The pressure to cut taxes comes from those who pay relatively more in taxes, and benefit relatively less from government spending.

Men, on average, earn more than women. Hence they pay more taxes than women do:

Men account for about half of those filing tax returns in Canada, but 59 percent of taxable income is earned by men. Because the income tax system is progressive, higher income earners pay a relatively higher percentage of their income in tax. That's why two-thirds of federal and provincial income tax revenues are collected from men.

The pressure for income tax cuts comes primarily from men, because men pay more, on average, in income taxes than women do.

Not all taxes have the same kind of gender split as the income tax. Men actually pay less in employment insurance premiums, relative to their income, than women do. That's because employment insurance premiums are regressive – they max out at a certain income level, so they are a lower percentage of income for high income individuals, and men make up the bulk of Canada's high earners. Also, EI premiums are only paid by employees, and more of men's incomes comes in the form of business and professional income.

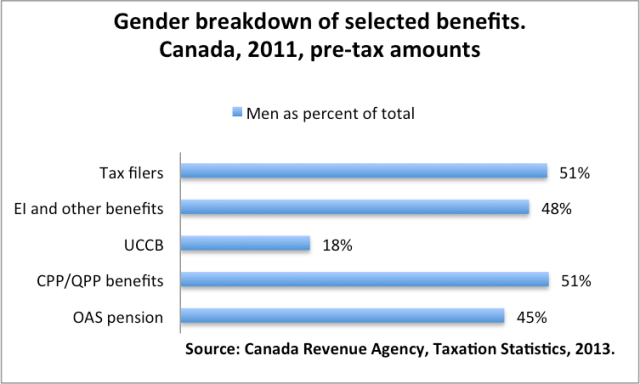

Men might be willing to pay higher taxes than women if they felt disproportionately advantaged by government spending. Some types of government spending, like infrastructure or military spending, create jobs in male-dominated industries. Yet the bulk of government spending goes to health care, education, and support for people in need. Drawing again from Canada's taxation statistics, which summarizes the information reported on people's tax returns – and thus represents pre-tax amounts of benefits –

Women live longer than men, hence collect their Old Age Security pension (OAS) for longer than men do. The Universal Child Care Benefit is usually paid to women. Maternity and parental leave, combined with women's greater risk of poverty, mean EI and other (anti-poverty, income support) benefits go slightly more to women than to men.

A salaried employee with a stay-at-home spouse earning $150,000 or $200,000 a year pays a good percentage of his income in tax, but he is unlikely to benefit disproportionately from government spending. I use "his" and "he" advisedly – the majority of people fitting this description are men. That's the gender politics of taxation, the gender politics of support for income splitting, and the source of serious tension between the federal and provincial governments.

The federal government is seriously contemplating allowing families with children to split their incomes. This would cost billions in tax revenue, and no serious economist argues that it would have benefits in terms of economic efficiency, or do anything to reduce poverty or overall income inequality (although some argue income splitting is fair). The federal government can afford to give away this kind of tax revenue because it has unlimited taxation powers, and limited spending responsibilities. Provincial governments pay for health care and support for the poor and vulnerable - the spending areas that are set to grow in a serious way with population aging. Yet the provinces have a limited revenue raising capacity, because their tax base is relatively more mobile – see, e.g. Kevin Milligan and Michael Smart's work.

That we as a nation can contemplate the kind of tax cuts that income splitting would involve when the national finances – taking provincial and federal governments together – are in such precarious shape, boggles the mind.

But that's the gender politics of taxation.

Good post. Proves what I’ve been saying all along.

On a quick skim, I didn’t see the connection between gender and income-splitting. Then I re-read it more slowly, and this bit caught my eye:

“A salaried employee with a stay-at-home spouse earning $150,000 or $200,000 a year pays a good percentage of his income in tax, but is unlikely to benefit disproportionately from government spending. That’s the gender politics of taxation, the gender politics of support for income splitting,…”

I think I agree, but I think you maybe need to spell it out a bit more explicitly. Because at first glance, you could say there is no gender angle to income-splitting; it’s a couples vs singles issue.

I always wonder why, if it is “fair” to allow income splitting, it wouldn’t also be “fair” to allow double income working families to deduct the cost of home production (ie, cleaning, cooking, repairs, gardening).

If the argument is that there is some fairness to income splitting, it is ignoring the benefit to the household that comes from the non-working spouse doing that home production. Following on the gender angle, it also flows from the fact that women’s work tends to not be counted as part of a market, thus is not given a dollar value, and is outside of the tax system.

There is a limited deduction for child care expenses (the cap of around $7,000 is not adequate if you live in a city where daycare costs $1,700/month like in Toronto).

I have never heard of the value of home production being like an extra part of income being discussed as part of this debate.

Great post. Especially on tension between provinces and feds. And it’s not just couples v. singles, as most couples have two income earners.

By the way, does the UCCB being paid disproportionately to women come from where the cheque goes, or who claims it on their tax returns? I might assume, given the income data, that it is still more likely to go to a woman, but maybe not at such high rates?

My wife’s name is on the cheque, but she earns more than me, so I think that I claim it on my tax return. I think the mother’s name on the cheque is the default, and like in my case, even where from a tax perspective it makes more sense for the other parent to receive it, the name on the cheque doesn’t matter for who claims it.

