One of the best lines I heard at this year's CEA meetings was delivered by Chris Ragan, at a session on the Euro organized by Paul Jenkins.

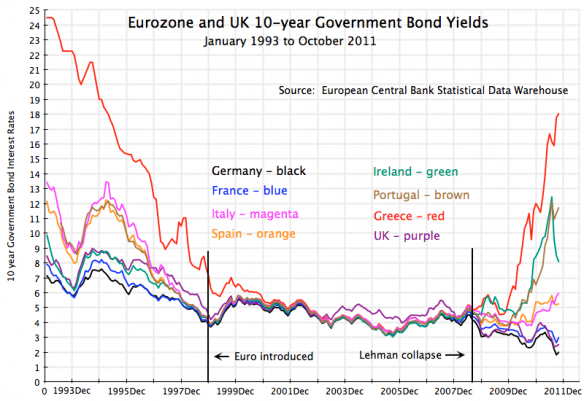

Chris was speaking to a picture of Eurozone bond yields, much like this one that I've lifted from An Economic Sense:

Looking at the convergence between the yields on higher-risk bonds like Greece's, and lower-risk bonds like Germany's, after the introduction of the Euro, Chris Ragan observed, "You look at this picture and ask yourself: What were they thinking? Actually, you can tell what they were thinking. The question is why they were thinking it."

The convergence of bond yields after the Euro was introduced reveals that the pre-Euro yield differences were almost entirely based on inflation and exchange rate risk. No one ever seriously considered the possibility that an EU country might not be able to repay its debt. That's what they were thinking. But as Chris says, the question is: Why?

@rsj,

where is your evidence that this was done on the request or whatever of the ECB.

Please provide date, participants, names and evidence / links for that.

I do not see anything like that in your ECB link above.

The Colm link also does not provide any evidence beyonnd some very wild vague claim.

Well, genauer, the exact communications are not open to the public. But the participants in the meetings said the ECB demanded guarantees, the credit markets believe this, and basically everyone except for you. The ECB certainly acts like it, demanding additional guarantees. That is enough evidence for me.

Here is the IMF disagreeing with the ECB about forcing Ireland to guarantee bank debt:

http://www.irishtimes.com/newspaper/finance/2012/0616/1224318055997.html

“The IMF called for “stability” in the European Central Bank’s funding of the Irish banks. This echoes repeated requests by the Government and its predecessor for a medium-term ECB funding arrangement for the banks. The ECB has consistently rejected making exceptions to its liquidity provision mechanisms for Irish banks.

The report distances the IMF from the decision to repay senior creditors in defunct banks and explicitly attributes the decision to the ECB, which insisted on the repayment because of its concerns about “pan-European financial stability”. It implicitly criticises that decision, saying that the “lack of burden-sharing on senior bank debt as part of the resolution process added to government debt, exacerbating the political difficulties with the annual payments of €3.1 billion due on the notes until 2023”.

Since you seem to view everything through a lense of nationalism and collective guilt or virtue, I thought you would be happy to hear that a minority of German representatives within the ECB sided with Ireland.

Didn’t Basel II capital rules provide 0 haircut on all European sovereign debt? If so, isn’t any spread inevitably arbitraged to 0? Wasn’t that the point?

@ rsj,

again, when was the guarantee given by whom, and when did the ECB or any other non-irish get involved.

The first guarantee was given by the Irish Government because the ECB said that they would not provide emergency loans to Irish Banks (liquidity support) unless the Irish government guarantee was provided.

Since then, there have been additional guarantees under the same circumstances, to extend protection to senior Irish bank creditors that were not protected by the initial guarantee. You can read about the details from the links I provided, or do your own research.

rsj, when is the question !

@rsj

I strongly reject your allegations “to view everything through a lense of nationalism and collective guilt or virtue”. I just reject that the German taxpayers have to pay for other nations bad decisions.

Second, it was a Taoiseach Brian Cowen on 1st of October 2008, who made this gargantum guarantee

http://www.guardian.co.uk/business/2008/oct/01/banking.creditcrunch1

and for some spicy commentary

http://www.vanityfair.com/business/features/2011/03/michael-lewis-ireland-201103

Your source above says “European financial chiefs made protection of senior bondholders a condition of its November bailout agreement”

[28th of ] November [2010] when the hyperbole came to an end and Ireland had to go to the IMF, and not 1st of October 2008, a little difference of just 2 years.

He was as the finance minister 2004 – 2008 in charge of the whole mess.

