I wrote a post a few months ago on the curiously nonlinear relationship between the Canadian exchange rate and oil prices. Since then, the prices of oil and other commodities have continued to increase, and it is perhaps time to consider the policy implications of the kink at parity.

Here is the graph from that post, using data up to last October:

And here is the story I told about it:

During the 2000's, oil prices drifted up and dragged the CAD with it along what looks to be a fairly straight line. By the time oil prices hit $US 80 in September 2007, the CAD was near parity with the USD. Oil prices continued to rise, and it looks as though the relationship that had held for six years remained stable for a couple of months more: the Canadian dollar continued to appreciate.

But here's where it gets weird. For some reason, the CAD depreciated back down to about USD 1.0 in November 2007, and it fluctuated around parity for the next eight months or so, even though oil prices almost doubled.

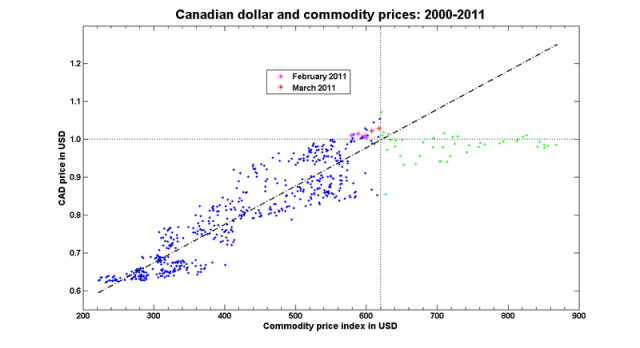

Since then, oil prices have continued to increase, but the Canadian dollar has stayed around parity:

The dash-dot line is a linear regression fitted through the blue data points, which are those where the price of oil is less than $85 US. Once again, the oil price-exchange rate relationship has broken down, just as oil prices hit the region that would predict a CAD significantly above parity.

You get a similar pattern if you use the Bank of Canada's commodity price index, but the difference here is that so far, we aren't in the region where commodity prices would predict a CAD well above parity with the USD:

Once again, the dash-dot line is a fitted linear regression using data points where the index is less than 620.

Exactly why we'd get such a non-linear relationship isn't immediately clear. The simplest and most plausible explanation I can think of is psychological: forex traders see parity as a powerful focal point, and are unwilling to adventure into price ranges we haven't seen in generations.

But that's not really the question that interests me here. If the prices of oil and of other commodities continue to increase, and if – for whatever reason – forex markets decide to set the exchange rate at parity, then what are the policy consequences of an under-valued Canadian dollar? It would seem to me as though one obvious consequence would be interest rates higher than they would otherwise have been.

There must be others. In the months in which oil prices were rising and in which the CAD was not appreciating, oil exporters were fabulously profitable, and investment flows were probably too large to be absorbed by the existing infrastructure. If – or when – that happens again, what should be the policy response?

Any ideas for what the policy challenges – and solutions – might be for an under-valued Canadian dollar?

Good graphs, good question. Not sure about the answer. Like you, my first hunch would be that the Bank of Canada would have to use a higher interest rate to keep inflation under control, as a substitute for a higher exchange rate. But maybe, in addition to having the interest rate higher than it would otherwise be, should we also want fiscal policy to be tighter than it otherwise would be, to take some of the pressure off the interest rate, and reduce capital inflows??

Does only comparing CAD to USD really show the value of our dollar? I know the US is our largest trading partner and it’s fair to compare ourselves to them, but world events over the last 3-4 years have made people risk-averse and created a demand for USD in the form of US Treasuries. That’s going to affect the short term USD/CAD rates. How are we doing against the Euro, Yen, or a basket of currencies?

Didn’t the Bank of Canada engage in open-market operations in 2008 to prevent the dollar from rising as high as oil prices would have sent it? That was, iirc, under political pressure from exporters.

Question – is it just forex traders, or would the impact of parity on shopping habits be meaningful enough to affect exchange rates? It strikes me that even when things are cheaper in the US, there’s a certain mentality to paying “more” after exchange that keeps people buying in Canada. Once parity is reached or exceeded, internet orders and crossborder shopping shoot up.

If it is meaningful enough, could this suggest that “undervalued” isn’t the right word for this kink, and that the kink could just be an indicator of a shift in the economy’s distribution between resource production and retail/consumer services?

Investors – other than forex traders – may also have a similar alegory, where they’re unwilling to give up $1m US for $900k CA, thus reducing investment inflows.

“Does only comparing CAD to USD really show the value of our dollar?”

The oil and “other commodities” upon which Stephen’s model is premised are priced in USD; the increases he refers to are in USD terms. So the model is inherently about CAD/USD.

Having said that, Nick’s “first hunch … that the Bank of Canada would have to use a higher interest rate to keep inflation under control” doesn’t make sense. The BoC might raise rates in order to keep CAD high, but it doesn’t follow that CAD being “too low” implies a need for higher rates. How could stable CAD/USD cause inflation? Only by importing inflation from the US. But there is none to import. What is getting more expensive? Oil and “other commodities.” But again, the premise of the model is that we sell that stuff to other people rather than use it ourselves. They look more like an outputs of our economy than inputs.

Really striking graphs, Stephen. Canada does seem to have elements of an imperfect monetary union. If an oil spike is going to cause stagflation (outside of Alberta), how about a bigger tax on extraction of oil (and other natural resources)?

Nick: “But maybe, in addition to having the interest rate higher than it would otherwise be, should we also want fiscal policy to be tighter than it otherwise would be, to take some of the pressure off the interest rate, and reduce capital inflows??”

The most obvious and directly relevant form of fiscal tightening would be a tax on oil. But anything generally designed to reduce capital inflows seems counterproductive since those flows seem like the obvious way to fix an undervalued currency.

“The oil and “other commodities” upon which Stephen’s model is premised are priced in USD; the increases he refers to are in USD terms. So the model is inherently about CAD/USD.”

Yes, but my point is that the USD is “manipulated” just as much, if not certainly more, than the Canadian dollar. If war in Libya causes oil to rise AND investors to flee into safe US denominated assets, then the Canadian dollar is likely to go down versus the USD, but perhaps not the Euro.

The Canadian economy is not only oil, mines and banks Ai it happens we have some industries left and there trying to export conveyors, structural steels (beams, anchors…)byke, trains…. A canadian dollar worthing 1.15US will probably run havoc with them or at least most of them.

I love the post Stephen!

One “positive” implication of the Canadian dollar no longer co-appreciating with WTI is that it allows the BoC to raise interest rates without fears of pushing up the currency. Another implication is that an “undervalued” Canadian dollar would somewhat ameliorate the “Dutch” Disease in Canada — that is the manufacturing industry in Central Canada would still have a fighting chance to compete in the U.S. if the Canadian Dollar remains at parity.

This is an interesting problem facing Canada, and one I think most countries would like to have.

A suggestion for reading:

http://knowledge.wharton.upenn.edu/article.cfm?articleid=2734

Stephen, OT comment but I thought you might be interested by this tool to produce pretty nifty graphs: http://www.tableausoftware.com/public/how-it-works

Sorry but I don’t really understand why the Canadian dollar would have to increase as oil prices increase. While I do see that they did previously have a linear relationship, why can’t the canadian dollar stagnate? (oil prices will almost always keep rising)