Nick – thanks. I’ve added a sentence to bring out the gender angle.

Whitfit – the Krzepkowski and Mintz piece linked to above http://policyschool.ucalgary.ca/sites/default/files/research/krzepkowski-mintz-income-splitting.pdfdoes discuss the non-taxation of household production, but the value that they place on household production is derisory – it works out to say $30 or $40 a day.

Whitfit – from who claims it on their tax returns, which has to be the lower income spouse. So, yes, you’re right – this probably overstates the amount of UCCB going to men.

Angella – thanks. Also divorced parents, blended families – the world is so endlessly and delightfully complicated…

Thanks for this post, Frances. I probably don’t follow demographics as closely as I should, but I would like someone to answer a couple of questions if that’s okay? 1) Are fewer people getting married today than in the past (ie. what is the trend?); and 2) Out of those couples that are getting married, are there more couples without children in the past? If both of these are true, I have to wonder if there is going to be a tipping point where our politics will begin to truly “choose sides” between singles, couples, and those adults raising children. Maybe it already has taken place, and it’s simply hiding in plain sight.

From a purely self-interested point of view, I agree that income splitting stinks. A married couples with kids where both adults work won’t benefit at all. And as an until recently stay-at-home Dad whose wife didn’t earn anything like $150K-200K, splitting would have helped a bit, but not enough to make staying at home any longer than I did look viable. Once the kids hit a certain age, the parental guilt vs. income trade-off tips towards additional income, so it’s off to daycare with them.

And if income splitting reduces tax revenue so much that it starts to cut into gov’t services we like – probably indirectly by cutting transfers to the province and local gov’t who do stuff like health care, parks, pools etc – then I’ll be really annoyed.

Nothing mind-boggling about it. Long overdue (45 years actually).

Pensioners have been able to split since ’07. Where was the concern from economists about that? Virtually every business owner and self-employed person finds a way to pay a spouse as “office manager”. Again, no concern. Single parents received a free $2,000 for a non-existent spouse to help equalize their tax burden vis-a-vis 2-parent families. This is viewed as good policy. Net family income is used to determine eligibility for tax-delivered benefits and tuition loan eligibility. Apparently, using net family income to restrict benefits is perfectly equitable.

Seems the ONLY group that doesn’t receive any special tax consideration are the stay-at-homes…and SOMEBODY has to look after those kids.

It’s hard to argue that income-splitting must be opposed because of the cost. Again, NO ONE talked about the cost of pension splitting. If you ask me, it really has more to do with making sure that daycare remain the only choice supported by our tax system…even if it means chopping 50% off the daycare costs for two married doctors grossing $500K of family income. Can someone show me where the media got its knickers in a knot over THIS kind of tax break?

@Nick: You’ve never heard of the value of home production being considered as income because no country on the planet has a way to attach a dollar value to it or force one family member to pay another to work in the home.

I’ve always wondered about the argument that single income earners have the benefit of home production. After all, think about your various familial/home obligations, cleaning, cooking, what have you, those get done in two-income families just as they do in one income families. There might be different qualities of home production, to be sure, and true, a two-income family may be more inclined to contract out SOME of that work (by hiring an cleaner or ordering dinner), but I suspect the difference in value of home production might not be that significant. It’s one thing to dismiss the value assigned to home production by Mintz as derisory, but what is the price that Canadians would be willing to pay for home production? Are there many Canadian families who would pay $14,600 a year (%40*365) to have someone else do all their housework, even assuming they could find people willing to work for that?

The real benefit of the single-income family isn’t increased home production, it’s increased leisure time. The two-income family may spend 80 hours a week in paid work, and 20 hours doing home work, while the one income family might spend 40 hours doing paid work and 40 hours doing home work. It’s not the home production that drives the welfare difference, its the extra 20 hours of free time a week. It means you can spend the weekend playing with the kids or going to the film festival (or whatever floats your boat) because the neccesary tasks of home production (cleaning, shopping, etc.) can be done while the other spouse is working . Now one can certainly make the case that we should tax leisure time, which would justify a higher tax burden on a single income family then a two income family, but since we don’t tax leisure in other contexts (i.e., the guy who makes $40K a year working an 8 hour day pays the same amount of taxes as the woman who makes the same amount pulling double shifts), so it’s not entirely clear why we make the distinction here.

There’s also the added complexity that the distinction between home “work” and leisure can be unclear. I spend my weekend cooking, because I find it enjoyable and relaxing, is that “work” or “leisure”? Sure, few people derive pleasure from doing laundry or mopping the floor (although I suppose the world is filled with sick freaks). As I say, I’m fairly agnostic on the subject of income splitting, but it’s not clear that the fairness arguments one way are decisively better than the other.

Is it really correct to measure the benefit of a tax reduction by reduction of tax by the person who paid it? Surely the incidence of the tax change is what’s relevant, particularly where we’re discussing the taxation of families. I think its fair to say, for example, that you taxed me at a rate of 100% the impact of that tax increase would be borne to a large degree by my wife and kids. I don’t know if there’s a workable dataset, but I’d be curious to see the impact of different tax changes on individual consumption patterns.

