up with his work over the years. I will be interested to see your take on his book.

“I’ve never understood the “Fordism” idea. It would seem to me that from the capitalists’ perspective, it would be better still to produce Aston Martins, pay the workers next to nothing, so profits would be so high the capitalists could afford to buy the cars.”

I think it comes down to short-run, selfish, zero-sum thinking vs. long-run, rational society-wide thinking.

Ford realized, quite correctly, that providing workers with a decent wage enabled a mass market to develop, radically lowering costs and increasing productivity, increasing output of the entire economy and therefore real incomes (even for soft-hearted tycoons). Sure, if he is the only one pursuing this strategy, he wouldn’t necessarily increase his profits, but that’s not what happened. The idea obviously wasn’t so crazy at the time, because a lot of other big companies (for example, Hershey’s Chocolate) saw the wisdom and essential morality of this approach and followed it. The New Deal also provided additional support for this approach, leading to the greatest economic system that the world has yet seen (the post-war compromise), as Krugman never fails to mention.

TBC..

It has taken the foolish, selfish, short-sighted conservatives close to 40 years to completely destroy this system, and now we see the end result: the return of extreme, Gilded Age levels of inequality, overt political corruption, extreme financial crises, and the clear decline of America as a world power. But it’s all good right? We wouldn’t ever want to question the importance of un-evolved, sub-mammalian sociopathic self-interest as a means of achieving pareto-optimal outcomes would we? It’s not like Stiglitz ever debunked the idea….

bob: a topic to debate another time. This is about Roger Farmer, search theory, and multiple natural rates, not about a shortage of AD per se.

What temporary shocks can cause a group going one director vs. another?

What I could think of so faris endogeneous – more desirable girls deciding to go to the disco, thereby inducing more boys to go there, thereby inducing more girls to go too

Rogue: someone starts a rumour, that someone else has started a rumour….that John Travolta is going to show up. Or the weather is fine. The point is, if you are at an unstable equilibrium (like where the two curves cross in the middle, anything whatsoever, however small, can push you a little bit away from that equilibrium, and then the ball starts rolling. “How often have you seen an egg standing on its pointy end?”

Right. Come to think of it, it can also boil down to uncoordinated scheduling. Girls go to the disco early, find no boys over there, so they decide to go to the punk venue. The boys arrive at the disco later on, and find all the girls have gone. It turns out the boys finished watching a hockey game on TV prior to coming.

In life and in the economy, timing can sometimes be everything:)

I would think it would have to be many more boys than girls. Ostensibly the girls could have their pick but the actuality is they would be too busy rejecting unwanted advances and leave while the boys have no where else to go. It is the refuge of desperation and exploitation. Any attempt by others to go elsewhere is followed by them. I would only call this quasi-stable though. Eventually the desperate become resigned, or the girls become as desperate as the boys, becoming or using exploiters, or attending in groups for safety.

Hi Nick

I just found this piece. You were supposed to get advance copies of both books. There are two separate people at Oxford dealing with the two books and hopefully the other is on its way. Peter Diamond and Preston Mcaffee had a piece in the 80s (IER 28, 1987) where they pointed out that there are two sources of multiple equilibria in search models. One is the disco problem you point to that leads to finite numbers of equilibria. The other is more serious. If firms and workers take the wage as given, as in a competitive model, there are not enough equations to determine unknowns. EVEN IN THE STEADY STATE. Search theorists solve this ‘problem’ by assuming that firms and workers don’t take the wage as given. They bargain over the wage once they meet. But as Howitt and Mcafee point out — the bargaining weight is arbitrary and, as a consequence, there is a CONTINUUM of steady state equilibria. I use the same structure but I throw away the Nash bargaining equation and I close the model with animal spirits in the asset markets. This is explained in (Farmer IJET 4 2008, Farmer NBER WP 14846 and Farmer CEPR DP 7526). All of these papers are available on my website for download. Thanks for taking the time to look so carefully over my book and I look forward to hearing your feedback after you see Expectations, Employment and Prices. I still prefer punk to disco.

Roger

Nick: Sorry, yeah that was largely off topic. I’m going to post this response in bits, as that seems to be the only thing that is working with typepad at the moment…

The one thing I was touching on there, albeit obliquely, is the multiple equilibria, multiple natural rates of unemployment.

