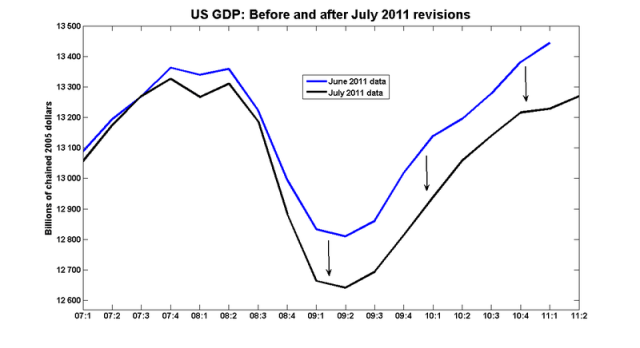

The BEA's advance estimate for 2011Q2 GDP growth was accompanied by news that 2011Q1 growth had been revised from 1.8% to 0.4%. This is bad enough, but the data revisions are much, much worse than that. Here is a graph of the data that were archived by the St Louis Fed last month, along with the most recent BEA data:

This is very, very bad news.

Bartender! Scotch, neat. Make it a double.

Since this news was released, the US dollar has tanked against every major currency. Except, that is, for the Canadian dollar which has depreciated against the greenback. #petrocurrency

Wow. Off by over 2% in their initial estimates. Is that a normal error?

Wow!

This makes me think back to my old “US Productivity Exceptionalism” post.

http://worthwhile.typepad.com/worthwhile_canadian_initi/2011/01/us-productivity-exceptionalism.html

We were trying to explain why, relative to other countries, US GDP was doing quite well but employment was doing quite badly. Maybe this is the answer. (OK, part of the answer.) US GDP wasn’t doing quite well. It was a data error.

Now wonder oil prices are declining. Move over fiscal stalemate and associated theatrics. Average real US income is stagnant.

“Average real US income is stagnant.” Actually, given that the population grows over time, I rather expect that we are still seeing a per capita decline. It might be small in absolute terms but given that smart money is on further contraction due to budget issues it might not be the best possible place to be starting from.

Hooray bailouts and money printing!

Brock, the bailout is what “stopped” the slide in the first place. Where is the “printed” money? Yeah, it doesn’t exist. A pure fantasy.

There has been no printing, no incentive for growth and no incentive for expansion.

“There has been no printing, no incentive for growth and no incentive for expansion.”

Well, this is technically true. But all those demand deposits created at the Fed, for which there can be no exit strategy without taking the Treasury down with them, can very easily turn into money printing, now can’t they?

Also, I don’t disagree that the bailout stopped the slide. But, of course, they fixed nothing. They allowed structural problems to deepen and worsen, and now the government and it’s supposedly independent central bank are close to having exhausted all their options for successfully pulling off a confidence trick on the economy, so everyone starts borrowing money en masse and engaging in conspicuous consumption.

Not only do I agree that “it would have been worse”, I’ll go so far as to say it should have been worse, in order to force liquidation of unproductive assets and malinvestment. Because, in the end, it will be far worse than Paul Krugman’s wildest dreams when the confidence fairy finally jumps off the merry-go-round.

“no incentive for growth”

Yes, of course. We need to incentive the economy to grow by holding an inflation gun to the head of savers and forcing them to take risks with their savings, or suffer the consequences of policy-imposed lost opportunity costs and savings debasement!

@Nick, or Frances, or Stephen:

Speaking of Nick’s US productivity post, this segues neatly into the recent article in the Globe & Mail, though by another of their economists, that discussed the Statscan report which concluded the substantial part of the productivity difference between the US and Canada is due to higher levels of self-employment in Canada.

I think this would be fodder for an excellent post here on WCI.

“substantial part of the productivity difference between the US and Canada is due to higher levels of self-employment in Canada.”

Self-employment in the US is either a very risky proposition (go without health care coverage) or a very ruinous one.

Fewer and fewer people pick either of these poisons.

Inquiring minds would love to get a link to this Globe & Mail article Determinant mentioned above (wink! wink!)

The Globe article

StatsCan

Thanks Jim.

Back on the subject of the graph, I am a bit unclear about what chained 2005 dollars are as a concept. An explanation would be appreciated.

Second, Stephen, why exactly do you think this is bad? There was no commentary with your OP. We, your fans, would like some more explanation.

Just looking at it I see the US is still in recession and the trend won’t bring them back to the previous peak for another six months to a year. Which I don’t find surprising given all the misery I see on the street. Of course what happens this weekend could very well make for another negative inflection point.

Stephen: a big THANK YOU for pointing out that data revisions sometimes matter.

Nick: data revision is a more serious problem for US productivity growth than it is for GDP growth. The problem is that productivity growth is less variable than growth in output or employment, so the noise is relatively more important. The problem is common to most of the commonly used measures of productivity growth and doesn’t go away as you try to average growth over longer periods. As a result, analysis of recent productivity growth is particularly treacherous. (I’ve got a whole paper on this with Jan Jacobs that you can download from CIRANO.)

Simon, in Nick’s follow-up post, the question was raised about whether or not this has any implications for possible revisions to Canadian GDP. Do you know if there are any correlations between BEA and StatsCan revisions that would lead us to believe that Canadian GDP may be also be revised downward?

eta: Or maybe StatsCan has already done its downward revision? See the 2009 graph from this post.

Simon: thanks. I’m going to think about that. It’s a non-obvious (to me) result. Or maybe I will just take your word for it!

But I am SO glad we had such difficulty trying to explain US productivity over the recession. If theory can easily explain facts that subsequently turn out to be non-facts, that’s bad.

Nick: This is macro — theory can explain anything, factual or otherwise!

Mike,

“Well, this is technically true. But all those demand deposits created at the Fed, for which there can be no exit strategy without taking the Treasury down with them, can very easily turn into money printing, now can’t they?”

In practice, it will never be unwound in that manner. They’ll just raise the interest paid on reserves.

“Not only do I agree that “it would have been worse”, I’ll go so far as to say it should have been worse, in order to force liquidation of unproductive assets and malinvestment.”

Something I don’t understand from this line of argument: how have TARP, Fed facilities and the ARRA thwarted anyone’s efforts to liquidate any assets?

Y,

They haven’t “thwarted” people’s attempts to liquidate. They have distorted price signals such that the market remains insanely imbalanced.

The government has effectively engaged, for instance, in supply management of the housing market to prevent market forces from collapsing the housing market. A major goal of the Federal Reserve and the US government has been to arrest the fall of housing prices in the United States. But in so doing, they’re trying to be the hand of god that prevents the market doing what it should: liquidate the malinvestment.

Through the Fed, Fannie and Freddies holdings of distressed real estate assets, they have managed to prevent the insanely over-valued US housing market from being cut down to size. And of course, everyone believes the US housing market is the lynchpin of the economy, and from there all else flows — which is an insane idea which, itself, has to be liquidated.