To the gender politics point, I assume your numbers above are for income taxes, I wonder if you get a different result for consumption taxes such as GST/HST? I’d wager that the pattern of people who spends family income (i.e., the stay-at-home mom (or dad, but let’s make it easy) may have no income of her own, but may be in charge of buying groceries, clothes, paying bills etc.) is very different from the pattern of people who earn it. Do we see different gender patterns in support for, say, income taxes (where the tax is seen to be “paid” by the person who earns incomes) vs. consumption taxes (where the tax is seen to be “paid” by the person who buys goods and services)? This might explain why political parties whose voting base tends to skew towards woman (i.e,. the NDP) often support some targetted GST/HST cut (e.g. eliminating the HST on home heating fuel, a proposal that makes no policy sense, but which is likely to appeal to the family member who sits down at the end of the month and pays the bills – often a woman).

I do have to say, relating to the earlier incidence point, some of the literature discussing the gender split on tax cuts or tax benefits strikes me as, at best, awfully simplistic. For example, you see discussions around the claim (which is made repeatedly) that RRSP deductibility overwelmingly benefit men. At a very simplistic level, that’s true, they generally make more contributions and claim larger deductions, but looking at the broader picture its hard to take that claim all that seriously.

Consider a few simple examples. If I made a contribution to a spousal RRSP, does that result in a tax benefit to me? Sure, it reduces my tax bill, but presumably, in the absence of a deduction, the incidence of income tax would be largely borne by my wife through a reduced RRSP contribution. If the deductibility of spousal RRSP contributions encourages higher savings in the name of lower-income spouses, is it a benefit to husbands or wives? Hard to say with a straight face that the answer isn’t both. Following the same reasoning, the ability to roll-over RRSPs on a tax-free basis to spouses on death would be characterized as a benefit to men (since they generally die younger, and it reduces their tax burden on death), but a cost to woman (since they’ll ultimately pay the tax on RRSP withdrawals), but I doubt anyone would sensibly characterize a provision which generally increases the wealth of elderly widows as something that benefits men at the expense of woman. At a basic level, the discussion focuses on statutory liability (presumably because that’s the data that’s readily available), not incidence, when presumably it’s the latter that matters.

Well, doh, child care = home production. Ok, including child care people would (and do) spend more than $15K a year. I stand by my earlier comment re: home production excluding child care.

Bob Smith says:

“Are there many Canadian families who would pay $14,600 a year (%40*365) to have someone else do all their housework, even assuming they could find people willing to work for that?”

Considering that the benefits of the income splitting largely go to wealthier families, I would say that there are a lot of double earning households in higher income brackets who would, if they could deduct if from their income for tax purposes. My family, for instance (which we would pay for someone to do our home production even if it did not include daycare) would buy more home services such as cleaning, cooking and maintenance if we could deduct the costs for taxes. We can’t, though.

And: “The real benefit of the single-income family isn’t increased home production, it’s increased leisure time. … It’s not the home production that drives the welfare difference, its the extra 20 hours of free time a week. … Now one can certainly make the case that we should tax leisure time, which would justify a higher tax burden on a single income family then a two income family, but since we don’t tax leisure in other contexts (i.e., the guy who makes $40K a year working an 8 hour day pays the same amount of taxes as the woman who makes the same amount pulling double shifts), so it’s not entirely clear why we make the distinction here.”

You could say the same thing about any form of income – that it can buy you more leisure. That leisure time is a big benefit. My point is, you can buy yourself that leisure time as a dual income family, but you still pay tax on the dollars you use to do that, but an equivalent earning single earner family, if they can split the income, get the leisure time, and also get a tax benefit. You can’t say “we can’t quantify leisure income, and this is too much like social engineering to try to count it” at the same time as arguing that we should do some social engineering to give a benefit to single income families with young children. The tax code promotes certain values, takes into account what matters to people and does other things not directly related to just taxing straight up income. Spending some billions of dollars to improve the welfare of middle and upper middle class, as well as wealthy single earning families is a policy choice that needs to take into account a lot of things, and subsidizing that set of families’ leisure time is a legitimate discussion point.

Bob – Yup, it’s the child care. Especially between 0 and about 2. Day care for kids in that age is not easy to find, and when it is available it’s expensive.

I did full time home production for a couple of years. Your time calculation is all wrong. My observation is that the trade-offs aren’t that simplistic. Now that I’m not at home, there is simply less home production. In some cases, we now buy what I used to produce (esp. food). In other cases we simply do without (esp. cleaning). In some cases, we do things sub-optimally because they are easier (e.g. we buy chicken breasts instead of a whole chicken ’cause I no longer have time to plan to use the whole bird, make stock, etc..). So it’s not a simple shifting around of hours or resources.

Also ask yourself: assuming there is some increased leisure time, it’s leisure time for whom? Not the person doing the work at home! I’d say the benefits of home production accrue to the children, and to the spouse working outside the home who is spared doing the school run, daycare drop-offs/pick-ups, shopping, cooking, cleaning, etc …

@whitfit: It’s not just a dual vs single-income family issue. My wife works 20 hours per week and makes only a fraction of what I earn. Still, our tax bill can be as high as $7,000/yr more than a family next door who has the same combined income, but split evenly between each spouse.

If the difference were only $700/year, it wouldn’t be as much of an issue, but $7,000 is a significant amount of money. In fact, our neighbours could lease a very nice BMW or Audi for that difference.

