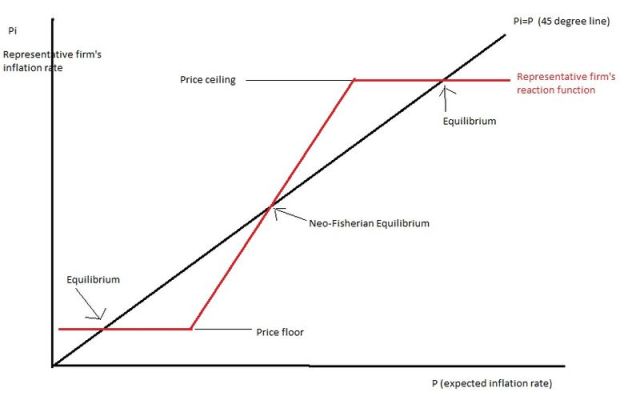

Update: Here's a picture:

Original post follows:

I read Steve Williamson's new post. I could try and poke holes in his modelling. But it would be pointless, like a high-school debate. The disagreement is much more fundamental. I hope this is more constructive.

Inflation doesn't just happen. In a New Keynesian model, individual firms choose how much to raise their prices, and the inflation rate is the average of their individual choices.

Let's simplify massively. It's a one period game, so we can forget all about dynamics. All firms are identical. At the beginning of the period, all firms start out with exactly the same price. The natural (real) rate of interest r is then revealed. The central bank then announces a nominal interest rate R. Each firm then chooses how much to raise or lower its price. Firm i chooses the firm i inflation rate P(i). The inflation rate that maximises firm i's profit is given by P*(i) = P – b(R-P-r) where P is the average of all the firms' inflation rates, and b is some strictly positive parameter. A firm's losses, relative to its profit-maximising choice, are (P(i)-P*(i))2.

That's roughly the decision facing firms in a New Keynesian model, if the central bank holds the nominal interest rate fixed, and ignores the Howitt/Taylor Principle that says it should raise the nominal interest rate more than one-to-one in response to inflation.

By construction, this game has a unique Nash equilibrium P(i) = P = R-r. By construction, that unique Nash equilibrium is Neo-Fisherian. If the central bank raises the nominal interest rate, the equilibrium inflation rate rises one-for-one.

That equilibrium sucks. I wouldn't trust it one inch.

To see why I think that Neo-Fisherian equilibrium sucks, let's suppose the government imposes a price ceiling and a price floor. But let us suppose that ceiling and floor are never a binding constraint on the Neo-Fisherian equilibrium inflation rate.

Non-binding price ceilings and floors shouldn't make any difference, right? But in this case they do make a difference.

We now have three Nash Equilibria. The first is the original Neo-Fisherian equilibrium. The second is where all firms raise their prices to the ceiling, and each firm wants to raise its price some more, but isn't allowed to. The third is where all firms cut their prices to the floor, and each firm wants to cut its price some more, but isn't allowed to. The Neo-Fisherian equilibrium is only unique if the strategy space is unbounded. The Neo-Fisherian equilibrium is an artifact of building a model with an unbounded strategy space

It doesn't have to be a legislated price ceiling and floor. There might be some limit on how quickly some firms can print new menus or catalogues to raise or lower prices. Or it might be that if firms raise or lower prices too quickly the monetary system collapses. A complete monetary system collapse is an equilibrium too.

If the central bank instead announces a rule like R = r + (1+c)P, we get a unique equilibrium, with or without the non-binding price ceiling and floor.

Update: Narayana Kocherlakota asks what happens when we add a ZLB constraint to the model, so R >= 0%.

Let me first modify the central bank's rule (if it obeys the Howitt/Taylor Principle) to R = max{0, r + P* + (1+c)(P-P*)}, where P* is the central bank's inflation target.

If P* > -r we get two equilibria: the first where inflation equals the target; the second is where inflation hits the price floor, firms want to cut prices even more but can't, and the central bank wants to cut the nominal interest rate below 0% but can't.

If P* < -r we get only one equilibrium where inflation hits the price floor and the ZLB is binding.

By the way: yes, the New Keynesian model is wrong. Because it ignores the stock of money. When central banks hit the ZLB they did not let the stock of money fall without limit. They increased it. Which is why the monetary system did not implode.

More generally, this looks like an error of mathematics rather than conceptual economics. For analysis purpose, the microfoundations keep only the lowest-order terms in the firm’s loss function, where P and P* are linearized about (R-r).

However, linearized models like this are valid in the long term – which you have because your model has no dynamics – only if the equilibrium is stable.

Consider an infinitesimal perturbation to this model, and look at the one-firm choice of price if P is not (R-r), but (R-r+ε). Now:

P*(i) = (R-r+ε)-b(R-r-(R-r+ε)) = (1+b)ε,

which amplifies the perturbation by a factor of b. This confirms that the equilibrium is unstable – we can apply the same analysis to any sort of error (such as a smudge in the newsprint) on the announcement of R or r.

