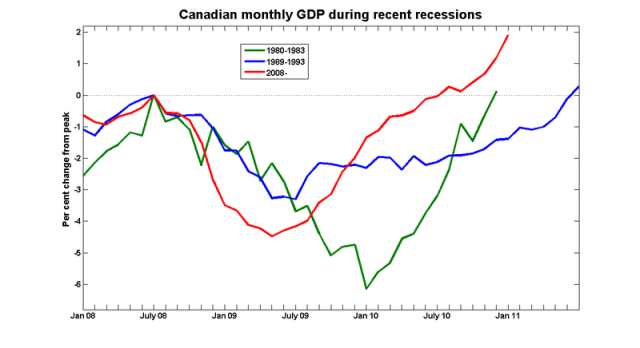

Today's GDP numbers are a happy contrast to the sort of numbers we were seeing six months ago:

Recent data from the US are also encouraging. The recession is over, and the end of the recovery is getting closer.

Today's GDP numbers are a happy contrast to the sort of numbers we were seeing six months ago:

Recent data from the US are also encouraging. The recession is over, and the end of the recovery is getting closer.

| liviodimatteo on It lives! | |

| Ben Atkinson on It lives! | |

| Stephen Gordon on It lives! | |

| irvineca on It lives! | |

| yildoyggdrasil on It lives! |

Why are Canadian unemployment rates so slow to recover, if your economy has been better than July ’08 levels for more than six months? Compare: 6% Jan of ’08, 8% when the economy got back to July ’08 levels, 7.5% today (estimates).

Data here: http://www.tradingeconomics.com/Economics/Unemployment-Rate.aspx?Symbol=CAD

“the end of the recovery is getting closer”

That’s a good thing?

So this is about the best it’s going to get? Jeeze……that’s pretty sad.

Dean:

My theory on Canadian unemployment rates is due to terms-of-trade. Most of our exports (75%) go to the US. The US has had a worse recession than we have. Some commodities like oil have done OK, more discretionary purchases like paper have suffered. Manufacturing has also suffered as it is higher-priced and more discretionary in product nature. A high Canadian dollar is just a kick in the teeth on top of that. Dependence on a low dollar was the crack-cocaine of manufacturing in Canada in the 1990’s.

A weak US market means weak demand which makes for bleak corporate expectations and poor employment gains.

This is the peril of living a small open economy. A Canadian recovery with a weak US economy is one that has one arm tied behind its back.

Dean: real GDP almost always recovers to its previous peak before the unemployment rate returns to normal. The main reasons are: population grows; and productivity (output per worker) grows. Adding population + productivity, you need somewhere around 3% per annum GDP growth to keep the unemployment rate constant. So, CBBB, the recovery should continue. This is not (I hope) “the best it’s going to get”. Eyeballing Stephen’s graph, it looks like we’ve had roughly 6% per annum GDP growth since the trough, about twice as fast as the normal 3%.

Shouldn’t “recovery” be judged/measured by how close the economy returns to potential (e.g., unemployment) rather than its rate of growth?

Yes, that’s what I had in mind. The recession was the part where output was falling, and the recovery is the part where we get back up to trend and back to where unemployment and/or employment rates go back to what they were.

Suggested reading about supply chain and its implications….

http://www.economist.com/node/18486015?story_id=18486015&fsrc=nwl|wwp|03-31-11|business_this_week

If you look at the data I linked to (and adjust to meet the same timeline as above) you’ll note that the percentage change was much higher for unemployment as it went down, and recent gains have been marginal at best. I appreciate some of the points raised in any case – comparing old data show a similar trend of very low growth in employment after recessions.

It will be interesting to see what the lag between GDP and jobs is this time around. Alberta is still working at recovering all the jobs lost since October 2008.