Considering that our two families would qualify for identical CCTB, UCCB and tuition loans because the NEED is the same, how can you justify a $7,000 difference in tax liability?

I’d just add that in my case, household income is nowhere near even the upper-middle class level. Even with income splitting, it wouldn’t make-up for the income lost by staying at home, and inevitably, the benefits to home production diminish as kids age and returning to full time work becomes the better choice.

So again from a purely selfish perspective, income splitting is irrelevant. It isn’t a big enough incentive given the household income. If Canada wants policies to encourage people to stay home and look after their young kids, give them money to do it.

@Patrick I don’t think the goal is to encourage people to stay home…although this may happen to some degree. I think you are correct that is not FAIR to subsidize only families who choose the daycare option, but can you imagine the outcry if those families with a stay-at-home spouse received an actual monthly cheque from the government?

It is much easier to make the case for equitable tax treatment of all families with the same aggregate income, just as they receive exactly the same benefit payments and tuition loans, based on their net family income. Much harder to oppose this, given all the ways that currently exist to split pensions, business income, self-employed income, plus the fact that single parents receive a free $2,000 for a non-existent spouse to help equalize their tax liability vis-a-vis 2-parent families.

Taxrage: Yeah, I know. I don’t really have a policy recommendation nor am I judging people’s choices. Just adding my own selfish perspective: in my circumstances, income splitting would have been irrelevant. I suspect it’s true for other in a similar position weighing the trade-offs between having someone stay home vs. working.

Patrick: “Bob – Yup, it’s the child care. Especially between 0 and about 2. Day care for kids in that age is not easy to find, and when it is available it’s expensive.”

Agreed, though it tails off as they get older.

In any event, whatever the theoretical merits of income splitting, politically I think it’s a loser. If they run on anything like the proposal they’ve previously made, they might as well hand-over the keys to 24 Sussex.

But the Tories have a past practice of scaling down high profile (if ill-conceived) tax proposals into much more limited, but politically much more effective, policies (think of their 2006 proposal to provide for tax-free rollovers on sales of Canadian securities where the proceeds were reinvested, which morphed into TFSAs when the original proposal was determined to be unworkable). If I had to guess, they’ll do the same thing with income splitting by allowing income splitting for families with very young children (0 to 2, or 0 to 4) or some substantively similar proposal (maybe a refundable small children tax credit at the top federal rate, which would have the merit of provding funds to single parents and the poor who actually need it). It would probably be wildly popular with young families, while giving them something that they can sell to the base.

“In any event, whatever the theoretical merits of income splitting, politically I think it’s a loser. If they run on anything like the proposal they’ve previously made, they might as well hand-over the keys to 24 Sussex.”

On the one hand, you think it’s ill-conceived, then in the next breath you think they’ll allow income splitting for families with very young children. You’re not disagreeing with the policy, only the age cut-off.

Politically, I view this as a winner. It will energize the CPC base and get the vote out, which is what they will need to defeat JT.

Taxrage,

THe problem with income splitting (at least as proposed heretore) as a policy is that (i) it is very expensive in terms of foregone revenue, (ii) only reduces tax for a small portion of the population (10-15%, (iii) amongst those who are effected, the impact is tiny (i.e., a few hundred bucks), and (iv) a significant portion of any tax benefits accrue to a handfull of relatively well-off people. Notably the consensus on these conclusions is pretty broad, including work from think tanks as diverse as the Broadbent institute on the left and the CD Howe Institute on the right.

I don’t know about you, but a tax policy that reduces taxes for only a small chunk of the population (10-15%), and only by small amounts for most of that group is never going to be a political winner. That a significant chunk of the benefit accrues to a handful of households who are relatively well-off, doesn’t help much. I can think of much of politically effective ways of spending a few billion dollars.

As for my suggested alternatives, the political implications of the first one is much more palatable. First, it’s going to be far less expensive, since fewer families will be able to claim it for fewer years. Secondly, the reality is that even two-income families, a parent (typically mothers, but increasingly fathers) takes time off to spend time with the child anyhow. So targetting income splitting at those early years is going to get much more broadly spread bang for your buck than allowing families with a 16 year old to split income. Finally, it seems to me to more important to have a parent at home during early years then when kids are teenagers. Of course, the real merit of that approach is that it allows the Tories to say they’ve implemented income splitting, even if a very limited form. I’d prefer the second approach, of just giving families refundable tax credits, which I think would be very popular (witness the success of the “beer and popcorn” money in the 2006 election).

As for energizing the base, it might energize the 5-10% of the population who might see some material benefit (not all of whom are conservative supporters). It’s not as if the base are going to throw their support to Justin Trudeau if they don’t get what they want – if the Tories toss them a face saving bone, they’ll take it, and saddle up to fight off the red menace.

Taxrage,

Just to emphasize the political point, which of the following policies do you think is most likely to engage the public:

(i) The government’s income splitting proposal, where 80-85% of households (including the poorest and most vulnerable in single parent families) get nothing, and most of the rest get $500 or less, while most of the money ends up in the pockets of families making $125k or more.

(2) A proposal where the parents of each of Canada’s 1.8 million children aged 4 and under get a refundable tax credit worth $1600 per kid (call it a “Head Start Early Childhood Tax Credit”).