His wiki says “Cowen’s third budget in 2007, in anticipation of the 2007 general election, was regarded as one of the biggest spending sprees in the history of the state”

I have asked you, rsj, 3 times nicely to provide evidence for your now apparently false claim, that this was not a unilateral Irish decision on 1st Oct 2008, to pledge some 200% of the Irish GDP.

And, quite frankly, you are typical of these many claims now, how other countries fiercely defending their own independent decision making , then later turn around, and claim they were pushed way earlier, by the usual suspects, the EU, the ECB, the bad Germans, somehow. And each time you go for details , time sequence, the claims never hold water.

First Ireland made its pledge, got people to extend credits to the banks based on that, because they were now backed by the whole nation, then 2 years later Ireland found, they need help, get a very generous package, which includes that liability, and then starts a never ending nagging, to default somehow on this part of the parcel, without taking the consequence the Irish state defaulting on its commitments, a national default, without being called that.

All the while with plenty of own meat to cut, exceptionally low taxes, high public salaries.

Somehow, in the end, always the German taxpayer should pay other peoples debt.

The credit rating of Ireland reflects this kind of behavior, in CDS premiums and interest rate spreads as well.

Look here: http://www.finance.gov.ie/viewdoc.asp?docid=6474

Basically, a limited scheme was put in place for 1 year, and was repeatedly extended each year after that. Moreover, additional forms of creditors were included as a result of ECB pressure — e.g. short term debt, subordinate debt, etc. Each time, as the scheme is due to expire, the Irish gov. is trying to untangle itself from the bank debt, and the ECB steps in and says “no”, threatening to withhold short term funding for the Irish banks unless the government caves in and extends the guarantees by another year. ELG alone has been extended 4 times now, 2008, 2008, 2010, and 2011, 2012. I am sure that as Dec 31, 2012 rolls around, another extension will be announced, even though Irish parties lost office and the guarantees are wildly unpopular in Ireland.

The only credible way that Ireland can stop the guarantees is to leave the euro, as each nation requires a functioning payments system, and if the ECB withholds those funds, then the entire payments system collapses. So in order to force these unpopular guarantees, all the ECB needs to do is threaten to withhold liquidity if ever the Irish propose to impose haircuts on bank creditors — something that IMF has criticized them for in the passage I cited.

Now, do your own research. I’ve more than made my case here.

Genauer, I provided lots of data. But everything has to be some black/white moralizing fairy tale of national imprudence with you. And you are completely wrong on all counts — everything from your bizarre view of inflation just around the corner devasting the middle class to some supposed imprudence on the part of ethnicities that you don’t like. I am truly sorry. Go and defend the honor of the “German taxpayer” if you like. Turn everything into a false morality play and blindly ignore the facts.

What that has to do with the ECB forcing the Irish taxpayer to bailout for-profit private sector banks is beyond me.

Oh, here is a nice ABC news story about it:

http://www.abc.net.au/4corners/stories/2012/03/08/3448633.htm

“Basically this is extortion and that’s what it is. It’s extortion. It’s the bullyboys of Europe, you know, the European Central Bank, the financial bullyboys of Europe forcing us to pay a debt that was never ours…”

Of course, we know what really happened. It was the imprudent irish who are irresponsible and threatening to sink the euro, the strength of which is a sign of German national virility.

genauer, speaking ill of the Irish will get you little sympathy in Canada and on this blog, anybody whose family has been here for four generations or more has an Irish ancestor.

The fact is that 1998-2008 Ireland became a net importer of people rather than a net exporter, which it had been for 200 years previously. Millions of Canadians’ families washed up on these shores due to previous hard times in Ireland, mine included.

Leaving the Euro is exactly what Ireland should do. Greece too. The whole thing won’t work and prosperity is not around the corner while it is in use.

@Determinant,

If you think I „spoke ill of the Irish“ and it is not just a fact, then please be specific, where that was.

Otherwise I agree with you, that people who can not or want not live by the Maastricht treaty rules, should leave it (the Euro). I doubt somewhat, whether that really makes them better off, but at least it would be my concern any longer.

@rsj

You “provided lots of data”. Well, yes, just not the relevant.

Your Irish Department of Finance overview page provides lots of links to some official mumbo jumbo:

The unilateral Irish government gargantum 200 % GDP pledge on 1st of October 2008,, as in the guardian link above, shows up as “which provides that the Minister may provide financial support in respect of covered liabilities of any credit institution or subsidiary which the Minister may specify by order”, in

Click to access si4252008.pdf

Which normal person would read this as what was said publicly?

Do you have any specific link there to disprove me on some specific item?

