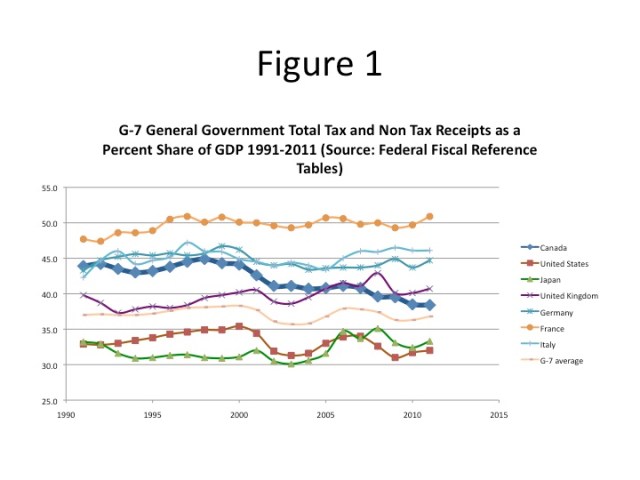

Given that the Finance Minister is presenting the Federal

Fiscal Update today in Fredericton, it is instructive to review some fiscal

comparisons right out of the release of the 2012 Federal Fiscal Reference

Tables (which in turn used the OECD Economic Outlook May 2012 numbers for

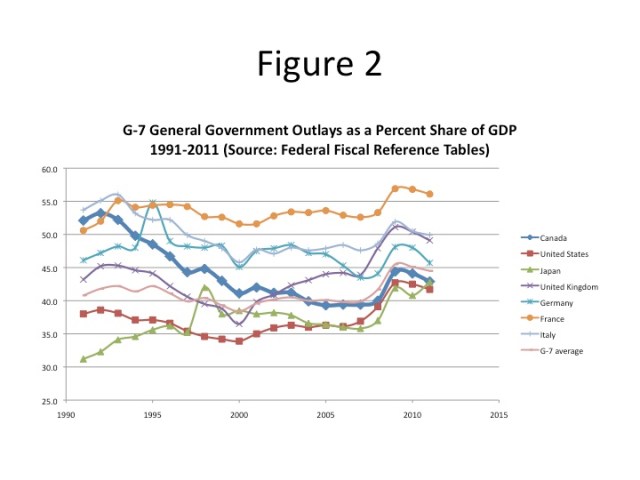

the international comparison). Figure 1 plots the ratio

of total general government receipts to GDP for the period 1991 to 2011 for the

G-7 while Figure 2 plots expenditures as a share of GDP.

The result?

Well, there seems to me to be evidence of Canadian distinctiveness and

exceptionalism at work here. Of

all the G-7 countries, Canada is the only one with a consistent downward trend over

the last twenty years in terms of both its revenue and expenditure shares of

GDP. For Canada, like the rest of

the G-7, the period since 2009 has seen a not unexpected increase in the expenditure share of GDP due to the recession, but the expenditure to GDP

ratio in Canada is now substantially lower than in the 1990s. The same cannot be noted for the rest

of the G-7, which have seen their receipt and expenditure shares fluctuate but

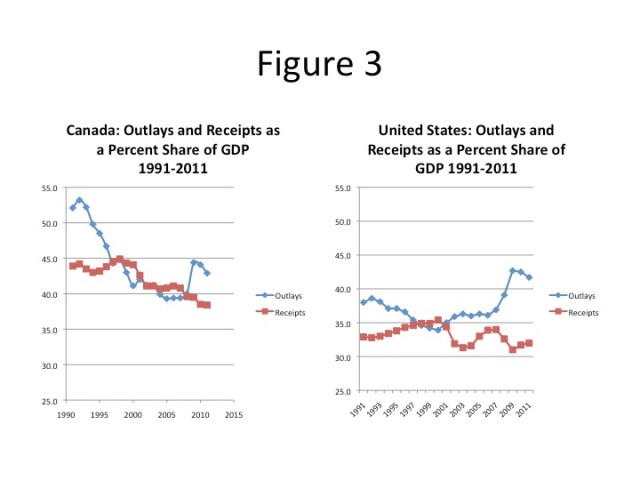

not demonstrate the long-term decline evident in Canada. By way of comparison,

take a look at Figure 3, which plots the expenditure and revenue to GDP shares

for Canada and the United States.

While both Canada and the United States have seen the gap grow since

2009 as a result of the downturn, the United States was seeing a growing gap

prior to this whereas Canada had managed to close the gap. Canada has managed a pretty good grip on its public finances

at the federal level despite its reductions in the GST rate and income taxes. Its expenditure to GDP ratio is now comparable to the United States but its revenue to GDP ratio is higher. If the federal deficit for this year is a

little larger than expected, I don’t think we need to start sounding distress

alarms.

Just a question, something that is not clear from your charts (and I’m not completely familiar with the definitions in the underlying source). Do the data include provincial (in Canada) and state (in the US) tax revenues and expenditures, or is this just for the nation as a whole? (Secondarily, would this make any difference?)

The OECD’s “General government current tax and non-tax receipts” refers to both local and federal direct taxes including social security payments. This isn’t OECD data though.

I’d be a little more concerned about the role of oil revenues for a low-population state.

The Federal Fiscal Reference Tables list the OECD as the data source and it is “general government”.

You know, if you were only looking at those numbers, you’d think that the next Euro-zone country to spook the bond market would be would be France, not Italy. While the latter has reduced spending and increased revenue over the past two decades, the former has seen signficant increases on both counts – and shows no obvious appetite for reducing spending. Obviously there’s more to it than that (although I’d be suprised if France’s GDP growth rates or demographics are sharply different from Italy’s), still…

I think David and Bob have good points.

The main distinquisher of Canada in the G-7 is, that it is the only commodity country, specifically oil &gas. And in contrast to Australia, Norway, New Zealand, Canadian debt / GDP is with 80% very high, after soo many so good years. And with 75% of exports going to just one single customer, the US, Canada is very vulnerable. Be very beware of the commodity curse, the dutch disease !

Cut the price of oil, gas, lumber to the levels of 2005, where would Canada be?

Just two years away from lining up for IMF loans.

@Bob

Italy has introduced a number of significant, long term reforms. France is still in a state of complete denial. I think you are good with the possible role reversal projection.

German FM Schäuble is positive about Italy, Italian FM Grilli presented

http://www.cesifo-group.de/ifoHome/events/seminars/Muenchner-Seminare/Archive/mucsem_20121107_Grilli.htm

his achievements and plans at CESifo Munich / Prof Sinn / Verein für Socialpolitik, positively.

German von der Leyen and her Italian colleaque Elsa Fornero http://www.youtube.com/watch?v=MVRJ18oHsa8 are working on apprenticeship schemes in Italy, possibly cross border, and together with the unions.

Following up a little bit on Elsa, sancta, I run across this:

http://translate.google.de/translate?sl=it&tl=en&js=n&prev=_t&hl=de&ie=UTF-8&layout=2&eotf=1&u=http%3A%2F%2Feconomia.panorama.it%2FMarco-Ventura-Profeta-di-ventura%2Felsa-fornero-choosy-appello-giovani