(3) A proposal were the parents of each of Canada’s 5.6 million children receive a refundable tax credit worth $500 per kid (call it a “Healthy Childhood Tax Credit”).

Now each of those proposals will cost roughly $3B, but I’d sure as hell campaign on the latter two. Apart from arguably being better policies (since the children of poor and single parent families benefit), they’re much more tractable for Joe Q. Voter. Ask Joe Q. Voter what income splitting is worth to him, he probably couldn’t tell you. I’m a tax lawyer and I couldn’t tell you. Ask him what a $1600 or $500 tax credit is worth, he’ll tell you. And I’m pretty sure the Liberals would rather campaign against the first one policy, rather than the last two.

Bob,

I think providing a benefit until age 4 is too small a window, plus it does not address the problem of two families with the same income paying wildly different amounts of tax. Comparing 2 families with a $100K aggregate income, you’re proposing giving the (2-earner) family that already enjoys an $8K-$10K lower tax bill, a few thousand more for 2 kids under-4.

If pensioners are going to continue to have unlimited ability to split income, and net family income is going to continue to be used as the basis for tax-delivered benefits and tuition loan eligibility, your proposal doesn’t address what I see as the root problem, namely, that the family should be the unit of taxation, at least while there are minor dependent children.

I might answer differently if we didn’t have pension splitting, and if virtually every self-employed and business person didn’t pay a spouse as “office manager”, and if we didn’t provide a $2,000 tax equalization payment to single parent households, and if we didn’t use net household income to determine tuition loan eligibility (did I miss anything?), but this is the current reality.

I might go for a significant deduction for each minor dependent child that either spouse would be allowed to claim, but this would be viewed as incompatible with the other child-related credits currently in our system.

Nope, the more I think about it, the more I want to see another simple 1-liner on Schedule 1 to transfer income from Spouse A to Spouse B. Alternatively, keep the existing line and make it dual-purpose: pension or income transfer…but this might require a $50K limit to be placed on pension splitting, which I think would be quite palatable to voters.

Taxrage,

My proposal doesn’t intend to address the issues you address, it intends to address the issue of getting the government of the day re-elected. I never suggested that your concerns weren’t valid, I merely said that it wasn’t an issue with meaningful political traction. That becomes obvious when set against plausible alternative policies.

While the issues you identify are all fair policy considerations (though I think you overstate the frequency of the “spousal” office manager mechanism for income splitting. You can only pay your spouse if he or she does actual work in the business and the CRA is obnoxiously aggressive on the point), they’re not issues that have much resonance with the voting public. When it comes to the question of whether families or individuals are the appropriate unit of taxation, there isn’t a theoretical “right” answer, reasoned arguments can be made both ways depending on how you weight various normative considerations (and Frances et al make the case for individual taxation). The fact that our tax system, in practice, represents a hodgepodge of those approaches reflects that reality (the case for income splitting with pensions, for example, is particularly compelling since the various counter-arguments re: home production are not relevant).

But none of that is particularly relevant to the political sphere. There the question typically comes down to “what’s in it for me”, and if all you can offer up is a policy that answers, for most people, “nothing”, that’s a problem.

“though I think you overstate the frequency of the “spousal” office manager mechanism for income splitting. You can only pay your spouse if he or she does actual work in the business and the CRA is obnoxiously aggressive on the point”

Gotta disagree with you. I once got into an online discussion with a tax lawyer, who admitted that pretty much ALL his clients do it. Have you ever seen a small business owner not pay his/her spouse? I also know small business owners and self-employed persons (dentists, doctors) who do this. In one case the spouse has absolutely no role in the business, but is an employee.

My gut feel is that most voters don’t understand either pension or income splitting, but a lot of the CPC base does, and may come out to vote in droves if it’s on the table.

In the end, the decision will be driven in large part by politics. If Harper believes it will ensure victory in 2015, we will have income splitting.

Bob,

BTW, can you imagine the shock and indignation among business owners and self-employed when they see the rest of us splitting income??? 🙂

Taxrage, I do believe Bob is a lawyer, and possibly a tax lawyer.

Writing from a Portuguese point of view (where the rule is married couples having a joint taxa declaration, what I suppose that is the same thing as “your” income splitting), I think that is a good argument to that:

Imagine couple A, where one partner earns 1500 and the other earns 500; and imagine couple B, where both partners earn 1000. The two couples have exactly the same income and probably the same welfare level. Then, makes sense that both couples will pay the same taxes, instead of couple A paying more than couple B (what is what happen – in a progressive tax system – when each person pays taxes only by his/her income, instead of income being calculated at family-level)

Miguel: ” The two couples have exactly the same income and probably the same welfare level.”

This argument gets made all the time – two people earning $50,000 each rather than one person earning $100,000 and one person staying at home.

The welfare level is not the same. Based on what we know about hours worked, the two people earning $50,000 each are working far more hours in total than the one person earning $100,000.

Imagine saying to a couple with an at-home spouse “here, I’ve got this great deal for you, I’ll cut Breadwinner’s salary in half, and At-home can take a full-time job to make up for the difference in salary.” I sure as heck wouldn’t take that deal. Having an at-home spouse is totally awesome.