How does this show that any non-Irish was involved in this?

So I am at a total loss, where you believe to have contradicted me in any single case.

Furtheron, you say “ELG alone has been extended 4 times now, 2008, 2008, 2010, and 2011, 2012”, whereas http://www.ntma.ie/ELGScheme/CreditInstitutionsELGScheme.php states:

“The [..] ELG Scheme [..] came into effect on 9 December 2009 and was amended on 29 September 2010”, so again you have a 2 year gap between your claims and the information provided by official sources.

So I am at a total loss, where you believe to have contradicted me in any single case.

You come with some general journalists rant (your ABC link) citing some anonymous,

Ill give you the exact date statements of the official institution NTMA.

Your “But everything has to be some black/white moralizing fairy tale of national imprudence with you.” Please be specific, where you believe this has been the case.

I am not defending nor attacking any’s honor, I just defend my wallet, vigorously : – )

As in the night walking through Harlem or Cuba, I am not afraid.

@genauer,

price stability is not legally or economically well defined. Just because the ECB picked HICP, does not make it appropriate, legal, or sound policy. That’s why the M3 is an important indicator: import prices or banking/velocity shocks can create the false impression of price stability in the face of downwardly rigid wages. The ECB made up a definition for price stability and therefore they can change it.

@genauer,

and by the way, the treaty does not say “no money printing.” In fact, the ECB has printed a lot of money. The treaty only talks about price stability, whatever that means. I say: the ECB should only print enough money to maintain 4.5% nominal income growth, period, by any meas necessary. Thats my definition of price stability.

rsj, genauer

Sorry to turn up late for this debate! This claim that the Irish blanket guarantee of their banks’ liabilities was made under ECB pressure often comes up, so I have looked into it before. On the basis of the public comments made at the time, I believe Genauer is correct to say that the initial Irish bank guarantee of 29th September 2008 ( http://www.finance.gov.ie/viewdoc.asp?DocID=5475 ) was made unilaterally. In fact, it came as an unwelcome surprise to other EU countries, which then felt under pressure to match the Irish move to head off a shift of their own banks’ deposits to Irish banks: http://www.guardian.co.uk/politics/2008/oct/02/alistairdarling.ireland

Welcome RebelEconomist !

And when we look back at the Irish 10 year rates of 5% http://www.bloomberg.com/quote/GIGB10YR:IND/chart (please take the 5 year view!)

Or CDS ridiculously low (well, hindsight is 20/20) as 0.6% http://www.bloomberg.com/quote/CT777651:IND/chart

This came pretty much out of thin air for me at this time.

What were they thinking?

European countries, who did sign up for strict Buba Rules with the ECB defaulting? Unthinkable! Well, in the moment somebody spells out a 200 % GDP guarantee, you are in the first moment speechless, and then you realize, that the guy is either crazy, or doesn’t know what he is doing, or isn’t really serious about what he commits. Whatever it is, as an investor a very strong reason to get away as fast as possible.

When Germany reactivates the Armageddon protection SoFFIn for German banks, to the tune of 15% GDP (450 b / 3 000 b, roughly), this is a very credible statement. 200%, obviously not. As in Iceland.

@dwb,

We had this discussion across 3 blogs about Inflation and targeting, and why the HICP /ECB are alright. You put forward the argument, why Germany might already be vulnerable to blackmail, good links to the BIS, and I believe to gave you back a calculation, why this is not the case, yet.

I extended recently a little bit on the 2.0% target at http://uneasymoney.com/2012/06/11/how-did-we-get-into-a-2-percent-inflation-trap/#comment-6055

(with the link to the original discussions with “dwb”. For the other readers)

You might find that useful. Especially the point that even if NGDP would work in one nation, it does not work in a many nation currency union, because of the tremendous moral hazard.

We also talked about, how the LTROs could be used for some low-national-emotion / rule breaking transfers.

The problem I was not aware of, Spain (cajas) and probably Italy and Germany “local banks” sold a lot of junior debt to their “75% middle class”, whose definition “rsj” doesn’t like.

According to the rules, they would have to stiff them first, and if these people then draw the knife on government, then we can indeed get back to a 1930ties scenario.

But a nice try to get to NGDP targeting via that M3. I appreciate that, technically : – )

And, for the record if no one is reading this post now, the following blog post, and the Irish Times article it refers to, is also relevant to the debate about whether the ECB twisted Ireland’s arm to guarantee bank debt: http://www.irisheconomy.ie/index.php/2012/06/08/mistakesself-interest-versus-european-pressure/