To put it very crudely: I think that under a laissez faire system, coordination problems result in suboptimal Nash equilibrium outcomes which result in a “Blue” equilibrium for the economy as a whole. The depression proved the existence of persistent “Blue” equilibria, while the New Deal shifted the equilibrium back to the “Red” equilibrium by solving those coordination problems via government mediation (regulations, progressive taxation, etc.) and providing automatic fiscal stabilizers to keep it there.

Eventually the “Red” equilibrium got taken for granted, and was assumed to be the one natural equilibrium. The New Deal institutional arrangements that actually supported the “Red” equilibrium were dismantled, because they were thought to be useless burdens, and monetary policy was thought to be sufficient to ensure full employment. By 2008 the US found itself back in the “Blue” equilibrium, with all sorts of things that “can never happen” according to the natural equilibrium models that assumed a “Red” equilibrium, happening.

In the midst of the what Krugman has correctly labelled The Macro Dark Ages, Farmer is at least generally on the side of the nascent renaissance. However, based on this post, I don’t find his search theory explanation very persuasive at all. I also found his unexplained anti-fiscal stimulus stance in the FT to be puzzling. I think that other approaches to the same issues are more likely to bear fruit.

Thanks Roger, that makes more sense already. I will check out those papers as well.

Hi Roger! And it’s really great to see you commenting here (I hoped you might).

(They sent me two copies of the general book!)

OK, now I understand you. And I’m really disappointed at myself that I didn’t catch this the first time. That story makes much more sense (empirically). It’s like Okun’s “toll model”. Firm and worker each have to pay a “toll” (search costs) before the interview. (Like the admission ticket to the disco, but don’t push that metaphor too far.) But even if the labour market is perfectly competitive ex ante (before they pay the search costs), there is bilateral monopoly/monopsony ex post, between an individual firm and worker, once those search costs are sunk. So the wage can be anywhere between those two “threat points”, and both sides will still want to do the deal. (The “Nash Bargaining Solution” says the equilibrium will be at a particular point, say halfway, between those threat points, but that equilibrium isn’t especially compelling, so Roger has ditched it.)

So, take my LRAS/AD picture above, and colour in the whole area between the red and blue LRAS curves. It’s all one big thick LRAS curve. If we are on one of the two AD curves, and somewhere inside that thick LRAS region, it’s an equilibrium. And where in particular we will be, depends on history, animal spirits, Schelling focal points, or whatever.

Maybe I’ll try to have another go at it, with a second picture showing the threat points.

I have found Roger’s articles over the last couple of years thought-provoking and look forward to reading his books.

If I understand him correctly here, it works like this:

– a reduction in AD initially reduces output (finding a new equilibrium between AD and SRAS)

– the position of the LRAS is influenced by the total capital stock, which is the integral of net investment;

– investment is a function of two things: the non-consumed share of the economy’s total output, and investors’ confidence in future AD (animal spirits), both of which are harmed by the short-term fall in output

– thus the LRAS curve can shift permanently to the left purely as a consequence of a short-run reduction in output

This makes plenty of sense to me although I’m not sure it differs much from a standard Keynesian model. And it ignores monetary factors, but if we allow for monetary policy to fail to correct AD in the short term (as it apparently did in 2008-09) then I think that’s legitimate.

So did boys and girls even try to hook up at punk gigs? Or is androgyny the new self-employment?

Two links:

From Alex at Marginal Revolution:

Is this a more realistic search-equilibrium argument than simply the idea that workers give up on looking?

And my thoughts on a Roger Farmer article from a few months ago.

Leigh: The idea you mention in your first comment above (that a recession causes a decline in investment which reduces future capital stock and shifts future LRAS left) has been around for some time. I think of that as an “old Keynesian” idea. (Not that it’s being old Keynesian makes it wrong). If you bolt that idea onto an “AK” growth model, you get a permanent effect from a recession.

The “hysterisis” effects on unemployment that Alex is referring to is more associated with “New Keynesian” thinking. It developed after the 1982 recessions. (Remember that line in a Dire Straits(?) song “The trouble with normal is it always gets worse”?

I think that both those ideas would best be described as “path dependence”, rather than “multiple equilibrium”. There is a unique natural rate at any point in time, though where it is depends on the history of the actual rate. (Though if really pressed, I’m not sure I could come up with a watertight distinction between those two concepts.)