This is the point that people don’t get: that at-home spouses do valuable work is precisely why income splitting is a bad idea.

Yes, an at-home spouse provides advantages. In BC right now, I expect a LOT of at-home spouses have a pile of their 2-earner neighbour’s kids under their watch. In ON, if you visit your local elementary school, don’t be surprised to find a lot of at-home spouses volunteering to provide assistance with reading for kids that are having difficulty keeping up with their classmates…when they’re not off in their SUVs getting their nails done or playing tennis, I mean.

People are too quick to judge the $100K family as either a well-off 1-earner or a 2-earner family working twice as many hours @ $50K/year each. Everyone seems to forget the $75K+$25K or $85K+$15K families, who also have both spouses out working…and paying a lot more taxes than the $50K+$50K families. The working twice as many hours argument falls apart the minute the 2nd spouse enters the workforce. My wife and I both work, so why should our tax liability be $8K more than our neighbours, who also both work, but just happen to have a more optimal split in their incomes? Yet, the government views both families as having identical need for tax-delivered benefit payments and tuition loan assistance. The neighbours can do a LOT with that extra $8,000. Someone please explain to me why this is fair.

Meanwhile, that 50-something high-profile general that just retired who is considering running as a Liberal MP can split his $150K pension with his spouse and save $15K-$20K in taxes. No outrage over that. Quite a different story, though, if we talk about allowing a $60K bus driver split his income with his stay-at-home wife and possibly save $2,000.

The reason people don’t get</> that domestic work should be taxed is because no country on the planet: a) attaches a monetary value to it and b) taxes it. Ditto for my snow shovelling, taking out the trash, doing laundry, cutting the grass etc.

What people do understand is that some families pay wildly different amounts of tax on identical household income, while retirees and others have tools to equalize family tax liability. Time to end this inequity.

Intersting to talk about income-splitting when nobody remember that a couple can have only one pricipel residence while two unmarried people can have two…

An italics tag is leaking. this is an attempt to fix it.

Please delete this comment

after

the tag is fixed

in the upthread comment.

Great post. Two small points.

On EI, granted on the employee side it’s regressive, but what about the cost on the employer side?

On benefits, I’d suspect that men benefit a good bit less from employment by the federal government as well.

If Harper believes it will ensure victory in 2015, we will have income splitting.”

I agree, which is why we won’t see income splitting. And the polling backs me up on tihs. Earlier this year, Abacus did a poll asking about income splitting. The headline number was that it was widly popular, with 57% supporting it. But, when contrasted with other ways of spending $2.7B, its popularity fell. From the Abacus press release (http://abacusinsider.com/politics-public-affairs/opinion-soft-split-income-splitting/):

“Given a choice of three alternative ways of using the estimated $2.7 billion price tag for income splitting, only 23% prefer income splitting, 35% would rather see the money spent on priority programs and 41% would rather see the money used to pay down federal debt.

Among Conservative Party voters, twice as many would prefer to see debt paid down (50%) as would choose to go ahead with the income splitting tax change (26%). Liberal (17%) and NDP (21%) supporters show less interest in income splitting: both are more likely to select spending or debt reduction. Among parents with children under 15, 32% would choose income splitting, 35% spending on priorities, and 34% debt reduction.”

Even among Conservative voters, income splitting isn’t a top priority. And note, that’s set against fairly generic and uninteresting policies, I have to think that the Liberals and NDP (and the Tories) can come up with more interesting ways to use $2.7B.

Bruce Anderson, who’s a fairly astute observer of Canadian (and Conservative) politics, I think nailed the analysis:

“Although income splitting was a central tenant of the Conservative Party’s 2011 election platform, our data suggests the proposal is not an immediate winner with most Canadians or even a majority of those who voted Conservative 2011.”

Patrick is right, I am a tax lawyer. The self-employed commonly hire spouses (as employees) to work for them, and for income splitting to be effective, the spouses do actually have to work for them, and they had better be able to support the reasonableness of the work done for what they were paid, otherwise the deduction will be denied (but the income still taxed in the hands of the spouse). It’s not the case that you can just transfer money to your spouse, they have to work for it. As I say, the CRA is very aggresive on the point, although I’m sure people play games with those rules. Of course, I wouldn’t characterize that as income splitting in the same manner as you do, the spouse is actually employed, they’re a two income family.

@Taxrage:

I wrote a long response to taxrage, but I’m not sure there’s value in engaging with that. Clearly if you’re enraged, then reasoned argument probably isn’t going to do much.

But I would like to address the question of gender politics. Would the spouses of the high earners that benefit from income-splitting not benefit just as much as their (mostly) husbands? Likewise, men like myself who earn pretty good incomes, but also married women who also earn pretty good incomes, aren’t exactly clamouring for this sort of policy change.

It seems much more like class politics than gender politics to me.

I do want to add that Bob Smith undervalues home production. If I could get all housework and childcare done for $14,600/year, I would jump at the opportunity. As it is, once we add daycare into the mix next year, we’ll already be contracting out around that amount (even after factoring in the childcare tax deduction, which returns about 1/5 of the daycare cost), and I’ll still have to mow the lawn and clean the house.

Neil –

“Would the spouses of the high earners that benefit from income-splitting not benefit just as much as their (mostly) husbands? Likewise, men like myself who earn pretty good incomes, but also married women who also earn pretty good incomes, aren’t exactly clamouring for this sort of policy change.”

