This is one of those posts where I present data in graph form so that people – in particular, I – can get a feel for what's been happening. Today's entry is on how the various components of aggregate demand contributed to the recession and recovery. We sometimes get too focused on the particularities of current events; it's useful to step back and see that what we're seeing now is another manifestation of patterns we've seen before.

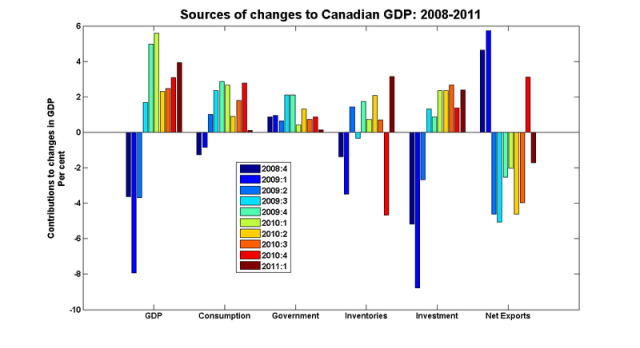

Here is how the elements of aggregate demand have contributed to GDP growth since the second quarter of 2008:

I've made this point before, but it's worth repeating: the 2008-09 recession was not caused by a fall in net exports. This isn't a feature specific to this episode; net exports have made a positive contribution to economic growth in the last three recessions:

Each time there's a recession, the Canadian dollar depreciates. These depreciations are generally greeted with alarming headlines, but they really shouldn't be. Things would have been much worse if the Canadian dollar didn't depreciate.

The driving force behind Canadian recessions is a drop in fixed business investment spending, with a smaller reduction in consumption spending. Canadian governments have generally managed to arrange things so that they provide some fiscal stimulus, and as noted above, net exports make a positive contribution.

After three quarters in which GDP contracted, growth resumed in 2009Q3; the principal contributors to growth in the first two quarters of the recovery were consumption and government spending. These developments seem to be policy-driven: consumers responded to the record-low interest rates produced by the Bank of Canada, and the much-heralded fiscal stimulus also played a role. By mid-2009, the rebounding Canadian dollar pushed the contribution of net exports negative, just as it was through the 2002-08 expansion. Consumption spending stayed strong going into 2010, but there was a handoff from government spending to investment spending.

It would be nice if I had a story about inventories, but I got nothing. There's a fundamental identification problem when trying to interpret swings in inventories: a positive number can be bad news (unsold inventory piling up) or good news (retailers anticipating higher future demand). The only thing I can point to is that the large positive number in 2011Q1 that seems so worrisome could be simply a rebound from a strong drawdown in the previous quarter. Or both numbers could be statistical glitches that will be revised away.

[It took you an entire paragraph to say you had nothing? You're not getting paid by the word, you know – ed]

It's worth breaking out the components of investment spending:

The investment recovery was in two stages. In late 2009 and early 2010, expenditures were concentrated in the residential construction sector, but housing has played almost no role in the last four quarters. Happily, fixed business investment – and especially expenditures on machinery and equipment – started picking up just as the housing sector stopped contributing to growth.

So the recession was fairly typical of Canadian recessions, and the recovery is taking the same form as the 1982-1990 and the 2002-08 expansions: growth coming from investment and consumption, and net exports being a drag on growth.

That the C$ depreciated proves the poinit that net exports had something to do with the whole mess. That the cure worked does not negate the malady.

INvestment drops for a reason.

I was surprised that net exports played no role. But they might have played an indirect role. When the demand for our net exports fell, that caused a fall in the real exchange rate/terms of trade, rather than a reduction in the amount of net exports. (I’m thinking especially oil prices, for example). That fall in the real exchange rate reduced Canadian real incomes so consumption demand fell, and also made investment less profitable, so investment demand fell. Might that make sense? Sort of like Stephen’s old beer and pizza post.

When we talk about “typical” perhaps it’s worth looking at savings rates as well. The last recession, on that front, was not typical at all.

Great work. Sure helps to get a few facts to base my airy-fairy theories on.

I have a few questions, since you seem to be blowing my idea that our recession was caused by a decline in exports to the U.S. out of the water. An increase in net exports could be a reduction in exports, accompanied by an even greater reduction in imports. Does that work? Do you have data on what sort of exports increased?

I might have to fall back on the idea that firms reduced investment in anticipation of a decline in sales. Does that make sense?

Paul: oil and gas prices tanked and the sector freaked out and started cancelling projects in a big way. Off the top of my head I can think of four or five bitumen upgraders, a refinery, and oil sands expansions that were cancelled. So that kinda fits your fall back position…

i too would like to commend you for a great job.

@ paul. i tend to hugely buy your idea that firm resulted to lesser investment. i tend to agree because businesses are guided by the optimistic or pessimistic tendencies when making decisions on investment. the aggregate of these microeconomics decisions are the ones that impact on the macro economic variables

Paul: Yes, both import and export volumes fell, with imports falling faster than exports. And that fits in with falling investment as the driving force, because much of our machinery and equipment spending is on imports.

nice blog

http://islam-and-economy.blogspot.com

Wish all visit it

Great post. Very interesting and informative. I really enjoy seeing the numbers broken down in this way, though it does make me wonder – are the numbers for these graphs available online and if so where can they be accessed?

So, what are the lessons here? Since a lot of machinery is imported, could we say:

1. Perhaps the government should change the rules on mortgages at the first hint of a recession – increase amortisation terms and reduce down payments, then reverse these policies once recovery firmly takes hold?

2. The B of C should be more aggressive in printing money when a recession starts, to lower the C$ even more than it has, and to ignore the inflation target?

Nick H: Sadly, no, the data are not freely available the way they are in the US; that’s a big reason behind why I take the time to do posts like these. Unless you have an affiliation with a university or some other institution that had paid to subscribe to StatsCan’s database, you can’t get these numbers without paying for them.

It sounds from the comments like reduced invesment spending would largely reduce imports, which, as far as I can tell, shouldn’t have much negative impact on Canadian GDP, since a lot of investment spending flows out of the country. So then wouldn’t the drag on GDP from reduced exports outweigh the drag from reduced investment (because a lot of investment spending occurs outside the country anyway?) I may be a bit confused on this issue. I may also be overexaggerating the extent to which investment spending occurs outside the country. It would be nice to see net exports broken down as exports and imports.