This doesn’t make the model entirely useless, but it means that we can’t use it to tell a dynamical story. If there is some exogenous force that forces firms to cluster around this equilibrium, then this model can tell us how that equilibrium changes with changes to R and r. But this is precisely equivalent to saying “conditional upon a yardstick being balanced on my hand, moving my hand to the right moves the stick to the right” – it doesn’t provide any instruction in how to accomplish that balancing.

As an addendum: the modified dynamical story also gives us a ZLB breakdown like we’d expect. If R’ is zero and R cannot be below zero, then the Nash equilibrium in step 3 is unstable on the deflation side. In fact, deflation is nearly guaranteed because inflation can be properly punished by the central bank.

In a dynamical, multi-period story, we don’t have the central bank announce separate R’ and R rates, but we do have R(n) and R(n+1), and it’s reasonable to expect a firm’s loss function to depend upon both. I suspect we can recover traditional monetary policy (lower interest rates to raise inflation, then follow rising inflation with lagging rate hikes) in the iterated case.

Nick your equation P(i) which looks like P is a function, but also P on its own, which looks like it is a variable. Perhaps this is a standard usage, but I’m not clear about what P is.

I have a bad cold or flu, and my brain isn’t working well.

Majro: I don’t see what’s wrong (conceptually) with the central bank just announcing an interest rate that is super-indexed to inflation. (By “super-indexed” I mean adjusts more than on-for one, like an indexed bond only moreso.)

Gene: I’m not following, sorry. P(i) is supposed to be Greek pi subscript i. It’s a choice-variable for firm i. It’s the amount firm is chooses to raise its price. P is just the average across all firms. So P(i) = P – b(R-P-r) is just firm i’s reaction function, where there are no price controls.

@Nick Rowe:

In your one-period, one-announcement model, the bank can’t announce a rate that is indexed to inflation because it doesn’t know the inflation rate at the time of the announcement.

You have the bank setting its rate in step 2, then inflation is determined in step 3. If the bank has an already-existing inflation rate to work with, you’re working with a dynamic model rather than a one-period model, but you say “forget all about dynamics.”

If you mean “super-indexed” in order to mean that the rate itself is not determined until after the prices are set, then your model is more or less equivalent to the one I set out with R’ and R. However, you still need a prior fixation on a target R (or equivalently, target inflation rate) for the model to have a unique equilibrium. (Otherwise there’s nothing to linearize about).

Majro: compare it to an indexed bond, or indexed wage contract. When signed, they don’t know the inflation rate either. But the bond/contract specifies the formula.

But yes, I think it’s the same as what you set out.

My understanding of this post is as follows: If all firms know both the natural rate of interest r (which I take to be the rate consistent with full employment) and the nominal rate of interest R and we assume that they act rationally then they will chose to change prices by the difference between the R and r. The Nash equilibrium will be consistent with full employment . Neo-Fisherism will hold.

If firms are prevented by law (or for other reasons) from adjusting by the full difference between R and r, then we still get a Nash equilibrium but not full employment. Neo-Fisherism will not hold.

I have a question: What would happen in a model where the CB is targeting NGDP or inflation and a similar constraint on price changes is imposed ? If the inflation target is higher than the constraint , or RGDP falls so that the NGDPT can only be met with inflation greater than the constraint then won’t the money supply increase without limit ?

MF: No. (Obviously I didn’t write it clearly enough).

The Neo-Fisherian equilibrium is between the price ceiling and price floor. It’s non-binding. It’s like saying the Neo-Fiserian equilibrium inflation rate is 5%, but if the government bans inflation above 10% and below 0%, we suddenly get two more equilibria (10% and 0%).

Thanks for the clarification. Actually, you wrote it clearly enough, I mangled the reading of it. I am however now totally missing why the existence of the non-binding price floors and ceilings introduces the additional Nash equilibria. If firms know R and r, and can use that to work out optimal P(i), why would they choose to go beyond that, but only in the case where there are limits to what they can set p(i) to?

Because if all other firms raise their prices by the maximimum allowed amount, firm i will want to raise its price by more than the maximum amount (since (1+b) > 1 ), but isn’t allowed to, so will raise its price by the maximum amount, which is as close as it can get to doing what it wants to do. So it’s a Nash Equilibrium for all firms to raise their prices the maximum allowed amount.

Same for allowed minimum.

I’ve added a picture.

Thanks. The picture makes it really clear why we get the additional equilibrium points where expected inflation will be equal to actual inflation when we introduce the ceiling/floor assumptions.

But couldn’t proponents of Neo-Fisherism just say that the additional assumptions do not match the real world ? In situations where firms expect inflation to be high they are not normally restricted by legal or logistic reasons to a maximum price increase.

MF: thanks. I should have done the picture in the first place!

That would probably be their line of defence. But Zimbabwe is one example of what happens when inflation gets too high. The money gets abandoned. Something similar would happen if inflation got too negative. Also, can’t infinitely high inflation/deflation be an equilibrium? (My brain gives out at that point, but I think you get my drift).