As the eurozone bumps along from major crisis to minor crisis to existential crisis, the point is often made that a key feature of successful monetary unions that is missing in the eurozone is a system of transfers. These transfers act a sort of compensation for renouncing the option of pursuing an independent monetary policy.

The eurozone hasn't the means to make these sorts of transfers. The EU supranational government has limited powers of taxation, and AFAICT, the entire budget of the EU is on the order of €100b. This is something like 1% of eurozone GDP and is comparable to the size of the Greek budget.

Here's how I recently tried to transpose the Greek debt crisis to a Canadian scale:

To put things in a Canadian perspective, let’s look at Manitoba. Manitoba’s public finances look nothing like Greece’s, but its share of Canadian GDP – about 3 per cent – is similar to Greece’s share of eurozone GDP. Suppose that instead of running a surplus and a debt of $10 billion in 2008, Manitoba had a Greek-scale debt of $40 billion, a deficit of $5 billion a year, and that it was having problems finding buyers for its bonds.

This doesn’t sound like a very big problem: $5 billion was 0.3 per cent of Canada’s GDP in 2008. In this scenario, we would probably expect a federal bailout, a restructuring of Manitoba’s public finances and a few pointed barbs at Manitoba’s expense. But it wouldn’t have been an existential crisis for Canada, and the file would have been closed well before 2015.

The reason that this wouldn't be a very big problem is that Canada has a federal government that has significant taxation powers – even after five years of the Conservatives' starve the beast strategy, federal revenues are 14% of GDP. And the federal government uses its powers of taxation and spending to redistribute income across Canada on a scale that many Canadians may not appreciate.

When people talk about federal transfers, they probably think of the equalization payments Ottawa makes to the 'have-not' provinces. But equalization payments are only a part of these transfers, and not the most important. Most of these transfers are the difference between federal spending and revenues: recipient provinces receive more in federal spending than they pay in federal taxes. (The difference between EI contributions paid and EI benefits received is also included.)

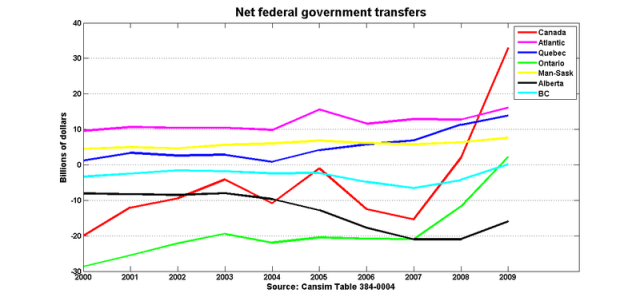

The best only source I know of for data on federal transfers is Cansim Table 384-0004, even though it only goes up to 2009 (don't get me started). Here they are, for the years 2000-09:

Negative values mean that federal revenues exceed federal expenditures. The red line is the difference between federal government revenues and expenditures within Canada; it doesn't take into account federal spending on goods and services imported from the rest of the world. The sharp jump in 2008/9 is associated with the move from surplus to deficit. As one would expect, the Atlantic provinces, Quebec, Manitoba and Saskatchewan were net recipients from Ottawa over this decade. Ontario was the biggest net contributor until 2007, at which point Alberta took over.

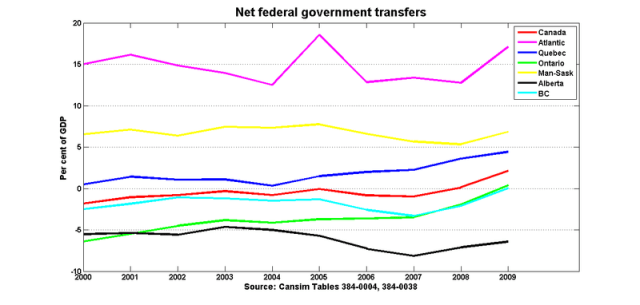

Here are the same data, but expressed as shares of GDP:

I must say that that this one surprised me. Net federal transfers are the equivalent of 15% (!) of Atlantic Canada's GDP, and about 6-7% of Manitoba-Saskatchewan's GDP. And while Quebec is a net recipient, federal transfers are a fairly small share of Quebec GDP. On the contributor side, the federal government takes the equivalent of 6-7% (!) of Alberta GDP to be redistributed elsewhere. This used to be the case for Ontario as well, but its contribution declined during the 2000s.

And here are the data in per capita terms. (I didn't bother correcting for inflation; I don't think it would add anything.)

Once again, I was surprised by the scale of these transfers. During the height of the oil boom, Alberta contributed almost $6000 per Albertan to Ottawa to be spent elsewhere, and Atlantic Canada received roughly $5000 per person.

