Bank of Canada Governor Stephen Poloz insists he is not talking down the Canadian dollar and its depreciation relative to the US dollar is the result of economic developments – in particular the fall in oil prices. So is oil driving down the dollar? How about a quick and dirty regression?

I obtained annual data for the following variables: (1) The average annual value of the monthly Canada-US dollar exchange rate, noon spot rate (CANSIM v37426) and (2) The price of a barrel of oil (US$ WTI) from the Alberta Department of Energy resource revenue spreadsheet. Along with the price of oil, another traditional determinant of the value of our dollar relative to the US dollar is the spread between our interest rates and US interest rates. So I also got (3) The average annual yield of Canadian 3-month T-Bills (CANSIM v122484) and (4) The annual value of US short term interest rates from data on EH.NET (US short term, contemporary series) and calculated the difference as an estimate of the interest rate differential (the Canadian interest rate minus the US rate). The data is annual from 1980 to 2014.

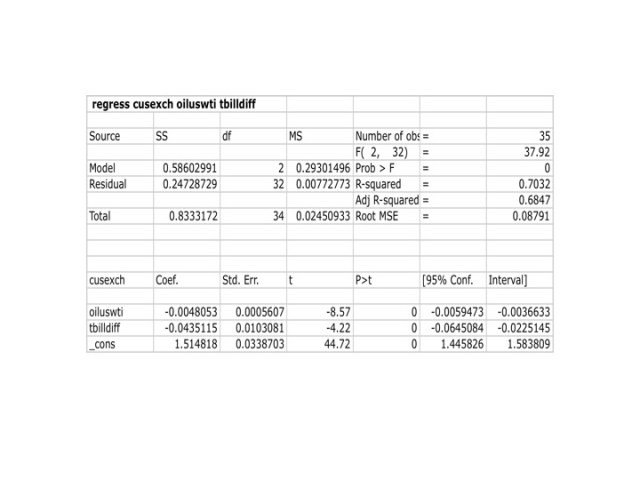

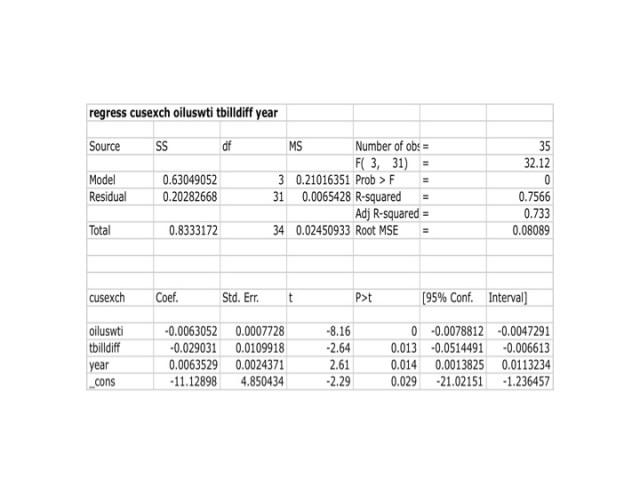

I used OLS to estimate two specifications (with STATA). First, I ran a regression of the Canada-US exchange rate (cusexch) on the price of oil (oiluswti) and the interest rate differential (tbilldiff). Second I ran an additional specification that included a year variable. The coefficients on both oil and the interest rate differential were negative and significant at the 5% level – as the price of oil or the Canada-US interest rate spread increases, the amount of Canadian currency needed to buy a US dollar goes down – the dollar appreciates. Notice that the coefficient on the year variable is positive – after controlling for the price of oil and the interest rate spread, there is a depreciating currency over this time period.

REGRESSION NUMBER 1

REGRESSION NUMBER 2

The results of these regressions suggest that approximately two-thirds to three quarters of the variation in the Canada-US exchange rate can be explained by variations in the price of a barrel of oil, the interest rate differential between Canadian and US short term interest rates and a time trend. As for the remaining influences – who knows? Maybe it’s the words of the Bank of Canada Governor (my recollection is that this is usually termed moral suasion) or some other economic variables. However, I used OLS on time series data without first differencing nor did I make any other allowance for time series issues like stationarity so these regression results are probably spurious. I’m letting Stephen Poloz off the hook anyway.

// <![CDATA[

// <![CDATA[

// &lt;![CDATA[

var sc_project=9080807;

var sc_invisible=1;

var sc_security=&quot;4a5335bf&quot;;

var scJsHost = ((&quot;https:&quot; == document.location.protocol) ?

&quot;https://secure.&quot; : &quot;http://www.&quot;);

document.write(&quot;&lt;sc&quot;+&quot;ript type=&#39;text/javascript&#39; src=&#39;&quot; +

scJsHost+

&quot;statcounter.com/counter/counter.js&#39;&gt;&lt;/&quot;+&quot;script&gt;&quot;);

// ]]&gt;

// ]]>

// ]]>

I am amazed by the general level of complacency around the depreciation in the Canadian dollar.

It is nothing like the concerns that were once raised in the depreciation episodes of several decades ago.

“I used OLS on time series data without first differencing nor did I make any other allowance for time series issues like stationarity”

Quite. Although it is also possible that a cointegrateed combination wouldb stationary. Even so, there could be latent confounding effects. And shouldn’t you be checking whether the OIL/IR time series “Granger causes” a lagged copy of the FX series?

very worth to look at your Current account (which is negative) and the time development

commodity/oil prices

according to the CIA world factbook:

oil seems to be 12% of your export revenue (dropped by a factor of 2)

refined petroleum another 6 – 12% (dropping maybe 30 % ?)

natural gas ? should have dropped in price too

(iron ore or other commodities ?)

that seems to add up to something like 25% – 30% of your total exports

If that drops by a factor 50%, that warrants a factor 50% *25 % in exchange rate, maybe easier to understand with:

the brutal & simple ( = textbook : – ) example Russian Ruble

http://de.slideshare.net/genauer/sampler-of-gdp-and-other-data-emphasis-on-russia, page 4

Given that oil dominates Russian export ( and the Government revenue !)

thr Ruble exchange rate is simply given by Ruble * Brent Oil price = constant (adjusted over time for an inflation of about 9%).

The one calibration constant (63*63) is given by the popular Russian joke:

What have the ruble, oil, and Putin in common ?

They all turn 63 in 2015 🙂

When they didn’t go by that in 2008, that had a very drastic impact on their foreign reserves (page 6)

I did plot, btw, the Canadian provincial unemployment rates in http://de.slideshare.net/genauer/sampler-2-of-imf-2014-weo-data-plots, page 2

@Phil Koop:

I believe Mike Moffat had a model that showed more or less the same thing you found. He used to post about it occasionally. I’m too lazy to search for it, but it’s probably there somewhere.

JKH: I’d hate to see what the adjustment would look like if the dollar wasn’t floating.