Yesterday saw an odd coincidence:

- The Globe and Mail ran a bunch of articles about the 10-figure salaries earned by a small number of people ([1],[2],[3]).

- McMaster University's Mike Veall passed along updated data (preliminary paper and data files [1], [2], [3]) confirming the trend in which income is increasingly concentrated among a small number of people.

Three years ago, I blogged about the results that Mike published with Berkeley's Emmanuel Saez on the evolution of top income shares in Canada up to 2000. The updated numbers are not directly comparable to the ones in the AER study, but they show the same trends over the periods in which the two data sets overlap. Even better, they show what has happened to the concentration of after-tax income.

The basic story is that the trends identified in the earlier study have not reversed themselves since 2000. Here is how the pre- and post-tax income shares have evolved for the top ten per cent of the income distribution:

The top 10% increased its share of total income, but these gains were made entirely by those in the top 5%. The pre-tax share of those in the 90%-95% category didn't change, and the after-tax share of the 90%-95% group actually declined over this period.

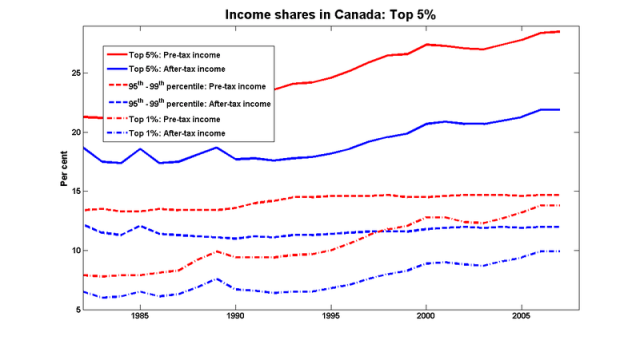

So let's take a closer look at the top 5%:

The same pattern repeats itself: although those whose incomes fell between the 95th and the 99th percentiles saw an increase in their share of pre-tax income, their share of after-tax income fell. The gains in after-tax income were made by those in the top 1%.

So let's take a closer look at the top 1%:

And again, the pattern is repeated. Although those in the 99%-99.5% group saw modest increases in their share of total income, these gains were dwarfed by those in the top 0.5%.

When you zoom in on the top 0.5%, the pattern breaks down: both the 99.5%-99.9% and the top 0.1% see gains in both pre- and post-tax income.

Here is Mike's Table 1, supplemented with a summary of the changes of the shares in total and in after-tax income:

Fractile Lower

bound: 2007Average

income: 2007Pre-tax

share: 1982Pre-tax

share: 2007After-tax

share: 1982After-tax

share: 200790-95 $64,363 $72,600 12.3% 12.3% 11.7% 10.6% 95-99 $83,872 $108,700 13.4% 14.7% 12.2% 12.0% 99-99.5 $169,321 $200,700 2.6% 3.4% 2.2% 2.5% 99.5-99.9 $246,842 $358,000 3.0% 4.8% 2.5% 3.5% 99.9-99.99 $621,297 $970,000 1.4% 3.0% 1.0% 2.0% 99.99-100 $1,843,601 $3,832,500 0.9% 2.6% 0.7% 1.9%

So the main thing to come away with is that the trend to higher income shares a the very top of the income distribution – particularly in the top 0.5% – is still ongoing.

There's more in Mike's paper, and I'll be coming back to this topic in a couple of days.

“simply begs the question of how CEOs managed to gain control without ownership.”

You mean being white, male, and taller than average doesn’t explain it? 😉

I think they hold the capital hostage and demand a ransom: “Pay me tons of money or I’ll kill this stock”. So no dividends for granny.

To figure out why top corporate income earners get the compensation they do (not so much in Japan or Europe BTW), you have to read Galbraith, not Marx.

Galbraith identified the consequences of corporate structure a long time ago (“The New Industrial State”). In particular, he noted a transfer of income from owners to officers.

DH said: “With this type of taxation do you think we’d have any high income earners?”

That is the point, no high income earners who won’t retire and spend down some to most of what they made.

DH said :”They’d all go somewhere where they can keep their income…. I would.”

Bye and replace them.

DH said: “And they’d take a lot of jobs along with them.”

The businesses and the jobs stay. If they try to net export from somewhere else, don’t allow it.

The point of loopholes and tax evasion is to get a nominal low income on the tax returns that doesnt reflect reality. Capital income is far easier to circumvent. Actual income share for labour is most likely much lower.

That may be trueto a degree (although, in practice, I think you’d find it’s not that easy to circumvent tax on capital income, at most you can defer it or have it recharacterized as something to be taxed at a more favourable rate), but that would have been true 50 or 35 years ago as well (more so, since the Income Tax Act has been tighened up considerably since the 1970’s to prevent what is seen as abusive tax avoidance). That wage income has increased steadily as a proportion of the incomes of the very rich suggests a more fundamental structural change than mere tax avoidance.