Good question. My parents (who are retired) have benefited a lot from the ability to split their income and, yes, both my mother and my father see it as something that has benefited them personally. So there is some truth in what you say.

Yet – at the risk of committing sociology – our culture assigns certain responsibilities to mothers, and certain responsibilities to fathers. Among the more socially conservative base – remember these are the ones who are pushing for income splitting – there is a sense that good dads work hard and provide their families with financial security. This is why it’s the support for income splitting is gendered – it’s brutal for a father to feel that his kids can’t play hockey because he isn’t able to pay for it.

Jim “On EI, granted on the employee side it’s regressive, but what about the cost on the employer side?”

For min wage jobs, I would say progressive, for jobs above the minimum wage, it depends upon incidence assumptions.

@Majromax, I just don’t think Taxdove works as well as a moniker. 🙂

It goes without saying that two high-income earners wouldn’t be pushing for income-splitting. They already benefit from it by virtue of their income distribution.

@Majromax, no, the tax differential I quoted does not account for payroll taxes, but one is insurance (EI) and the other a pension (CPP).

There are many facets to this issue. What is really needed is tax reform, vs more barnacles. We dance around taxing individuals, doling out benefits to families, allowing pensioners unlimited pension splitting while denying a bus driver the ability to split $1 of income for an at-home spouse.

I see income-splitting as finally putting Canada on track to meaningful tax reform, recognizing the family as the unit of taxation. We don’t seem to have a problem creating something like a trust to defer/minimize taxes on millions of dollars of family wealth, but for some reason the idea of families with the same income paying the same taxes is somehow unjust. Go figure.

“This is why it’s the support for income splitting is gendered – it’s brutal for a father to feel that his kids can’t play hockey because he isn’t able to pay for it.”

But the mother in the same family wouldn’t support the proposal with equal intensity for the same reason? Not sure I buy that reasoning. Indeed, I know a number of families (not particularly socially conservative) where the wives are keen supporters of income splitting because it would allow them to stop working and spend more time with their families. In that case, the benefit of income-splitting arguably accrues to the wife.

Frankly, from a personal perspective, I should oppose the idea because it would makes my wife’s case for becoming a stay-at-home mom (and giving up her cushy public pension) that much easier. I couldn’t handle the stress of being a sole income-earner.

“but for some reason the idea of families with the same income paying the same taxes is somehow unjust”

But if the argument is that we should “treat equals equally”, the point that Frances and others is making is that a one-income family with a given income is generally better off than a two-income family with the same income (whether because they have the value of home consumption, or additional leisure, or what have you). They aren’t (generally) similarly situated. It’s hard to seriously dispute that point. You can quibble over the magnitude of that benefit in dollar terms, or point out that the additional tax liability might bear little or no relation to the value of that home consumption or additional leisure (i.e., two people working part time pay less tax than one person working full time for the same family income, even though the aggregate value of family home consuption and leisure may be the same), but the validity of the point is indisputable.

In any event, the mere fact that two families have identical income doesn’t mean that they pay (or should pay) the same taxes, for a host of reasons. For example, a family with a disabled child will pay less tax than an otherwise identical family with a non-disabled child (owing to the disability tax credit or the medical expense tax credit). Is that unfair, or is that a recognition that income is only one axis of equality, but that there are other factors that matter? Is it unfair that a person with children will pay less tax than a person with no children for a given income? A person who earns $20K working a McDonalds will pay less in income tax tax than a person who earns $20K in interest (owing to various credits for employment income). Is that unfair? The flipside of treating equals equally is that you treat unequals unequally.

In any event, the tax system will always have various imperfections or absurdities in it. It’s an axiom of tax policy that three are three attributes of a perfect tax system, fairness, efficiency and revenue collection. You can have any two of those attributes (or varying degrees of all three), but you can’t have everything.

Miguel: ” The two couples have exactly the same income and probably the same welfare level.”

Frances Wolley: This argument gets made all the time – two people earning $50,000 each rather than one person earning $100,000 and one person staying at home.

But my example was not “one person earning $100,000 and one person staying at home”, was “”one person earning $150,000 and one person earning $50,000”; in this example (not one “breadwinner” + one stay-at-home person but one high-wage person + one low-wage person; at least in Portugal the second case is common, while the first case is almost extinct), I think the “hours of work” point does not apply

Note that I am a foreigner that does not know exactly what “income splitting” mean – I am assuming that is calculate the taxes as if the total income of the couple was divided equally by the two partners; it is that, or it is something that only applies to couples with only one have a job?

“In any event, the tax system will always have various imperfections or absurdities in it. It’s an axiom of tax policy that three are three attributes of a perfect tax system, fairness, efficiency and revenue collection. You can have any two of those attributes (or varying degrees of all three), but you can’t have everything.

On this we agree. Have you seen the Ally Bank commercial in which two kids are asked if they would like a pony, and one gets a toy pony while the other gets a real pony? The look on the face of the girl who got the crappy plastic pony is priceless. Pretty difficult to explain to her that she and the other girl were treated fairly, since they each got a pony.

