The budget turmoil in the United States is certainly attracting a lot of attention and of a kind it is unaccustomed to given its global power status. The International Monetary Fund has just urged the United States to outline credible measures to reduce its budget deficit as well as a plan to reduce its massive debt levels as it approaches a 14.3 trillion dollar limit on its borrowing authority.

While the United States is not Greece or Portugal, the federal public debt has more than doubled over the last decade. The IMF concerns are amplified by the fact that it has cut its growth forecasts for the US economy given the rising price of oil, turmoil in the Middle East, inflation in China and the economic effects of the earthquake in Japan. Canada, on the other hand, had the IMF declare that its plan to eventually erase the deficit (based on the Conservative pre-election budget) was actually sound and credible though they did not weigh in on whether it could actually be erased a year earlier.

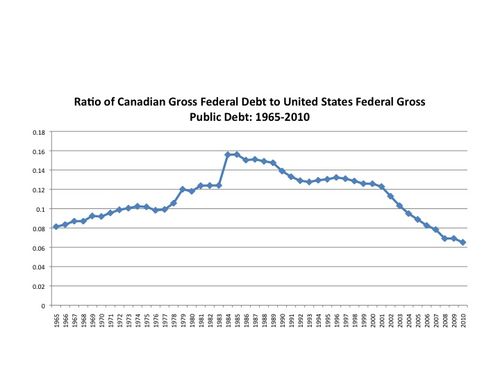

So how does Canada stack up against the United States when it comes to federal debt levels? I’ve put together three graphs with which to compare the evolution of the gross federal government debt of Canada and the United States. Figure 1 plots the ratio of Canadian gross federal government debt to United States gross federal government debt. Figure 2 presents the ratio of federal government debt to GDP for each country. Figure 3 plots the ratio of the debt to GDP ratios. The evidence shows that while Canada performed more poorly on the debt front than the United States during the period from the mid 1960s to the 1990s, it has since done a better job. The ratio of Canadian to United States federal debt declined from the early 1980s (Figure 1) but this does not take the size of the economy into account, which occurs in Figure 3. Figure 3 shows that after adjusting for the size of the economy, Canada’s debt situation relative to the United States improves in a consistent and dramatic fashion after 1996. Canada has a higher gross debt to GDP ratio than the United States after 1981 and its debt rises faster than GDP until 1996. After 1996, Canada’s gross debt to GDP ratio begins to fall (as does the American ratio) but the American ratio then begins to rise in 2000 and a crossover occurs between 2001 and 2002.

Figure 1

Figure 2

Figure 3

For the United States, after the improvements in its debt situation that occurred from 1995 to 2000, the years since have seen a steady deterioration of its fiscal position. Its gross debt to GDP ratio is now nearly twice that of Canada’s (about 93 percent compared to 54 percent). By way of comparison, at the end of 2010, Portugal’s gross debt to GDP ratio was 83 percent while Greece’s was 130 percent. However, when net debt is considered, Portugal was at 79 percent, Greece at 110 percent and the United States at 66 percent. The United States is not yet in Euro-bailout territory especially given its untapped fiscal capacity (Federal Sales Tax anyone?) and it is in better shape than Japan or Italy. Nevertheless, it is in dangerous economic territory given its slow steps to grapple with its debt and deficit and so are we given our economic dependence on the United States.

Net debt is the more meaningful measure. Off-balance sheet liabilities are probably quite a bit worse for the US.

You shouldn’t look at gross federal debt, but debt held by the public.

And one of the reasons why you don’t want to include debt that one governmental department owes another is this will be specific to the intra-departmental arrangements in each country and will not valid for a cross country comparison, nor will it be valid for looking at the debt for the government as a whole. The reason is that you are counting all the liabilities of the government, but not all of the assets.

Comparing the U.S. to Greece or Ireland is ludicrous; no country has ever defaulted in its own currency in the history of the world. Canada will never run out of Canadian dollars; Japan will never run out of Japanese Yen, the U.S. will never run out of U.S. dollars; the UK will never run out of UK pounds;…etc. Greece,Ireland and Portugal can (and did!) run out of Euros, just like Argentina did run out of U.S. dollars in the 1990s.

I look today at the U.S. 10-year yield and it is at 3.5%. You call this level dangerous? Canada’s 10-year bond yield is at 3.5% as well, is this also dangerous?

Yes Canada had high debt level in the ’60’s. It also had the largest baby boom of all the Anglo-Saxon countries ( there were no baby boom elsewhere) and so a graet need for social equipment. Would it have been better if we had no debt and unedcated population?.

Most of the Canadian ( including the provinces) was not even conjonctural but asset-related ( including intangible like human capital).

US. debt is a mixture of the conjonctural ( you would rather have a depression?) and the stuctural induced by the Repuiblicans for ideological reasons , a combination of starvve the beast and rob the state blind.

