Canadian

Institute for Health Information numbers show that there is a moderation in

health expenditure growth underway.

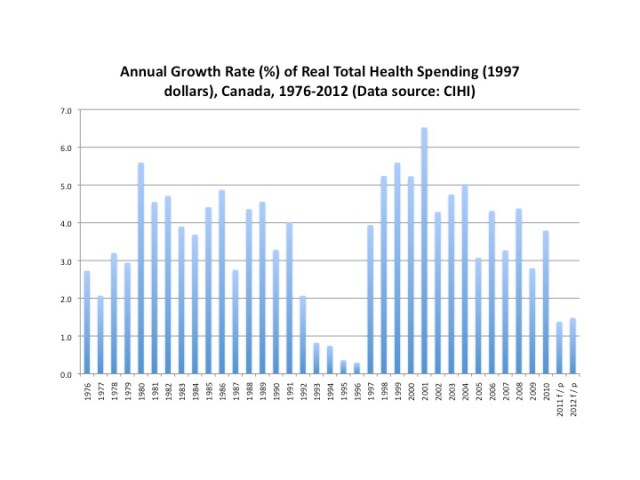

From a growth rate of 6.1 percent in 2010, the CIHI estimates growth in

total nominal health spending of 3.9 percent in 2011 and 3.4 percent in

2012. Over the same period, the

health expenditure to GDP ratio in Canada is estimated to go from 11.9 to 11.6

percent. The growth rate for total

nominal public health spending is going from 5.6 percent in 2010 to 2.0 percent

in 2012. Even private health

spending is being marked by the slowdown with the growth rate going from 7.3

percent in 2010 to 4.6 percent in 2012.

Well,

ultimately economics is a form of story telling as McCloskey’s The Rhetoric of Economics

tells us. So what is the story

here? Well, here are a number of possible explanations:

Story

Number One: The prescription of the Romanow Commission on health care that we

should provide money to buy transformative change has worked. We have invested in new technology and

transformed health care delivery and the result is declining rates of growth

after the initial surge. Indeed,

the accompanying figure shows that the real growth rate has been in decline

over much of the early 21st century. Caveats: The average real growth

rate from 2000 to 2012 was still 3.9 percent (6.6 percent nominally). This was still faster than the growth rate of GDP. As well, prolonged declines in the

growth rate have characterized other time periods. As for transforming health care delivery, while wait times

are down in some procedures, there are still the usual complaints of access to

certain procedures or to physician services.

Story

Number Two: The slowdown is entirely due to the effects of the 2009 recession

and the current economic slowdown.

There is some merit to this explanation as the recession of the 1990s

and the transfer cuts that came with the deficit crisis also resulted in a

spending growth slowdown. The

economic recovery and boom after the mid 1990s is then associated with a

recovery in health expenditure growth rates. Indeed, the extremely high growth rates in health spending

from 1997-2003 – before the transfer increases of the Health Accord – can be

seen as the result of faster economic growth, the fiscal dividend from lower

interest rates and a rebound in spending after the restrictions of the

1990s. Caveats: There were

recessions in the 1970s and 1980s also but spending growth was pretty high then. Those periods were marked by an

expansion of provincial government drug programs and home care. As well, Canada was supposed to have

weathered the recession better than any other major G-7 economy so why the

slowdown in health spending? As

well, interest rates are still low so one might still expect some benefits of a

fiscal dividend despite the higher government debt levels as a result of the

recession. However, a story based on

economic conditions also helps explain why private sector health spending

growth rates have also declined.

Story

Number Three: Most health spending is public (about 70 percent) and quite

sensitive to Federal Transfers. After

all, some of the lowest growth rates are in the 1990s, when the cash portion of

federal provincial transfer payments was cut. Public health care providers are forward looking and have

seen the writing on the wall.

After 2017, federal health transfers will no longer grow at the 6% rate

of the Health Accord but will grow at the rate of growth of GDP with a floor of

3 percent. As a result, provincial

governments are busy restructuring their health systems and embarking on

transformative change in a reverse Romanow mechanism – the prospect of less

money is buying transformative change.

Caveats: Well, this suggests governments are very forward looking indeed. It does not help explain the private

sector spending growth decline.

These

are of course possible explanations.

I’m not sure I have an answer.

There could be elements of all three explanations working as well as

others that I have not thought of.

Perhaps the last couple of years have seen provincial governments start reining in health sector compensation increases and the effect is bearing fruit? Ontario, for example, is planning to limit the increase in its health budget this year to about 2 percent. Given the size of Ontario's health care budget is this slowdown mainly the effect of Ontario on the data? Or it could be the growth spending declines are simply a fortuitious short term pause before spending increases resume at a higher rate though the reason for the recent pause still needs to be explained. I'm sure people in the health ministries are looking for explanations.

Related articles

// <![CDATA[

var sc_project=9080807;

var sc_invisible=1;

var sc_security="4a5335bf";

var scJsHost = (("https:" == document.location.protocol) ?

"https://secure." : "http://www.");

document.write("<sc"+"ript type='text/javascript' src='" +

scJsHost+

"statcounter.com/counter/counter.js'></"+"script>");

// ]]>

The parallel slowdown in US healthcare group has been debated there as well (more in terms of recession vs Obamacare)…I think John Nyman, Victor Fuchs et al attribute that great majority of the slowdown to the recession. Of course it’s different here but I suspect it’s largely the recession as well. There hasn’t been much in terms of transformative change of any kind in Canada. When I was at the recent CAHSPR conference in Vancouver, Cam Donaldson of the NHS was talking about how dismal Canada’s record is at innovation in HC delivery, including the post-Romanow period. Other than regionalization (sort of), there’s really been no serious effort in Canada other than the usual low-value hype about electronic medical records.

How much of this is driven by pullback from the big spenders (ON, AB, BC) who had the most rapid increases in spending prior to and during the recession? I agree on the escalator cutback though, and think it’s also a broader signal for provinces to have low expectations.

The growth rate seems to spike then gradually slow down in the early 90s as well, in line with the last severe recession.

I’m inclined not to believe any story that doesn’t explain why the slowdown would be coincident across both the US and canada. In fact, the slowdown is common to most OECD countries. While unlikely, that doesn’t rule out the possibility that a policy change in the US–a giant economy and major exporter of medical sciences–caused a global cost slowdown. But it basically rules out any possibility of being due to Canadian policy.