There's no conscious decision to take $5000 (or whatever) from each Albertan and give $5000 (or whatever) to each person in Atlantic Canada. Moreover, these transfers are not once-off 'bailouts'; they are made year after year.

The contrast with the eurozone is, to say the least, striking. Since there is no supranational government with the means to make Canadian-style transfers, they have to be thrashed out by the constituent national governments, and these national governments answer to their own people.

It's probably for the best that the scale of these transfers are not well-known, and that they occur automatically in the course of the federal government's usual operations. And it's also for the best that the provinces aren't involved.

What’s wrong with 380-0080? It’s got up to Q1 2015.

A few comments :

1)for most provinces, net transfer are almost witin rounding errors ( so much for the arguments that without the federal Québec would be argh! Greece!)

2) for the physically large provinces, the total figures hide a large disparity between regions. At the top of my head and being on vacations, for example many Montréal suburbs and the Québec City area are probably net contributor while a good part of the eastern Island of Montréal and Bas-St-Laurent and Gaspésie are big recipients.

3) Provincial boundaries are mostly artificial. Lloydminster(AB) has always been a contributor (as part of AB, I don’t know enough about its local economy to compute its net contribution) Until recently, Lloydminster (SK) has been a net recipient and has recently moved to net contributor (same caveat about the computation). Move the arbitrarily drawn boundary by a few kilometers and everything change ( Lloydminster AB moves from makers to takers.). Draw AB and SK along an east-west line like the two Dakotas instead of the current one and Calgary is a insignificant agricultural regional town while North Battleford boast of its new daily non-stop flight to Beijing, befitting its well-earned god-ordained status as capital of an oil sheikdom.

4) The constituion arbitrarily assign sources of income to governments. Give mineral royalties to the federal instead of the provinces and the receiving provinces are merely getting their right share of their common property with no one arguing about that

5) Given that education and health are provincially funded on an equal basis in each locality (unless the US), provinces are practicing an equalization program of their own, with nobody complaining.

Another factor that helps a monetary union work is labor mobility. According to an article in The Economist, mobility is ten times as much in the US as compared to the EZ:

http://www.economist.com/blogs/freeexchange/2014/01/european-labour-mobility

very interesting analysis

the tiny scale of the EU budget speaks volumes

and it’s easy to see here the value of the CANSIM data that was previously available

Stephen: “I must say that that this one surprised me.”

Surprised me too.

There’s one other big difference. Canadian banks are separate from Canadian provincial governments (or are there exceptions?). Banks and provincial governments would go bust more or less independently. If Manitoba government goes bust, Manitoba bank (branches) carry on as before.

Kevin – 380-0080 doesn’t break down federal govt spending/revenues by province.

Ah! That would do it. 380-0080 also doesn’t disaggregate by tax and spend categories as far as the old series did…..

It looks like those Canadians outside of Alberta who didn’t think that they got anything out of Alberta’s oil & gas bonanza need to think again.

I really enjoy reading Stephens blog posts. Nick Rowe is also good but a bit of variation doesn’t hurt!

A crucial difference between Canada and the Euro is of course that when a province within a country suffers a debt crisis people are willing to help because they feel like “that could happen to us” while the greek debt crisis has instead led to a reaction of “those lazy greeks deserve it”.

I think this simple sequence lies at the heart of the problems with the Euro:

1. For the Eurozone to operate at anywhere near potential some fiscal transfers will be neccessary

2. The northern european members are (rightly or wrongly) never going to accept the semi-permament from north to south that would be the inevitable result of a fiscal union.

3. Therefore the Euro will not (and should not) survive.

Nick- “Canadian banks are separate from Canadian provincial governments (or are there exceptions?).”

I’m not sure if there’s a useful distinction in macro, but credit unions function as banks, and are regulated and insured by the provinces. If a province goes bust, credit unions have no meaningful deposit insurance.

And in Alberta at least, there’s also ATB Financial, which looks like a bank, acts like a bank, but is in fact a government department. I imagine if the province went bust those deposits would simply be gone.

Hugo- “A crucial difference between Canada and the Euro is of course that when a province within a country suffers a debt crisis people are willing to help because they feel like “that could happen to us” while the greek debt crisis has instead led to a reaction of “those lazy greeks deserve it”.”

I’m not sure that is a useful difference. Where I live, “those lazy maritimers/quebecers” could easily substitute for “those lazy greeks” in the public consciousness. I think the bigger difference is that the rules that govern our fiscal union are long-standing and largely not thought about. If it were felt that we were re-writing the rules to send more money to the maritimes in a time of crisis, you’d start seeing western separatists picking up seats in parliament. Helping Manitoba might be less controversial, though.