Today's CPI release shows a reduction in pretty much every measure of inflation, so talk of just how high and how fast the Bank of Canada will increase interest rates will be a bit subdued for a few days – although last I checked, the CAD was still trading above parity.

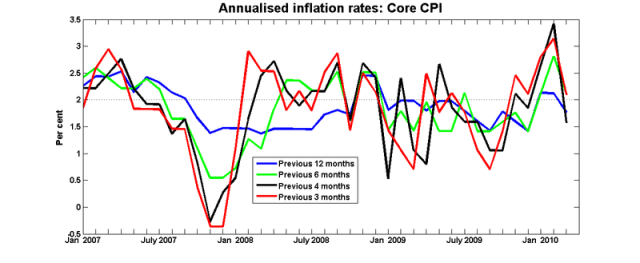

Here is the latest in my series of graphs of annualised core CPI inflation over various horizons:

Core CPI declined by an annual rate of 3% in March, but that followed an annualised increase of 5% in February, so today's release could be simply a correction of a one-month blip – apparently the Olympics generated a one-off spike in certain components of the CPI.

But there's another thing that could be happening, although it will take a few months to confirm. If you look at that graph, the sharpest reduction in core CPI inflation over the past three years didn't happen during the recession. The drop at the end of 2007 coincided with the first time the CAD reached parity with the USD in almost 35 years. Even those who weren't sure if you should by multiplying or dividing prices by the exchange rate could see that we were paying more for many consumer goods than were American consumers, and the resulting consumer revolt forced many Canadian retailers to reduce their prices.

The last few weeks have been peppered with talk of the appreciating Canadian dollar, so it may be that March's drop may be the beginning of another case of an exchange rate pass-through to consumer prices that is accelerated by reaching parity.

Consumer revolt?

I was under the impression that the increasing number of substitutes for local and regional retailers, particularly in the form of web-based retailers, were imposing more price discipline and making it harder for local and regional retailers to price-to-market.

Consumer revolt?

That means reduced profits will result in lower wages – the second of only two possible outcomes.

“Even those who weren’t sure if you should by multiplying or dividing prices by the exchange rate could see that we were paying more for many consumer goods than were American consumers, and the resulting consumer revolt forced many Canadian retailers to reduce their prices.”

I think you’re right, but it’s not exactly a model of rational behaviour!

There are plenty of exchange rate converter black boxes available free of charge on the web.

Interesting that the consumers didn’t shower praise on retailers for allowing CPI to stay near 2% for the entire time that the Canadian dollar was below 70 cents. There’s no pleasing some people.