Our tax system is not unlike the commercial. While some differences are viewed as fair (e.g. the two girls would be okay with a real (or fake) pony that was a different colour, it is quite unfair to give one a real pony and the other a piece of plastic.

Is this a silly example? Well, actually, $8,000 buys you a nice real pony, so in effect we give one family a real pony and the other a fake substitute. Why?

Okay, some will argue that there are other considerations, and perhaps an $8,000 tax difference is justified. All right, how about the way former Nortel CEO gets a $30K tax break if he splits his $750K pension, while the $750K Bell VP pays the full shot? At middle-class income levels, how about the fact that someone coming out of the RCMP/CF/military in his/her 40s, split a 6-figure pension, and rejoin the workforce?

The fact is, you cannot justify these very real scenarios, and pension splitting has, at least for salaried folk, really changed the rules of the game.

Time to extend those rule changes to everyone.

Miguel,

In Canada, if you receive a pension, you can transfer up to 50% of that pension to your spouse. There is no dollar limit on the amount that can be transferred. In Ontario, since the top tax bracket kicks in on something like $509,000, then a $1,018,000 pension could be split in two, saving > $30,000 in tax.

The Harper gov’t has proposed allowing up to $50,000 of salary to be transferred from one spouse to another for tax purposes. In Ontario, this could result in a tax saving of > $7,000 on the first $100,000 of income – more if the transferor was in a higher tax bracket, e.g. $509K in Ontario. The result would be that all families would pay the same tax on the first $100,000 of family income…which is not the case today unless each spouse earns $50,000/yr.

This is not quite the same as the tax system in the US which has a joint tax return for married people, as well as a single tax return for singles. The tax brackets for the joint tax return are 175% the width of the singles’ brackets.

Taxrage: “Is this a silly example? Well, actually, $8,000 buys you a nice real pony, so in effect we give one family a real pony and the other a fake substitute. Why?”

I think the problem is that you are assuming that the family should be the unit of taxation. That is not at all clear to me. Although there are arguments for it, there are arguments against it. Trotting out more examples and hypotheticals doesn’t change that fact.

whitfit,

Not sure why you think it’s not all that clear. Seems to me that the only thing missing from using the family as the unit as taxation is that we don’t have the ability to split salaries. Everything else can be split (or organized to be), plus benefits and tuition are based on net family income.

When 40-somethings have unlimited ability to split pensions, we’re pretty much there.

Taxrage:

“The fact is, you cannot justify these very real scenarios, and pension splitting has, at least for salaried folk, really changed the rules of the game.”

Actually, my last post provided a reasoned justification for providing differing treatment of two-income famiies and one-income families. You may diagree with that justification, which is fair, but don’t claim it can’t be justified without providing a compelling rebutal of that justificaiton. Moreover, the reasons I gave would also justify permitting income splitting for pensions (rather than employment or business income) since none of the arguments regarding additional leisure or home production apply to pension income (or other forms of passive income, though curiously the Tax Act contains numerous attribution rules to prevent income splitting from investment income)

Taxrage: “Is this a silly example? Well, actually, $8,000 buys you a nice real pony, so in effect we give one family a real pony and the other a fake substitute. Why?”

First, for most Canadians, income splitting translates into a few hundred bucks, at most (in fact, unless the provinces followed the federal lead – which none of them can afford to do – the maximum tax reduction would be~$6500, so I don’t know where you think the $8,000 figure comes from). So the only pony they’re getting from income splitting is the diseased one on its way to the glue factory.

Second, whatever tax “benefit” arises from being in a two-income family isn’t free, it’s not a gift owing to the benevolence of the fisc, its a function of having earned income. The second income earner has to forego the value of 40 hours (or whatever) a week of home production and leisure. You want an extra $8000? Send the spouse out to work and you’ll be in the exact same position as other two-income families. But I suspect you and your spouse don’t think that makes you better off.

“Seems to me that the only thing missing from using the family as the unit as taxation is that we don’t have the ability to split salaries.”

Sure, we could do it, other countries do (of course, other countries do a host of stupid things, so that doesn’t mean we should emulate them). But Whitfit’s point is that there’s no obvious reason for thinking that that is infinitely fairer or better than taxing individuals. Apart from the equitable considerations I discussed earlier (which you don’t seem inclined to rebut), there’s also the reality that it sharply discourages participation in the labour market for lower-income spouses (since it means that the low-income spouse pays tax on their income at the marginal rate of the higher income spouse.

More to the point, as a country I can think of infinitely more pressing concerns that could be addressed with $3 billion in foregone tax revenue then righting the alleged inequality inflicted on certain upper middle-class families by an individualized tax system.

“Is this a silly example? Well, actually, $8,000 buys you a nice real pony, so in effect we give one family a real pony and the other a fake substitute. Why?”

And t

“At middle-class income levels, how about the fact that someone coming out of the RCMP/CF/military in his/her 40s, split a 6-figure pension, and rejoin the workforce?”

Members of the CF have pretty generous pension (though they literally have to kill for them), but if you think there are a lot soldiers running around with six-figure pensions, you’re kidding yourself. Badly.

Bob can correct me, but a glance at the pension splitting section of the CRA website states a taxpayer has to be 65 years of age or older in order to apply for pension income splitting. So a military retiree at 55 does not quality for income splitting at all with respect to their own pension benefits.