According to a report in the May 11th edition of the Globe and Mail, the U.S. government is pressing the Canadian federal government to loosen the rules so that fewer Canadians have to stop and pay duties as they return from a trip to the United States: “The personal exemption issue has been formally raised by the United States trade representative,” an official with the U.S. embassy told The Globe and Mail on Wednesday.

“The message is that the U.S. believes that both countries have a lot to be gained by reducing trade barriers in general. And there is work to be done on both sides to achieve that goal.” Of course, the U.S. government is raising this in the context of national security, that is: “Border inspectors need to spend less time looking for extra bottles of duty-free whisky and more time trying to identify people who might be a genuine threat.” It would appear from the sub-text of this story that the Obama administration is concerned that terrorists might enter Canada from the United States which is certainly a reversal of the general American attitude regarding terrorists and Canada. In reality, the higher Canadian dollar is encouraging more Canadians to shop in the United States and a larger exemption is good for border businesses.

Apparently, legislation recently reintroduced in Congress calls for the United States to raise the amount Americans can bring back customs-free from Canada – even on a day trip – to $1,000 from $200. In contrast, Canadian law does not waive any taxes or duties for items purchased on a day trip. A 24-hour stay is required for a waiver on up to $50 (not including tobacco and alcohol). That amount rises to $400 for a 48-hour stay and $750 for a week-long visit. Why does this concern the federal government? Well, preliminary data from Statistics Canada show Canadians spent $18-billion in the United States last year – a 14.5 per cent jump from 2009 and nearly 40 per cent more than in 2006. The concern in Ottawa is that making these trips any easier on Canadian wallets will hurt retailers at home and mean less sales-tax revenue. Oddly enough, lowering the GST rate also reduced sales tax revenue and apparently has not deterred Canadians from visiting the United States.

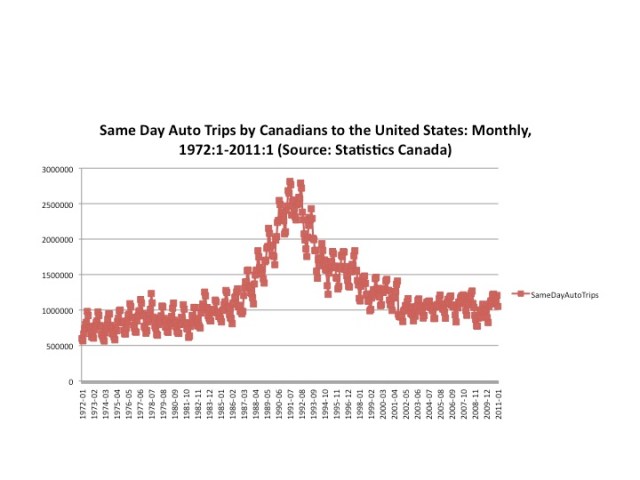

The cross-border shopping saga is a long one in Canada and as the accompanying figure shows, despite the recent increases in spending by Canadians in the United States, trips are no where near their peak in 1991. The fact is that same day auto trips by Canadians to the United States have actually been flat over the last five years or so. What has increased in the number of one or more night trips and we are obviously spending more per trip. Canadians have gotten around the low exemption amount they can bring back by simply going to the United States longer enabling them to spend more and bring more back. Really, who can blame us? Ninety percent of our population lives within one-hundred kilometers of the border and U.S. cities are often closer than Canadian ones. And, many retailers in Canada are American anyway but charge higher prices because they are obviously able to get away with it in the Canadian market. Canadians, it seem are willing to pay more in Canada and those who don’t cross-border shop. If anything, more cross-border shopping may provide some pressure on retailers in Canada to lower prices.

“The fact is that same day auto trips by Canadians to the United States have actually been flat over the last five years or so. ”

Why go through the hassle of driving across the border when you can just order things over the internet?

Excellent point. I think a reason the one or more night trips are up are generally part of a travel/ tourism experience and shopping on these trips is important but a secondary consideration. The same day trips are down partly because of border hassles though the drop in the dollar after 1991 was a factor. People who used to same day trip can just order many things over the Internet. However, a lot of grocery shopping is also being done cross border and that is not as easily done via the Internet – yet.

I grew-up a stones throw from the Vermont border around the time of the peak in the graph above. Everyone bought gas and groceries in the US. In those days the US border guards would regularly wave us through the crossing, no questions asked. The Canadian guards were a different story. They would routinely search cars (over looking the $300 in groceries) for booze and smokes. Not infrequently they’d ask someone to pull into the inspection area and fetch the tool box (to take off the interior door moldings, check for false floor in the trunk).

And back then (which really isn’t all that long ago) the border towns in Vermont and upstate NY were doing OK. Not so anymore. It’s extremely depressed now.

The more easily cocaine and guns slip across the border into Canada, the more votes the Conservatives can rustle up by playing the crime fear card.

“Why go through the hassle of driving across the border when you can just order things over the internet?”

Contrast internet shopping in Canada with that in the US – it is a different world. Here, there is limited choice and not much in the way of a price advantage (plus expensive and slow shipping). In the US, it is a whole different situation.

I think a better question is, why is retailing (both bricks & mortar as well as online) so much more competitive in the US than it is in Canada? Is it because of tax structure? Population? Culture?

Also, I can’t fathom travelling to Buffalo for 24 hours to shop. Don’t people place a value on their sanity and time? Not to mention the costs of getting there – do people make rational pricing decisions, or do they get a positive psychic benefit from getting a deal?