The last thing the U.S. should be doing right now is worrying about its deficit. The Fed can just buy any bonds it issues. Under normal circumstances, such money printing would cause inflation, but printing money is exactly what the U.S. needs to do now to end its slump.

I am a little more worried about some Canadian provinces. The Canadian government cannot run out of Canadian dollars, but the Ontario government could, theoretically. Provinces are a bit like Euro-zone countries in that way, although their debt levels are still well below where I think the danger zone is. Also, provinces could probably expect more federal help if they got into trouble than Greece or Ireland have received.

“conjunctural” is a lovely old word for the business cycle, rarely used now in English, and normally replaced by “cyclical”. Just thought I would explain Jacques’ meaning, since few people nowadays are familiar with the term. It’s good it survives in French “conjoncturel”; here’s why. What was lost when “cyclical” replaced “conjunctural” is the idea, emphasised by Lucas, that the business cycle is many different time series moving together. We kept the cycle part, but lost the conjuncture (joining together) part.

Provinces can expect a lot more help from Ottawa if they got into trouble. More importantly, transfers for equitable social services mean that they have to work really, really hard to screw up that much in the first place, and if you cut you still have a firm baseline compared to other provinces that will survive.

Europe’s problem, IMHO, is that the Euro area doesn’t have the transfer mechanisms and most importantly the tax mechanisms where they should be for a currency, at the top, in this case with the European Commission.

We know from the USA, Australia and Canada that when you set up a federation you need a central government with significant taxation and transfer power to mitigate the policy impacts of having a single currency and trading area. Europe, for political reasons, hasn’t done all it needs to do and is now paying the price.

Nice catch Nick! Economic fluctuations is a more technically more precise way of referring to business cycle movements, and that works in both English and French: fluctuations économiques. The term cycle appears to mislead many into believing that macroeconomic fluctuations are somehow periodic and predictable.

Must disagree with Jacques on the course of US fiscal policy. It is causing a lot of grief–expert and popular–at the moment. Taxes must be raised. Fossil fuel excise taxes are the obvious albeit unpopular choice. Otherwise economic and political confidence will suffer.

Increased taxes, presumably announced and scheduled, would vastly expand the room for maintaining stimulative Fed monetary policy without risking run-away inflation expectations.

Determinant:

I don’t disagree with what you are saying. But I am a bit worried that the level of commitment that provinces have to the health of the whole country seems to be fraying around the edges. You hear claims that provinces are being short-changed by equalization. If a province got in trouble or was receiving very large equalization payments, it could become a tempting target for politicians in “have” provinces the way Greece is a target for German politicians.

A fair point, Paul. However every province has been on both ends of the equalization formula, including Newfoundland, Ontario and Alberta, so in practice turnabout is fair play applies.

Plus we are all in this together, a default by one province would have the finance ministers in Ottawa and the other provinces in apoplexy. It would kill the market for their own debt.

Though I would say that the blatant provincialism exhibited by some provinces cough Quebec cough Newfoundland cough is not healthy. Chantal Hebert, CBC panelist and Quebec columnist said that first and I agree with her.

This is also why I think Duceppe was entirely off-base for criticizing federal assistance for a Newfoundland-Nova Scotia DC Power link. What, he can’t stand the shoe on the other foot now?

westslope: “The term cycle appears to mislead many into believing that macroeconomic fluctuations are somehow periodic and predictable.”

Periodic and unpredictable? I like the metaphor I read in an old book of a pendulum at which small boys are throwing rocks. 😉

Lucas argued, and I think it’s an important point, that each business cycle is different in amplitude and frequency. What makes them all alike, and so what makes them all deserving of the same name, and what makes it possible to think of a common explanation for all business cycles, is precisely the conjunctural aspect — that the same variables move in a common pattern relative to each other. It’s the co-movements that make them all alike. “Output down, employment down, unemployment up, etc., here we go again!”.

What has the IMF got to do with the US. The US largely finances the IMF and the US the major supplier of international reserves – with currency it can create out of thin air. That is a part of the reason for many problems – the overvalued US dollar, the liquidity trap, the current account deficit (even in a deep recession) and the budget deficit.

Now look at private debt. You can’t ignore the relationship between them – government debts are private sector wealth – so long as the current account is in balance. I don’t think any of this can be sensibly analysed without reference to foreign and private sector balance sheets.

Nice post Livio, great comparisons.

To echo some earlier commenters, it’s unclear if we should be looking at Gross Debt, Net Debt or Debt Held by the Public. There certainly is a tendency to report Gross debt, at least in the media.

Also, should pension obligations be included in the numbers? I recall a Nick Rowe post from about a year ago highlighting that the Canadian Federal Gov’t had a huge pension obligation.

It would also be helpful to include provincial debt into Canada’s nunbers (and state debt into US numbers). Let’s honest, the Canadian Federal gov’t under Martin reduced its deficit by unloading responsibilities to the provinces. So while the Federal Debt/GDP has dropped through the 2000s, provincial ratios have not improved. A fair comparison should reflect this.

Thanks again for the charts!