I am writing a piece on the Electro-Motive dispute in Canada and needed data on equipment and machinery. I had forgotten which CANSIM series I was looking for and asked if anyone knew. Reader Chris Hylarides pointed me towards a piece written by… Stephen Gordon. Not only did Stephen's piece have the data I was looking for, it answered the questions I was looking to ask! However, his piece was from early 2006. How have things changed since then?

In the earlier piece Stephen wrote:

If high profits weren't leading to higher levels of fixed business investment, that would definitely be a cause for concern – although not necessarily a reason for increasing corporate tax rates. But is it in fact the case? The reference to 'corporate capital spending' bothers me: I've never heard of a data series with that name, and a search of CANSIM (Statistics Canada's main source of economic data) leaves me no wiser as to what he meant.

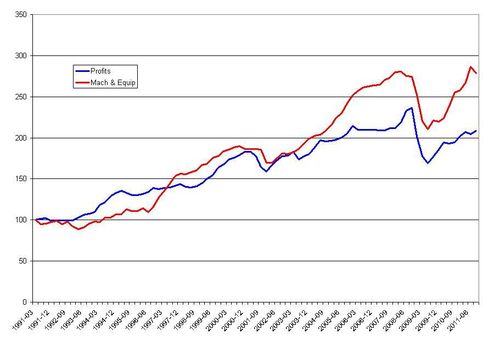

Here's what I did find*. First, there's little reason to claim that increases in profits aren't being matched by corresponding increases in investment:

Stephen's chart extended from 1991 to 2006. Here is the same chart, from 1991 up to the 3rd quarter of 2011:

Profits and Expenditures on Machinery and Equipment

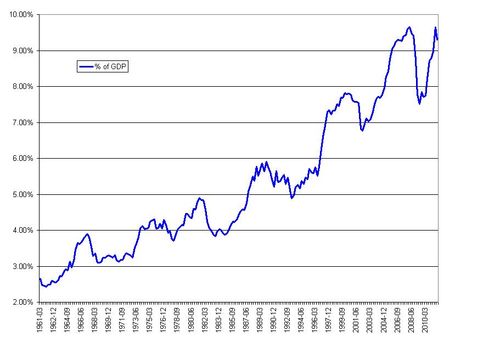

Investments in machinery and equipment are still going strong. In Stephen's second graph he concluded "as a proportion of GDP, expenditures on machinery and equipment are at a 45-year high". Here is the same data, starting from 1961 and going up to Q3 2011.

Private Expenditures on Machinery and Equipment as a % of GDP

Large downard blip during the recession, but investment in machinery and equipment has bounced back and is as strong as ever.

Mike: are you sure that last graph is right??? That is a stunning rate of increase, trebling as a percent of GDP since 1960. My prior would have been that it was roughly flat. If it is right, all I can say is: Wow!

Seems high to me, but Stephen and I got the same numbers from 1961-2006 (which made it really easy for me to check my work – I could check my work against his).

You have to be careful about interpreting those shares of real GDP. Those are constant-dollar numbers, and the shares will change each time StatsCan resets its base year.

What you can say is that real expenditures on M&E have grown more rapidly that real GDP.

Ahh.. okay. That makes sense! Is there a way we can account for that?

Ah. So if nominal expenditure on machinery and equipment kept a constant share of nominal GDP, but the relative price of machinery and equipment fell by two thirds, we would see a trebling. That makes sense. And if computers and hi-tech stuff are in there, that big fall in real price is plausible. But it’s still makes me Wow!

Not really. It’s a pretty fine point, and lot’s of people punt on it – including, obviously, me. I came across a correction on that point long after I wrote that.

BTW, there’s also this old post on profits vs investment

Nick – yes. Not accounting for that change in the relative price of M&E leads to things like this debacle.

If you are going to compare profit shares of GDP and investment in m and e share of GDP then you have to look at the latter in nominal and not real terms.

Andrew: why would you want to do that? It’s a bit like comparing profits in apples+orange production to investment in apple trees, when the price of apple trees is falling compared to oranges.